The Nintendo Switch ecosystem - where next?

Publikováno: 9.11.2021

Maybe we can get some clues from Nintendo's latest analysis.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to a brand new week, crew. Delighted to return as your personal discovery Mission Control, as you slingshot around the dark side of the game platform ecosystem, finding those pesky players hiding in craters in the heavens.

Anyhow, we’ll stop evoking the Clangers & get on with today’s free GameDiscoverCo newsletter. It starts out with a look at the state of the Switch, filtered through Nintendo’s own folksy slide deck.

[REMINDER: plz consider signing up to our GameDiscoverCo Plus paid subscription. Helps us keep making these newsletters, and includes an exclusive weekly Plus newsletter, an info-filled Discord, a data-exportable Steam Hype back-end, two high-quality eBooks, & more!]

State of Switch - clues from a new briefing?

The information we get from the large video game platforms about a) financials and b) the state of their userbase can sometimes be frustratingly non-transparent. Which is why select tidbits from Nintendo’s annual ‘corporate management policy’ briefing [.PDF link] can be so fascinating.

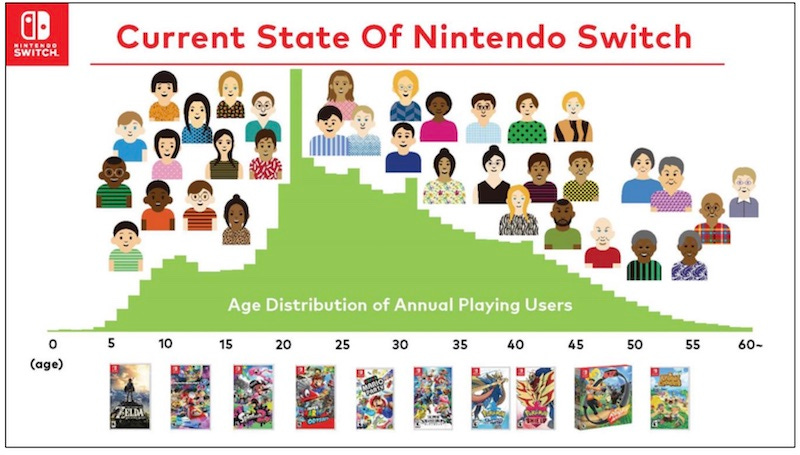

Firstly, this age distribution of ‘annual playing users’ (above) on Switch is intriguing, since it’s showing there’s a decent set of players into their 40s - and a tiny bit into their 50s. Thinking about it, those who were school-age when the NES came out still seem to have interest in Switch, but if they were older than that… not so much.

Unfortunately, we can’t compare to PlayStation or Xbox demographics. Veteran journo Owain Bennallack had an interesting reaction on Twitter, though: “Isn’t a positive response to this graph really showing how terribly low gaming’s ambitions are? TV, iPhones, Facebook would all have a FAR more broad/equal distribution.”

Outside of console gaming, free-to-play smartphone titles have captured a lot of the much older and more casual market. The fact you still have to use (relatively fiddly) joysticks and buttons is probably the accessibility snag to reach an audience that didn’t grow up playing that way. But it’s still impressive to me, at least.

