The 'shape' of the PC new game market in 2024

Publikováno: 18.2.2025

Also: why platforms always come up short against Steam & lotsa links.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we recover from DICE (where some of us ‘boop’-ed our boop card) and keep moving inexorably onward, it’s time to take another long, hard stare at game discovery news & data - possibly with the help of Aunt Lucy in Peru. So let’s do it…

Oh, two GDC 2025 things: first, our ‘new biz’ lead Matt Styles will be there to talk GameDiscoverCo Pro data - hit him up to chat. And second, we’ll do a GDCo Plus/Pro meetup on the Thursday afternoon of GDC - details coming in a Friday newsletter.

[HERE’S THE THING: support GameDiscoverCo by subscribing to GDCo Plus, inc. access to our second weekly newsletter, Discord, basic data & lots more. And companies, get even more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 50+ have.]

Game discovery news: Nightreign heads interest…

First comes love, then comes marriage, then comes GameDiscoverCo with the ‘discovery news’ carriage - that’s how it goes, right? Let’s fuss over that infant now:

We took our customary look at ‘trending’ unreleased Steam games(above, by new followers in the last 7 days) - multiplayer Souls-like spinoff Elden Ring Nightreign (#1) continued soaring, helped by a playtest, with first-person RPG Avowed (#2) in Advanced Access when we checked yesterday, helping its follower count majorly.

There’s also a lot of ‘trending’ via Sony’s State Of Play or PS5-first games: slick-looking 'also on PS5' Arthurian action-adventure Tides Of Annihilation is new at #3, ‘already a PS5 hit' Stellar Blade added a Steam page (#4), and Split Fiction (#8) and the brand new Digimon Story Time Stranger (#9) got State of Play boosts.

Lots more honest DICE 2025 takes on LinkedIn: Ryan Manning says: “2023 was the ‘food shortage’; 2024 was ‘we're living off fat reserves’; 2025 is ‘we're feeling the empty stomach.’”; Vitor D notes a Chinese funding exit & publisher disruption; Molin Yang sees a ‘2nd wave of impact’from Chinese games launching worldwide.

Oro Interactive and Embers have documented the good wishlist start to Storebound, their IKEA store-inspired co-op horror game -also SCP-ish - whose reveal went great: “It's been 14 days since the reveal and we now gathered 30.000 wishlists and are gaining between 1-2K wishlists on average per day.” (It’s now at 50k!)

What’s hot on mobile? There’s a new piece looking at First Fun and RiverGame’s rapid product expansion in the ‘secretly a 4X game’ field with games like Last War: Survival. And here’s a look at “how drama and fake ads convert to real profits”, highlighting how storytelling-based paid UA is trending again.

Epic Games Store revealed its 2024 ‘year in review’ data, with 295m EGS PC users, up 25m YoY - but remember this includes all Fortnite PC players. Overall: “player spending on third-party applications using Epic Payments reached $255 million, down 18% YoY…. total spending, including Epic’s games, [was] $1.09B in 2024, up 15%.”

Speed of recovery from a wobbly launch is key nowadays. So it’s intriguing to see the Legacy: Steel & Sorcery devs talking about this: server connections and a sound memory leak took their review sentiment to Mostly Negative on Day 1, but they “did multiple patches [swiftly] and… climbed out of the hole up to Mostly Positive.”

An interesting data point from Circana’s Mat Piscatella: “High income households are becoming a bigger part of the US console hardware market. 49% of US VG console buyers during Q4 2024 had a household income of at least $100k/yr. This is a record high, beating the 48% seen in Q4 2021. This group accounted for only 29% of VG HW purchasers in Q1 2020.” (Yes, there’s been inflation, but nonetheless…)

Third-party game key seller Gamivo analyzed its internal data, noting the discount-centric nature of that business: “Titles [costing] over 45 euros account for only 7% of purchases.” There’s also some rare-to-see public splits on price paid per country, at least within Gamivo’s ‘grey market’ G2A-like ecosystem.

Microlinks: Ludocene is a Kickstarter for a B2C game discoverymobile app for finding new games, dating app-style; Xbox Game Pass’ latest adds will include Avowed, EA Sports F1 24, and CRPG Warhammer 40: Rogue Trader; data on the most-streamed live service games, the top 10 of which have 30% of all watch time.

