The state of VR games in 2022: survey results

Publikováno: 23.2.2022

We asked some key questions on platforms.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome, my pretties, to the show that never ends, the innumerable and incalculable, the constant whoosh of information heading for your cortical regions that is the GameDiscoverCo newsletter.

This time out, we’re taking a look at the VR space in some more detail, tunneling into the ‘publisher vs. developer’ mines of chaos, and rounding up a whole heap of awesome news about the game discovery world as we see it today. Let’s boogie…

[LAST CHANCE: the 22% off GameDiscoverCo Plus dealruns out on Thursday, so - y’know, get on that?Perks include an exclusive weekly game trends analysis - next one’s on Friday, an info-filled Discord, a Steam/console data back-end & game discovery eBooks - thx for helping!]

What’s up with VR? GameDiscoverCo surveys…

Some of you may remember that we analyzed Quest 2’s marketplace a few weeks back with the help of Cassia Curran, and then asked VR game developers to contribute anonymous data and opinions to us. There’s been scant public surveys of these folks.

Overall, we got about 20 responses, which ranks in the ‘OK, but anecdotal’ range. Just over 50% of the respondents had their latest game on Steam. Additionally, just under 50% had their newest title on the ‘official’ Meta Quest 2 store, whereas about 25% had their game on the lower-profile unlisted App Lab section that Meta provides.

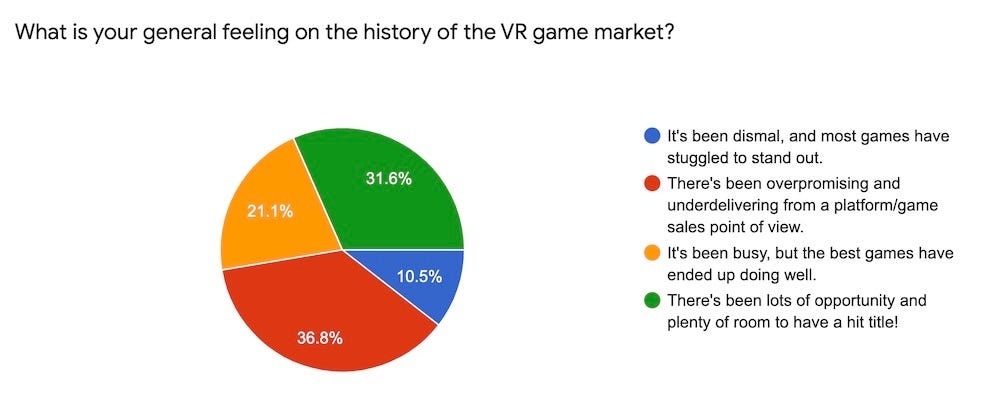

We first asked about the VR market using multiple choice responses, and the results were intriguing. Even from the active and presumably enthusiastic VR game developers, close to half haven’t been that happy with the market to date:

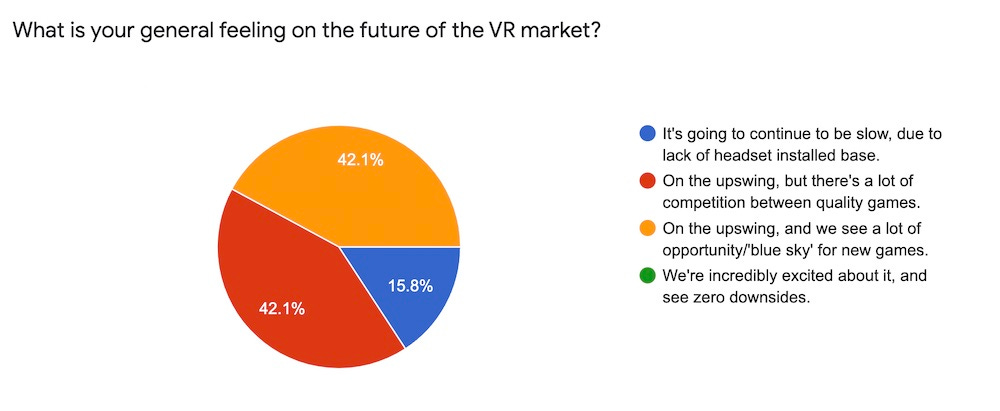

However, if we’re looking forward, there’s a lot more optimism - with only 16% of respondents thinking installed base is going to be a continuing problem. (But many still clear-eyed about a busy market!)