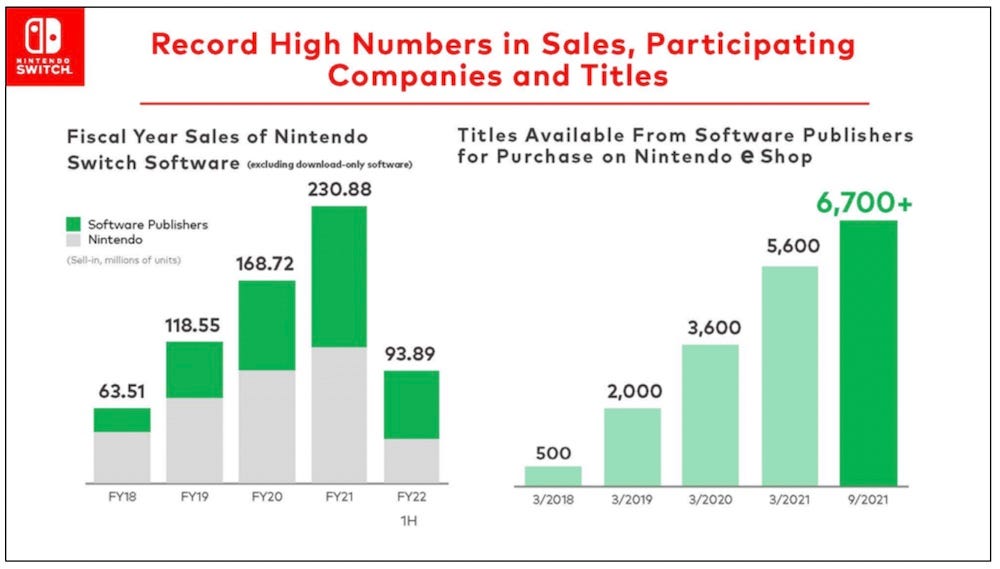

Oh, now this is interesting - a break down of first party vs. third party sales in ‘millions of units’. Except… we just read the small print, and it says ‘excluding download-only software’. Why, Nintendo? Why would you do this?

Actually, I probably know why they would do this: because by just showing games that have both physical and digital versions - the highest cost title - the company will get a more gradual and investor-understandable view of the increase of third-party sales on Switch. (And they are still using ‘retail sell-in’ as a metric, I guess.)

This enables them to say: “Last fiscal year, titles by other software publishers accounted for more than half of the total unit sales for packaged software and its downloadable versions on Nintendo Switch.” I’m sure if you included eShop-only games, it would be more like 80% or more non-Nintendo units - but those units averaging one tenth of the sales price of Nintendo games.

Another view: Embracer’s Martin Lindell was kind enough to point out, via the detailed Nintendo financials [.PDF link], that Nintendo’s first-party game sales (by revenue?) declined from 80.6% of total game sales in the first half of FY21 to 70.6% in the first half of FY22. Could be seen as a ‘broadening out’ - or could just be Animal Crossing’s 10 million launch sales in FY21 normalizing, haha.

Also notable in the presentation? It’s great that Nintendo releases precise ‘legacy’ units sold even for smaller titles - in this case for thirteen of the standout Switch back catalog titles over a 6-month period.

Some of these numbers are truly impressive - especially since these games are very rarely discounted more than 30%. 3.2 million units of Mario Kart 8? 1.6 million units of the 2018 release, Super Mario Party? To us, these shows two things: the power of IP, and the value of having variants of your top IP available in enhanced form on the latest console.

For example, some IP holders might have scoffed at making yet another Mario Kart game, or rebooting Super Mario Party yet again (a newer iteration just dropped, too!) But these games just keep selling and selling. 14 of the 18 million-sellers in FY22 so far were from first-party games. Switch is Nintendo’s world - we just live in it?

We could keep going for a while here, and WorkingCasual has a deeper dive through the numbers. But just summing up the other notable things from the presentation about Nintendo’s general direction - and what it means for the Switch discovery ecosystem:

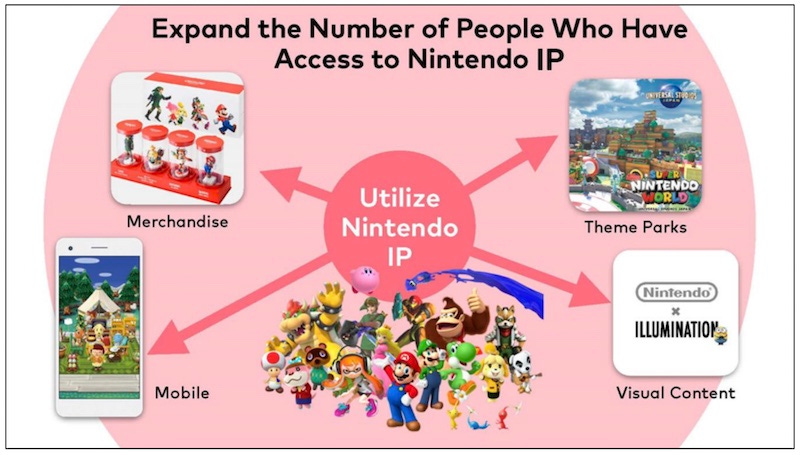

After a long time of sticking to ‘we just make games for Nintendo consoles’, the company is finally unlocking its IP in more modern, transmedia ways - the Illumination movie collab is almost out, the theme park areas are getting sorted, and so on.