OUR SPONSOR: Track creators, streams and community with Coverage Bot

Coverage Bot: Capture your full creator and community data - get alerts for everything, including influencers streaming your game! Tracks Web, YouTube, Twitch, TikTok, Reddit AND Podcasts. Perfect for Steam Next Fest. Engage and grow!

(Use code GAMEDISCOVER10 for 10% off forever.)

Showing the ‘shape’ of 2024’s new PC game biz..

When we featured Steam’s top-grossing games of 2024 at the beginning of last month, folks enjoyed seeing ‘the winners’. But we did get one waggish response on the GDCo Plus Discord: “Could we see a "Steam's median-grossing games, a representative sample" next?”

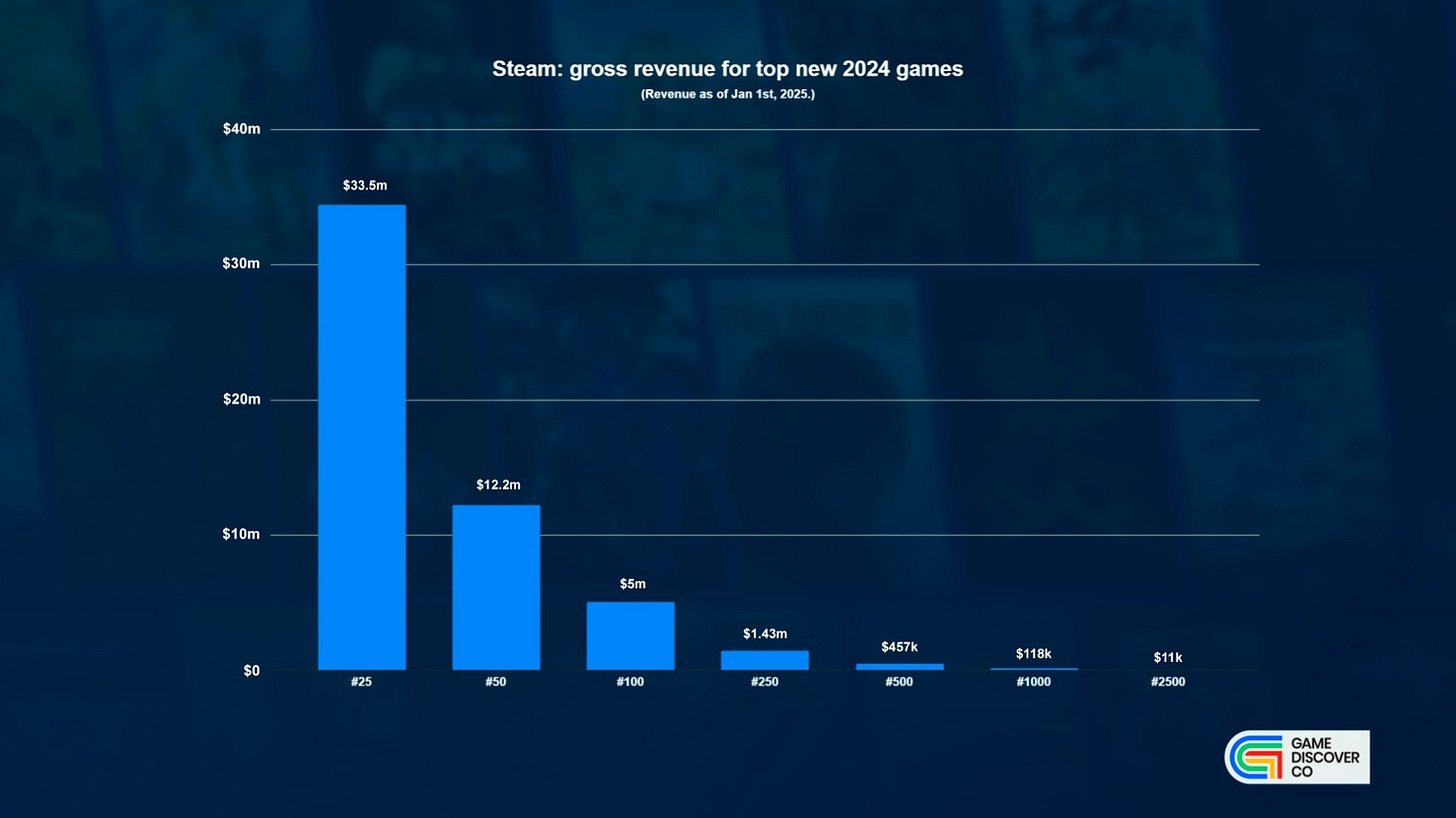

And you know, that’s a reasonable request. So GameDiscoverCo calculated some of the top-ranked new games of 2024 by Steam gross revenue (above), to give everyone a much clearer idea of how the ‘long tail’ behaves. And specifically:

We see the #25-ranked new game of 2024 at $33.5m gross, the #50 game at $12.2m, and the #100 game at $5m gross. (That #100 title converts to about $2.9m net right now. But back catalog discounts should ~double the number over time.)

