Three key discoverability takeaways from the Epic/Apple lawsuit

Publikováno: 5.5.2021

We've got CHARTS for you all.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Listen here, we’re back again, and we’ve got a newsletter which features… oh no, the Epic/Apple lawsuit. Haven’t you all heard enough about that already? Well, we agree that there’s been a lot of coverage.

But not many outlets have gone deeper into what GameDiscoverCo cares about. What does the data exposed by the discovery process of the trial - the 1000ft view of which we analyzed a couple of weeks back - show us about which platforms are good to make games for? And how has Epic Games Store itself has evolved? Let’s do it.

(PSA: if you aren’t signed up to GameDiscoverCo Plus, our premium tier, you’re missing a helpful member-only Discord server, custom researched game hype/sales analysis newsletters, a Steam data backend, & more!)

#1: Platform splits for Epic titles might surprise?

One thing we very much care about is how games sell across multiple PC/console (and mobile!) platforms. So it’s great that, as part of the trial discovery process, an Excel document has been made public with Epic-owned games’ monthly revenue on all game platforms.

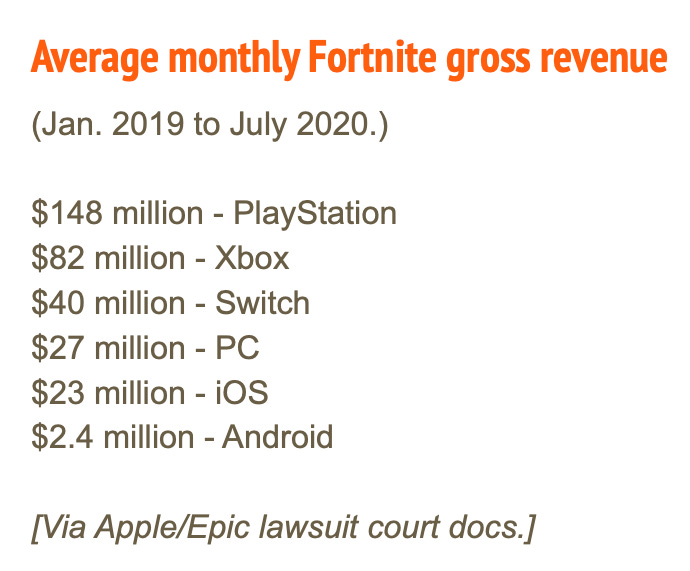

It’s a big/scary document, but we can distill this down for you by presenting average gross revenue (before platform cuts.) Firstly, here’s what Fortnite looked like for the 18 months ending July 2020. (Starting in August 2020, the game was pulled from the iOS App Store, so the comparisons break down.)

This is pretty interesting. When I posted this on Twitter, most people’s reactions were that PC revenue was a bit lower than expected, console (and especially PlayStation!) was higher, and the iOS vs. Android revenue difference was far higher than you might have thought.

And I’d agree with that. On iOS/Android, there might be a couple of reasons - firstly, the Android hardware base is fragmented (has a lot of lower-spec phones that can’t run Fortnite), and the store ecosystem is fragmented (the company ran a standalone Android launcher for Fortnite, then moved onto the Google Play Store, then pulled it off again.)