There’s now over 32 million Nintendo Online members, and the company says generically: “we will continue to improve and expand” both the base Nintendo Online service and the (slightly lumpy/odd) Expansion Pack service in the future.

The company is yet again downplaying acquisitions as a way to build new content. In fact, Nintendo president Shuntaro Furukawa says: “We are not dismissing the possibility of M&A activities”, but the priority is to spend money “to organically expand our own organization” and retain Nintendo’s existing culture.

There’s a lot of other detail - and any slowdown in the company’s hardware numbers looks like it’s due to supply chain issues, rather than lack of interest. But the message seems to be that Switch will be Nintendo’s main console for at least 2-3 years (there’s a very vague tease that there will be more hardware eventually, coming in 20XX.)

With lifetime Switch hardware sales now at 93 million units, and the OLED version of the console just rolling out? Even though the eShop’s pretty darn busy, it’s still a place to be, given Nintendo’s general mastery of the space right now. So let’s all get on that.

What makes for a good Steam event?

Over time, I think most of us have shifted our views on Steam sales/events from ‘just get in as many as possible and work it out later’ to ‘listen, there’s a lot of events - what’s the cost/ROI on each of those?’

And we haven’t talked that much about how to evaluate this ahead of time. But a lot of it is related to the number and type of games featured - and the efforts made to publicize the event, in addition how ‘featured’ it is on the Steam front page.

So this Medium post by Ishtar Games’ Bruno Laverny talking about the recent Games Made In France sale is helpful, because it highlights one of the yearly Steam sales that I think goes out of its way to showcase itself outside of Steam - and to positive effect.

Specifically, the sale works with big French Twitch streamer MisterMV and other influencers to do a four-day French language Twitch showcase of the titles in the sale, with guests and professional production. This year, there was also an English-language stream hosted by Dechart Games, interestingly.

The pitch: “Discover over forty French games with live demos and [reveals]! Including Amplitude's Humankind, Bethesda's Deathloop, Shiro Games' Wartales, Homo Ludens' Blooming Business: Casino, Tactical Adventures' Solasta, Dotemu's Windjammers 2 and many, many more.” And by picking highly watched/subscribed Twitch channels, some bigger games and co-promoting a lot, interest for the sale is effectively enhanced.

This was obviously a lot of work, and required those participating to pay the Steam sale organizers, so that streamers, sets and logistics could be co-ordinated. But the idea here is one others should consider emulating: build a bigger off-Steam structure around the sale, and create one that sends interest directly from ‘the Internet’ to the sale.

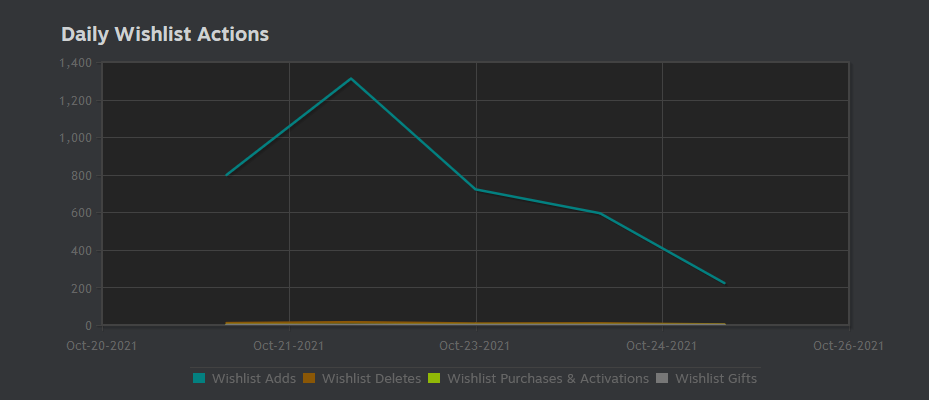

And the results worked out for Ishtar and their upcoming game Lakeburg Legacies, as you can read in Bruno’s blog, which has much additional detail: “When there’s no ads or events, we have around 15–20 [wishlists] a day. So, in five days, we estimate the organic numbers to be about 100 [wishlists]. In five days [with this sale], we got 3605 wishlists added!”