Further down the spiral, the #250 new game released in 2024 grossed $1.43m by Jan 1st, 2025, the #500 game grossed $457k, and the #1000 game made $118k before refunds, VAT, and Steam platform fee.

Finally, according to our data, the #2500 new game - out of about 18,900 released on Steam in 2024 - grossed approximately $11,000. That ranking, btw, is the top 13% of all Steam titles released in the year. Gives you a lot more context, huh?

Obviously, the next question tends to be - ‘oh yes, but how many of these games were serious attempts to make money?’ To which we would say - how can you even tell? But one method is to look at pricing, presuming - perhaps not always correctly - that games that cost >$10 were going for a more ‘proper’ premium audience:

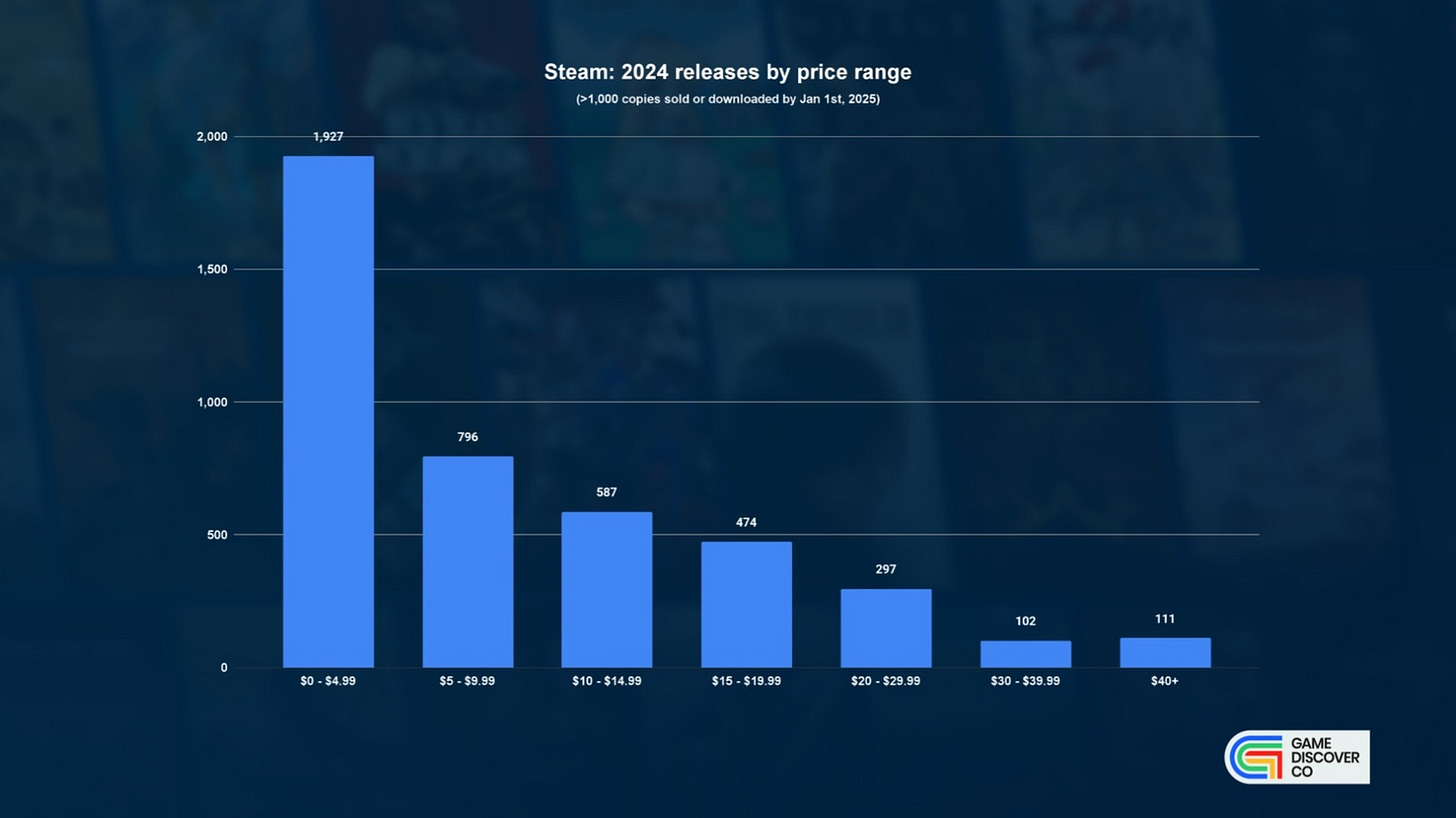

So, for games newly released on Steam in 2024 that had >1,000 copies sold or downloaded by Jan 1st, 2025:

1,900 were free (or F2P) or cost <$5, and ~800 cost between $5 and $10.

590 cost between $10-$15 and 470 were priced between $15-$20. And only ~300 were in the $20-$30 range.

At the high end of pricing, ~100 games cost between $30-$40, and 110 were $40 upwards. So yes, there’s quite a lot less choice on that end of things.

Still, we can better understand the competition set this way, huh? If you’re launching a $40+ game, there are ‘only’ 2 per week launching at that price point on Steam nowadays.

Finally, we could slice and dice this data for days, but let’s look at how much the Top 250-ranked new games on Steam in 2024 by revenue charged as their ‘default’, non-discounted price to players:

The raw numbers are above. But as a percentage of all the games with at least 1,000 players or downloaders that grossed >$1.43m in 2024, you get the following:

1.7% of the games - 33 out of 1927 - that cost $4.99 or less made it to the Top 250 highest-grossing new Steam games in 2024. (Mainly F2P titles, obviously.)

Next up, 16 out of 796 (2% )of those costing $5-$9.99 made it to ~$1.4m in launch year, and then 20 out of 587 (3.4%) costing $10-$14.99, and a slightly better 30 out of 474 (6.3%) costing $15-$19.99.

Moving to the most expensive pricing, 57 of the 297 (19.2%) costing $20-$29.99 did end up grossing ~$1.4m or more, and 25 of the 102 (24.5%) costing $30-$39.99. Finally, 69 of the 111 (62%) that cost $40+ made it to >$1.4m total.

Of course, we’re not even trying to calculate ROI here. And when your game costs $40+, it’s quite possible that grossing ‘only’ $1.4m on Steam is not remotely getting the job done re: covering dev and marketing costs. (We can’t tell, just speculate.)