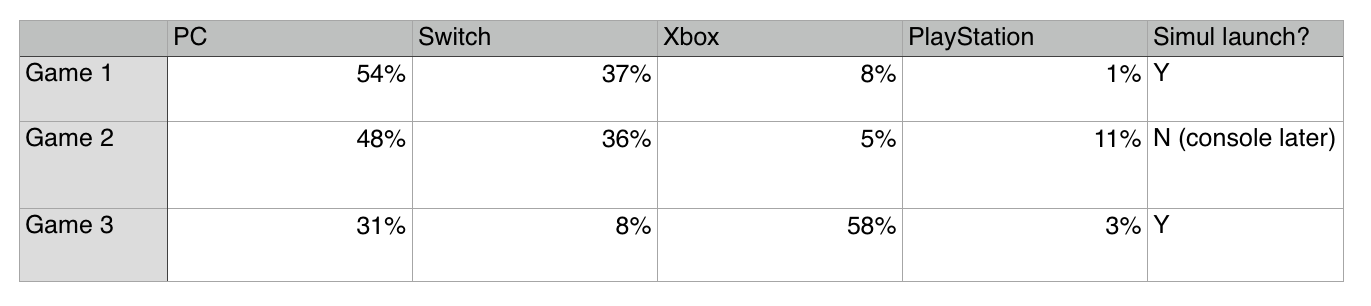

As for PC vs. console sales data: we’ve talked about platform share for smaller PC/console games before. Below is some anonymous data we got about first-week sales by percentage. You’ll often see the platform sales ranking - in descending order - as: PC, Switch, Xbox, PlayStation:

But for social-centric F2P phenomena like Fortnite, the situation can be very different. Clearly, the demographic that plays Fortnite is much more likely to have higher-end console hardware, or at least, is more likely to pay on those systems.

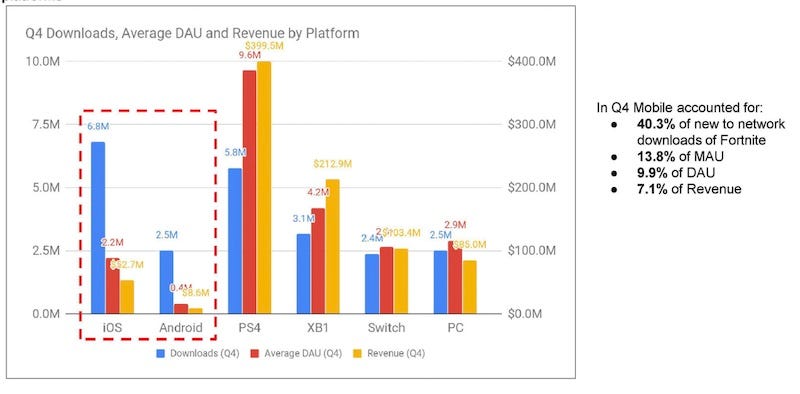

Oh, and as a bonus, here’s Fortnite’s downloads, DAU and revenue across all platforms in the last quarter of 2019 (from this employee onboarding document), showing mobile monetizes somewhat less well:

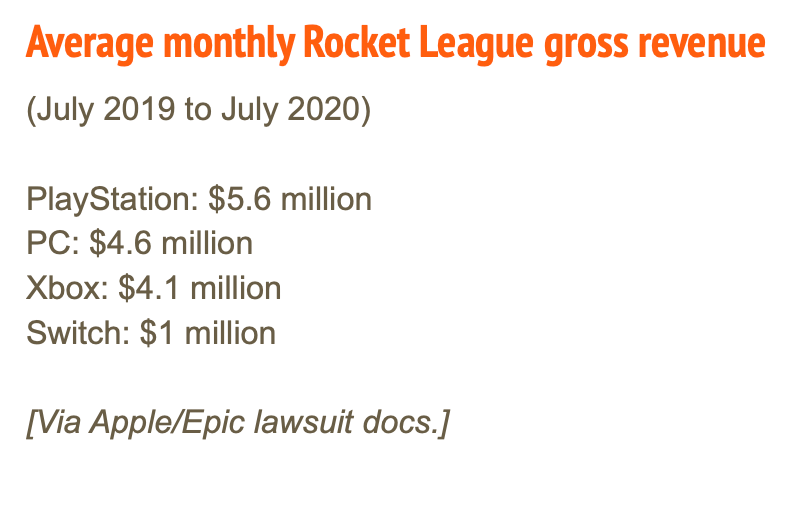

Finally for this section, here’s the monthly grosses for the Epic-owned Rocket League for the year to July 2020. These are the kind of numbers I would expect for a ‘cross-platform hit’ which started on console, and came to Switch later.

(BTW, Rocket League went F2P and new PC sign-ups shifted from Steam to Epic Games Store right at the end of the revenue data we have. So we can’t easily see what happened. There is a big projected increase in revenue, though.)