We then asked a few questions about ‘sales to review ratio’ on Steam and ‘sales to star ratings ratio’ on Quest Store. We were trying to work out if VR games have a higher ratio on Steam, and if our putative ratio for Quest Store (sales being 110x star ratings?) was approximately correct.

Obviously, response rates were fairly low, with a couple of anomalies due to misunderstanding the question. But here’s the conclusions we came to:

If you think recent Steam ‘reviews to sales’ ratios across all games are in the range of 20x to 55x, we’d speculate VR-specific games on Steam might trend a bit higher: median 55x, range between 25x and 75x. This would be because playing in VR doesn’t interface well to typing reviews into the Steam interface, presumably. Responses were as low as 20x and as high as 120x tho, so YMMV.

For the Meta Quest store itself, the median of the responses - minus one anomaly - were sales being 108x the Quest store star ratings. So Cassia’s first estimate looks good. But bear in mind that the lowest response was 50x and the highest was 250x, so it can vary quite a bit. Still, it’ll be directionally correct.

We then asked: “If your game is available on the Meta VR 'main' store, over the last month, what percentage of your latest game's gross revenue has come from it?” So basically, this is comparing Quest revenue to Steam revenue (and some PlayStation VR/other revenue, in a couple of cases.)

The results, in anonymous descending order, were the Meta store providing 98%, 96%, 80%, 78.5%, 72.5%, 60%, and 31% of the last month’s total revenue for their VR game - so a median of 78.5% of gross revenue.

And we also asked about total revenue on the Meta store vs. other platforms, revealing an average and median of 84% of lifetime revenues coming from the Meta store. No wonder VR devs dig Quest 2 right now…

VR devs speak out: the comments!

Finally, we gave people a chance to anonymously comment on the state of the VR game market as a final question. And here’s the particular trends we saw in the comments:

Quest is great, if you can get a) on the store b) store featuring:“Very healthy if you can get onto the main store - even better if Oculus like your app and feature it / give it prominence.”

Some older catalog titles are improving sales again thanks to Quest:“We have had the rare fortune of seeing sales for one of our oldest VR titles increase year over year over year due to the growing Quest market.”

Meta is in danger of being a ‘kingmaker’ for VR games:“Very hard to get funding for good VR games. Feels like Oculus/Meta has picked the winners and is only investing in them. If you’re not in the club, hard to see how to break in, especially without many other funding sources.”

SteamVR got some harsher comments, as people worry about a Meta monopoly:“Domination by a single platform (Meta) is not healthy for the market. Valve appears to have completely given up the PC space.” “Even App Lab seems to be better than SteamVR.”

PlayStation VR got mentioned in passing, but more focus seems to be on PSVR2:“Playstation VR games sell quite well too.” “By holiday 2022 and into 2023 we could be seeing major changes to the market with the release of PSVR2 and potentially Apple.”

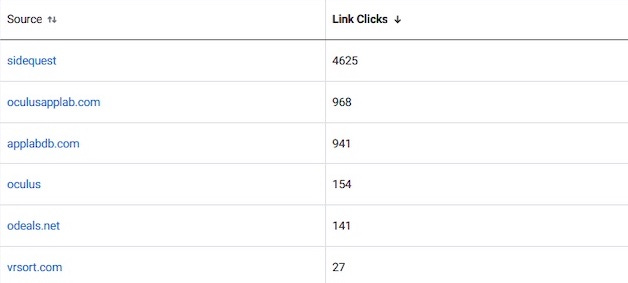

Quest’s unlisted ‘App Lab’ section can do decently:“App Lab alone can be really profitable if you promote your game correctly on SideQuest.” Although others noted: “App Lab is worse than Steam since you have no chance to ever go "trending". You're "unlisted"“

On this final point, the developer of the excellent-looking Stunt Track Builder, Duc Le Minh, also weighed in on how being solely on App Lab was working well for him as as solo developer.