But this all does a better job of describing the overall market for new launches than just a top list. And while it doesn’t quite cover the ‘median’, it does at least help us to understand the level of competition in today’s market. At least, we learned things…

Why platforms keep coming up short vs. Steam…

As a promo piece for an article on his newsletter from IMVU’s James Birchler about scaling that platform, a new LinkedIn piece from ex-Amazon VP Ethan Evans is fascinating - for us - because it talks about why a behemoth like Amazon still couldn’t disrupt a PC incumbent like Steam.

As Evans says: “As VP of Prime Gaming at Amazon, we failed multiple times to disrupt the game platform Steam. We were at least 250x bigger, and we tried everything. But ultimately, Goliath lost.”

He ends up listing at least three different initiatives the firm tried to expand its PC digital video game store capabilities:

“The first way we tried to enter the online-game-store market was through acquisition. We acquired Reflexive Entertainment (a small PC game store) and tried to scale it. It went nowhere.”

“Then, after buying Twitch, we created our own PC games store. Our assumption was that gamers would naturally buy from us because they were already using Twitch. Wrong.”

“Finally, we built Luna, a game streaming service that let people play without a high-end PC. Around the same time, Google tried the same thing with their product Stadia. Neither gained significant traction.”

Evans concludes: “At Amazon, we assumed that size and visibility would be enough to attract customers, but we underestimated the power of existing user habits… The truth is that gamers already had the solution to their problems, and they weren't going to switch platforms just because a new one was available.”

This is obviously ironic because Amazon’s core strength is built around being an online store - for ordering physical products - that’s so easy to use. And nobody wants to switch away from it, no matter how they feel about it at any given moment.

But it also speaks to a larger truth - Steam, as “a store, a social network, a library, and a trophy case all in one”, may be effectively undisruptable, because the switching costs are just too great for most players to countenance. And that’s all we’ve got - toodles!

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]