#2: Epic Games Store lives and dies via exclusives

We unfortunately don’t have data on this from 2020. But there’s an Epic Games Store October 2019 ‘review of performance and strategy’ document which has been the source of a lot of the most interesting store trends data. (More on this in #3.)

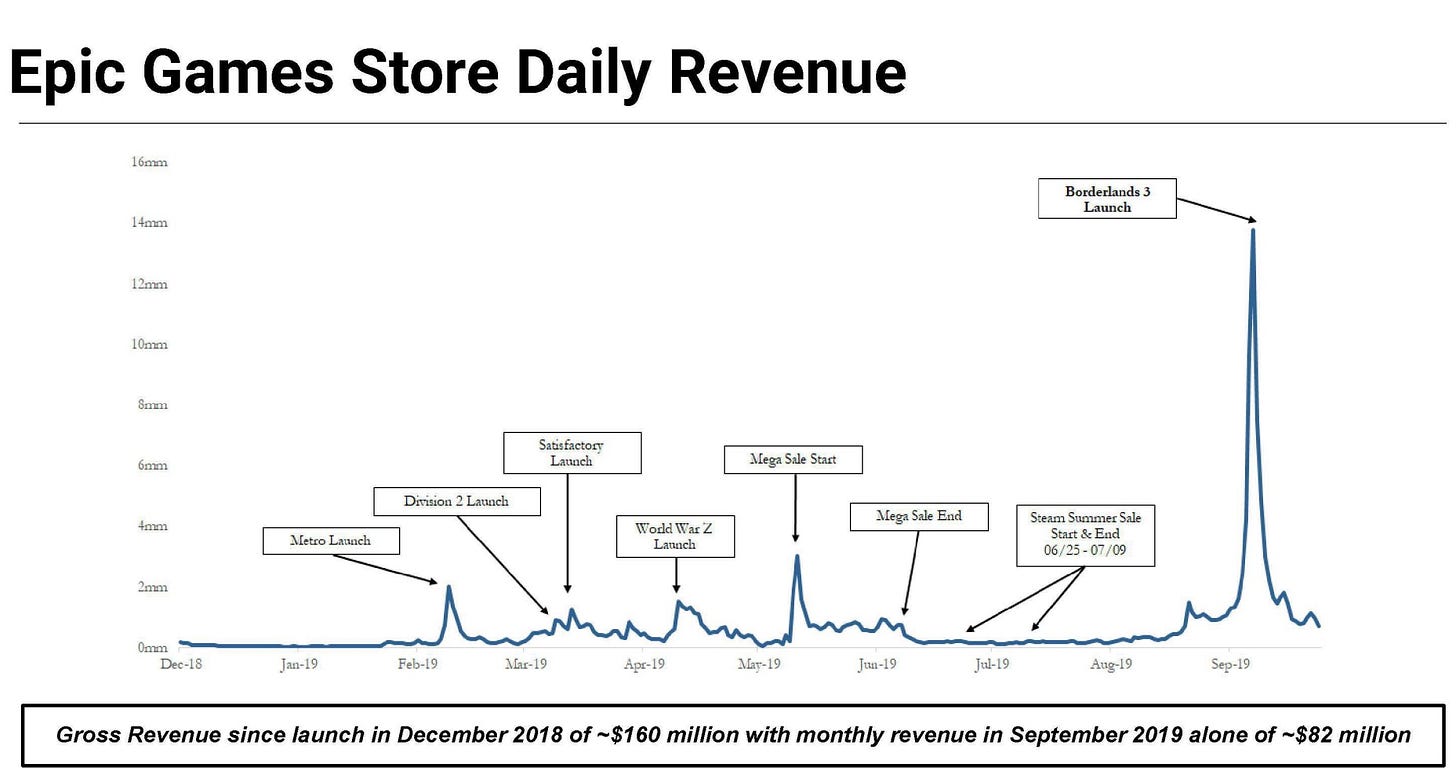

But you get to see a lot of data from the first 9 months of the store, including super interesting charts such as annotated daily revenue:

What’s very clear - at that time - is that store revenue is powered by paid-for exclusives. You can see the spikes around particular game launches, with Metro, The Division 2, Satisfactory, and World War Z being the initial 2019 winners. All of these titles had guaranteed advances in the millions of dollars - so Epic would pay out, even if it didn’t sell.