In particular, he provided this chart of referrals to his App Lab page from those who downloaded his Quest game, showing how his SideQuest page (and to a lesser extent inclusion in AppLabDB) allowed prospective players to discover his game.

Duc’s game is free with DLC, and you probably (?) can’t sell hundreds of thousands copies while not being on the Meta Store ‘proper’. But it looks like some App Lab-only games like Deisim may have sold 50,000+ units.

And there are quite a few in the 10,000 to 30,000 unit range, if you take the ‘star ratings to units’ multiplier from the main store and apply it. That’s a bit surprising to us. And it’ll be interesting to see how the Meta store curation evolves over time.

[BTW, we will return to the VR space one extra time in due course. We’ll take another look at the Quest and App Lab data via Cassia’s lens, with some extra ‘logarithmic graph’ detail in data. So please watch out for that in the next few weeks.]

New ‘you don’t need a publisher’ claims, poked at..

It’s true, game publishers reading this newsletter - we’re in ‘The Rock’s exaggerated eyeroll’ territory again. Back in late January, Reddit’s r/gamedev had a long, slightly ranty post entitled ‘Stop. You don't need a publisher. You're walking into a trap’.

We might not feature if the piece was wholly ill-considered. But the dev (though he doesn’t mention it in the post) is Gavin Eisenbeisz from Two Star Games, who is making v.creepy ‘a spider-train is stalking you’ game Choo-Choo Charles, which we did a ‘designing for virality’ newsletter about back in October.

So Gavin, who has worked with publishers before and also made much-downloaded free walking sim Cloud Climber - has some knowledge of the market. I will say that I think his status as a solo/tiny team dev makes his perspective different from many. But the things he said that seemed most resonant were as follows:

Some publishers are just waiting for a fast horse and jumping on it: “Half of a publisher’s business model is to find a game that might be successful, sign a deal, and hope it's a hit so they can fund a few more games and bag another few hits.”

They may provide ROI-negative paid advertising that needs recouping against: “Often publishers will spend money on paid advertising, sponsoring YouTubers & streamers left and right, racking up their expenses in incredibly ineffective ways. (pro-tip: don't pay people to play your game, it rarely pays off).”

There’s a lack of attention if the game is doing less well: “If a publisher realizes before (or after) launch that the game isn't going to pay off, they'll probably just cut their losses and stop putting any form of care into the project that you might have been getting.”

Actually, I have a long-standing joke about the world-weary developer’s view of publisher relationships. There’s only two binary positions: either a) your game does poorly, and you fault the publisher, or b) your game does well, and you feel like the publisher isn’t doing enough for their substantial ‘long tail’ revenue cut.

What’s particularly interesting is that the post’s comments have significant pushback from devs who find value in publishers. For example, this post is a good example, pointing out that funding is a key part of many publisher deals, and “publishers are a business, they are not a panacea.”

But wanted to end by featuring a comment from the folks at Unbound Creations, whose Rain On Your Parade is one of my favorite indie games of the past year. They say: “We are an indie studio who worked with publishers and also self-published with 5 games total. I think OP's points are all valid, BUT the premise is bit flawed. There are a lot of predatory publishers, but not all publishers are predatory.

The thing to remember is this is a business deal. You should seek a publisher to obtain a clear added value you cannot provide yourself. For one of our games, this was a native Japanese release (they knew the market better than us), AND porting to extra consoles globally. It was not something we could/wanted to do at the time, so it was a clear value-added and basically extra "free" money. Even with rev share and recoup, it was 100% worth it.

If you don't have a concrete idea what you want from a publisher, and you haven't considered the best/worst case scenarios under the deal you are being offered, you should not be getting a publisher. Hoping a publisher ‘might’ improve your sales without understanding how, is a recipe for disaster (even big dogs like Devolver have some lukewarm duds).”

And that’s sort of the point. If you are self-funding and publishing Choo Choo Charles and it already has traction - maybe all offers look subpar to you? But it wholly depends on your game’s situation and what risk (funding) or workload (community, marketing, porting, localizing, platform relations) you want to personally assume.

The game discovery news round-up..

