TCG Card Shop Simulator: the second 'surprise hit' Steam sim of 2024?

Publikováno: 24.9.2024

Also: why game publishers are successful, and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

A fresh September week is upon us, and GDCo has returned to ‘bless’ you with blather and blithering about how PC and console video game discovery works. (We haven’t yet managed to acquire the ‘secret formula’ for it, but we’ll steal that bottle eventually.)

By the way, as X/Twitter continues to go downhill, just a note that GameDiscoverCo has a BlueSky account where we’ll post latest newsletters - and a weekly chart or two. (We’re still also on Twitter, and also post updates on LinkedIn via Simon’s account.)

[PSA: yes, you can support GameDiscoverCo by subscribing to our paid GDCo Plus tier. You get to read both of our weekly newsletters, hang on a Discord server with peers, access a complex Steam data suite with lots of useful real-time info on hit games, & lots more.]

The game platform & discovery news round-up…

Back in March, GameDiscoverCo covered ($) the rise of Supermarket Simulator, a spectacularly well-honed ‘you run a supermarket’ PC sim from a Turkish former mobile hypercasual dev, Nokta Games. Then, it topped out at 23,000 concurrents on Steam - but it subsequently hit 51k CCU, and is still at 5-6 CCU right now!

Supermarket Simulator is the surprise hit of 2024 so far. Our‘top games launched this year’ charts on GameDiscoverCo Plus have it at 2.6 million units sold and $27 million gross. (And remember, this is a small dev and near-100% organic user acquisition.) It’s popular chiefly because influencers just can’t stop playing it.

Then in July, we talked about why we “actually think ‘simulators’ are under-developed as a genre/style of game”, and lo and behold, here comes TCG Card Shop Simulator, which GDCo estimates has sold almost 400k copies on Steam in 10 days (!), and peaked at a whopping 38k CCU a couple of days ago. (It’s $13 in the U.S., too - a decent price.)

The dev, OPNeon Games, seems to be a tiny (basically solo?) Malaysian creator which previously had some success with Idle Card Shop Tycoon on mobile (>1m DLs on Google Play, $1m lifetime revenue), as well as a robot fighting game. But this Steam success way exceeds that! How did he do it? Here’s some key points:

TCG Card Shop Simulator is a broad influencer phenomenon: with a more niche PC game, you’re hoping for very specific YouTubers. But with this game & Supermarket Simulator, you’re seeing a giant range of creators enjoy it. (It’s also the kind of game you watch and want to play, as opposed to watch and not play!)

The game is a Supermarket Sim ‘fast follow’ x ‘card pack’ opening: it’s a clever twist to use the red-hot Supermarket Sim gameplay loop - stocking shelves, ordering supplies, expanding the store, giving change by hand (!) - but set in a trading card game store, and with Pokemon TCG-like packs to open and re-sell.

Trading cards are having a ‘moment’ right now: you might know that Pokemon cards are taking off again - “Professional Sports Authenticator… says 43% of the cards it graded in 2023 were Pokémon, up from 17% in 2018.” So this setting is absolutely a great, understandable entry point for the mainstream PC game player.

We were actually surprised about how close to Supermarket Simulator this game is, core gameplay-wise. The setting makes it, though, and it’s promising differentiating features for the future, including a playable version of the TCG.

And it’s a global phenom, too. Here’s our view of ‘owners by country’ on Steam for TCG Card Shop Simulator, which has an average playtime of >8 hours. It has a chunk from China, and Indonesia and Singapore also punching above their weight, but plenty of U.S. and European sales.

A couple of other key points we’d like to make on this game’s surprise smashiness:

TCG Sim launched a very successful ‘Prologue’, but close to launch: it only came out August 6th, but a limited-feature Prologue demo quickly scaled to 7,500 CCU. And while it wasn’t the reason for TCG Sim’s success, it def. greased the wheels…

‘Simulator’ players like playing this sim too: per GDCo’s ‘Affinity’ data on players more likely to own TCG Sim than the average Steam player, Supermarket Sim stands out (19.1x more likely, though total overlap is only 20%!) Also notable: PC Building Simulator(9.4x),House Flipper(9.3x), Escape Simulator(11.9x.)

Finally, we’re just surprised about just how viral these vendor sims have been going. It’s showing the true size of the market for accessible and fun first-person games that are attractively priced on PC, and escape niche filter bubbles.

Talking of filter bubbles, we were reading The Entertainment Strategy Guy the other day, and he was ranting on a particular TV show that was big in certain filter bubbles, but not reality: “Outside of the very online media bubble reality, people aren’t watching Pachinko. It didn’t make any of the viewership charts I track. Nielsen? No. Samba TV? No.”

There’s an element of that with critic-friendly underdog titles like I Am Your Beast, which is doing fine for a small indie, btw (15k copies sold?), and is less of a ‘repeated play’ game, but topped out at 225 Steam CCU.

So if you’ve seen more about that game - or even something like the wondrous UFO 50 (3,600 CCU and rising) than TCG Sim (38,000 CCU!), that’s OK. (That’s your filter bubble at work.) But let’s try to escape all filter bubbles and say - what’s empirically hot? And boy, it’s this…

Why are game publishers successful in AD 2024?

There’s been a few smart articles about how game publishing on PC and console is changing - such as this piece suggesting‘the era of the generalist indie publisher is over’. And GameDiscoverCo gets asked about the key to successful publishing - a lot.

We believe in the classic record company-esque A&R role, being personally enamored of classic record labels like Creation (above), Heavenly or 4AD. But that’s not quite the right lens, since distribution is a solved problem in digital - which it wasn’t back then.