The game discovery news round-up..

OK, time to cascade down the knowledge, in the form of all of these lovely game discovery news and links, all sluicing down in your general direction:

Those who want to sign up for the next demo-festooned Steam Next Fest, the February 2022 version is now available for registration. It’s running from February 21st-28th, and is “a multi-day celebration where fans can try out demos, chat with developers, watch livestreams… please register your eligible games by Monday, December 6th at 23:59 PST.”

We’re in the ‘most DRM is a net negative’ bucket ourselves, and further backing that up, “Dozens of high-profile PC games… including new releases Guardians of the Galaxy and Football Manager 2022.. were rendered temporarily unplayable this weekend, after DRM firm Denuvo appeared to experience issues with its servers.” Domain-related issues, apparently, but not the best.

So HowToMarketAGame’s Chris Z has two things going on: firstly, an article about how Steam demo retention might be important, and secondly, a new survey where you can contribute info about your Steam demo & success, so we can get more complete data - for the good of the Steam-developing public.

Microlinks: BattlEye anti-cheat for games like Mount & Blade II and ARK are now working on Proton, & therefore Steam Deck; need to understand more about this, but Zynga is now making HTML5 games directly for TikTok; Google Stadia will finally let you join multiplayer games without an invite.

Some new Epic Games Store news: “League of Legends PC, Teamfight Tactics, Legends of Runeterra, and VALORANT are all now available on the Epic Games Store. Downloading any of the free-to-play games will install the new Riot Client, with direct access to those titles.” Wonder if this was a ‘thrown-in’ trade for getting League Of Legends’ Jinx into Fortnite, or is part of a further ‘big F2P-centric store, splintered logins are fine’ strategy that Genshin Impact is also part of.

We talk about game platforms here, and I guess Niantic’s newly launched AR platform Lightship is one to watch! Niantic’s John Hanke: “The state of the world today is sort of 50/50 between Android and iOS. And I think it’s going to be much more diversified in the world of AR glasses. So a solution that actually solves the developer problem of being able to write something and create something that’s going to work across multiple platforms is really important.” An interesting bet, actually.

The latest ‘actual Steam numbers for the benefit of the Polish stock market’ announce is here, and it’s for last week’s debut Prison Simulator. Super-transparent stats: 21,500 units sold so far, with an 87% Positive rating based on 301 reviews; 188 outstanding Steam wishlists, 9,100 purchases from wishlist, 2,200 refunds, 210,000 demo downloads, 709,000 (!) Prologue downloads. Phew!

Microlinks, Pt.2: a good outlook for digital games - they won’t be affected by the supply chain/physical goods shortages this holiday; a look at the Top 10 Twitch streamers for October 2021, only one of whom is flexing preposterously; more from Mr. van Dreunen on the crypto game culture war we are currently adrift in.

Finally, wanted to give a shout-out to Devolver co-founder Mike Wilson’s Facebook post on the occasion of his company floating on the UK stock exchange for a lot of money. In particular, this section, which I find personally inspirational:

“We have published more than 75 original titles, all from small independent developers around the world, and ALL of those devs kept their full creative control and ownership of their creations, and ALL of them have made more money off their games than we did, even if we funded the whole project from scratch.

Good business does NOT have to mean “shrewd” … a euphemism for sociopathy … and “that’s just business” does not give anyone an excuse to fuck over someone because they are in a position of power.

We have not succumbed to addiction-based and exploitative business models, even when the whole industry shouts of this “inevitable future.” We have demonstrated this for the whole industry and now the whole world to see, and THAT is what I’m prouder of than anything numbers could say.” And amen to that attitude… see you Wednesday?

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]