Finishing up here, there sure is a lot going on in the game space again this week. And we’re not even taking into account Elden Ring’s launch, which seems to be something close to the Second Coming. Anyhow, here’s what we’ve got for platform goodness:

The latest Steam Deck update? Prospective players can now check which games from their library are Steam Deck verified directly on the platform, which is pretty useful. (GameDiscoverCo has a Steam Deck, btw, and we’ll be making discovery-related comments on it in one of next week’s newsletters.)

This PlayStation Blog update about Shadow Warrior 3 also announces: “Shadow Warrior 3 will be a PlayStation Now title at launch” on March 1st. This is a rare launch-timed deal for the previously backburnered PlayStation Now. And I would guess it’s an early deal from the upcoming PlayStation Plus revamp diffusing into the existing Sony subscription structure?

Interesting to see the folks behind the Backbone mobile game controller (above) get $40 million from various glitzy backers (Marshmello! The Weeknd!) The biz model is based on cloud streaming games to mobile being a thing, too: “As Roku built a business out of bringing all the video services to one place, and Sonos did the same for music, Backbone aims to do for mobile gaming.”

Omdia’s Rob Gallagher posted some interesting analysis of Netflix’s current foray into games, analyzing the reach for Netflix’s ‘interactive shows’ like Black Mirror: Bandersnatch, and adding re: mobile Netflix games: “Titles from its catalog were downloaded 6.8 million times in total between the global rollout in November 2021 and January 2022, according to Omdia partner Sensor Tower. Even making the generous assumption that each download was by a single Netflix household, that would equal just 3.1% of the company’s subscription base.”

As PlayStation VR2 advances, Sony put up a blog showcasing its hardware design, and there’s some aesthetics going on here, for sure: “…the PS VR2 headset has a similar shape as the PS VR2 Sense controller, taking on a matching “orb” look. The circular orb shape represents the 360-degree view that players feel when they enter the virtual reality world, so this shape captures it nicely.” (Looks good - shame it’s not wireless.)

In the latest ‘events are coming back’ news, TwitchCon confirmed final dates for its two shows for 2022: “TwitchCon Amsterdam will be held at RAI Amsterdam on 16-17 July and TwitchCon San Diego will be back at the San Diego Convention Center on 7-9 October.” Still not sure how exhibits will bounce back for B2C shows, but community gathering like this makes a lot of sense.

One interesting tidbit about PlayStation Plus ‘free’ game download reach & upsell from Embracer’s Q3 results: “On January 4, Coffee Stain and Ghost Ship launched Deep Rock Galactic on PlayStation 4 and PlayStation 5 as part of PS+. The game has already received more than 9 million downloads and has generated solid downloadable content (DLC) sales after the end of the quarter.” Numbers!

Microlinks: Amazon’s ‘Play on Luna’ button on Twitch “is more potential than practical” - but interesting anyhow; enjoyed this Dave Karpf blog on what the Quest Superbowl ad gets right about the metaverse’s promise; the Bethesda launcher is being retired, and games you own on it are “moving to Steam”.

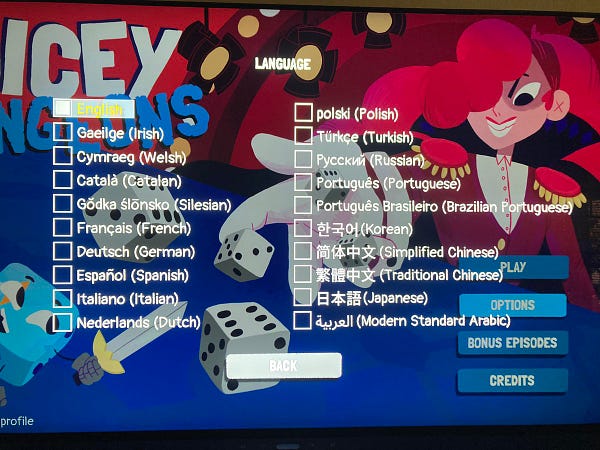

Finally, have you ever wondered what happens when a developer uses localization specifically as a tool to push overlooked languages, rather than tune for revenue? Well, Dicey Dungeons’ dev Terry Cavanagh is doing that, and it looks a bit like this:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]