So when we were talking to a potential client recently about what the best publishers get right in today’s market, this - slightly punched-up response - is what we said:

“On specific drivers to create games that are successful: if I could work that out all the time, I'd be on a desert island by now :) But I think the key things are:

- Right genre, and you need to have a DEEP understanding of that genre and whether it's undersaturated or oversaturated, including low and medium-selling games - not just the hits.

- Understanding of 'hook' and why, if somebody hears about the game, their ears perk up and they immediately get interested. (We just covered one of those in the newsletter, 'Tactical Breach Wizards' - excellent hook!)

- Ability for streamersto play a particular game you published repeatedly, not once. (This is a big one if you really want to scale, given how vital influencers are to expanding reach nowadays.)

The best publishers I see right now are either those who are very deep into their niches and understand the market, or spend a tremendously large amount of time on deciding which titles to sign and finding gameplay-dense, less expensive, streamer-friendly diamonds out there.

It's definitely my view that publisher-led marketing efforts are not the key success driver in today's market - it's how you create your portfolio - the games that you sign.”

We’re not going to name specific publishers here - that would be a fool’s errand! But we’ll just say - the ones hitting it out of the park - and they’re not all super-niche in genre fixation - deeply analyze a lot more games than you would think, pre-signing. (Our claim: portfolio strategy is deeply underinvested in, vs. post-signing effort.)

The game platform & discovery news round-up…

Finishing up here, let’s have a gander through the notable platform and discovery news of the week so far, starting with the following:

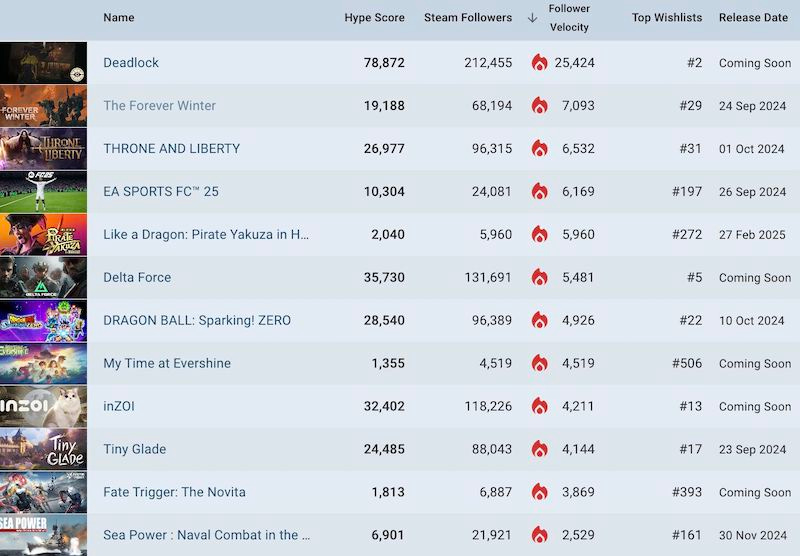

We're posting ‘hottest unreleased Steam games’ on social media regularly nowadays, ranked by new Steam followers in the past 7 days - here’s Monday’s(above) - note The Forever Winter surging, and the newly revealed Like A Dragon blasting it.

Digital Foundry went deeper, tech-wise on the Switch 2 hardware leak, which they say is “almost certainly real”. (The article is both a) semi-incomprehensible to non hardware buffs, but also b) useful for understanding the direction of travel.)

TwitchCon just took place, and here’s all the product announcements from it - Zach Bussey has a breakdown, highlighting more mobile friendliness and TikTok-like paid watcher reactions. (Everyone’s acting like dogs and chasing that TikTok car!)

Looks like the price of Meta’s Quest 3S leaked in a TV ad (!), in a disclaimer saying: “Meta Quest 3S 128GB is $299.99. Content sold separately.” The actual announce is during the Meta Connect keynote on Sep 25-26, so not long to wait..

Steam’s ‘top new games of August 2024’ sale is always worth persuing to see the top Early Access and 1.0 releases of previous months, and we particularly like peeping the ‘top DLC’ section - headed by Risk Of Rain 2, Dead By Daylight x Castlevania, Dredge, Cult Of The Lamb, and launch DLC for CarX Street.

There’s a giant new Bloomberg profile ($) on Xbox’s Sarah Bond, which includes some interesting tidbits: “Microsoft now spends $1 billion a year getting third-party games on the [Game Pass] subscription service” - coupled with some more ‘handheld Xboxes would be cool!’ hints from management.

PlayStation is doing its streamed ‘State Of Play’ game update in a couple of hours, so you may know the results by the time you read this. (Sounds like some remasters & announcements for multi-platform games are part of it all!)

Another Steam CCU milestone? Absolutely, as the platform reached 38 million CCU over the weekend, up from 37 million a month ago, and 36 million in March. (Reminder: that’s people in the Steam interface, not in-game, which was ~12.3m.)

Some neat graphs from Bloomberg/Aldora about current-gen hardware sales estimates: “Microsoft has sold 28.3 million Xbox Series X|S units as of June 2024.

For comparison, Sony has officially sold 61.7 million PlayStation 5 units to date.” Aldora reckons it was closest 2 generations ago - Xbox 360 (84.9m) vs. PS3 (87.4m).

Microlinks: how Intel ‘lost’ the chance to make the PS6 chip to AMD, the current PS5 chipmaker; Xbox talks carbon reduction goals via ‘energy saver’ modes preventing 1.2m metric tons of CO2e being emitted; Netflix adds Street Fighter IV and Civilization VI mobile versions to its subscription game line-up.

Finally, we’re still rooting for Fruit Ninja and Jetpack Joyride creator Luke Muscat’s game Feed The Deep. And his latest post-release video is a collab with trailer maker Derek Lieu, detailing advice Derek gave to ‘punch up’ Luke’s game trailer. It’s v.helpful:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]