But then look at the period after the first Mega Sale (which had $10 off every game on the store, with that discount paid for by Epic) - pretty flat, huh? Yet if you look at Al (Morwull)’s document on EGS exclusives, sorted by date, you can see plenty of new exclusive games launching in that period.

That’s the problem the Epic Store had back then. We don’t have full internal data to confirm, but we suspect they still have this problem now: in the absence of community or critical mass, players will visit platforms only to buy exclusives or get free games.

Some supporting evidence: the document says that only 7% of the 18.5 million Epic Games Store users acquired up to October 2019 via free game giveaways went on to buy games. And we do know that Epic has $330 million in unrecouped costs on game advances - we suspect that’s higher than expected.

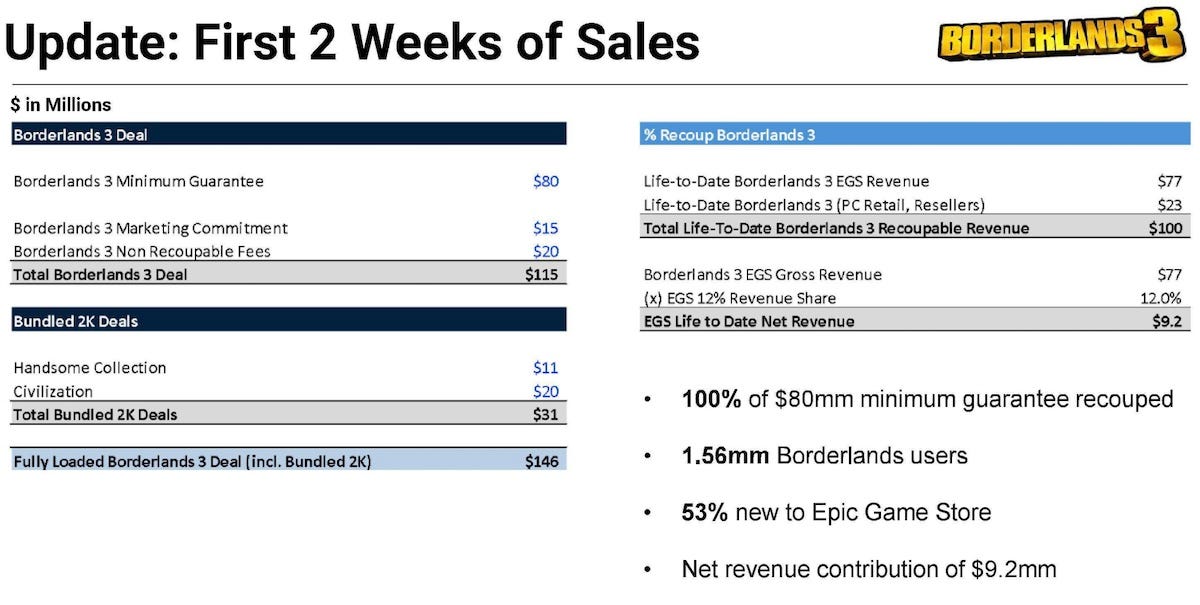

One area that Epic doesn’t have an unrecouped minimum guarantee, at least, is Borderlands 3. The same document reveals the specifics of the Take-Two and Gearbox deal, and it’s eye-opening:

So the entire $146 million (!!) upfront deal included ‘minimum guarantees’ for Borderlands 3 ($85 million), the Borderlands Handsome Collection ($11 million), and ‘Civilization’ ($20 million - is this Civ VI or the next Civilization game?) Plus there’s a non-recoupable $20 million and a $15 million co-marketing spend on Borderlands 3.

Anyhow, most Epic Games Store minimum guarantees are probably in the ‘mid hundreds of thousands, to high millions’, USD-wise, so this one stands out. And… it totally paid off in terms of drawing players to EGS in that time period.

Just two weeks after release, life-to-date Borderlands 3 recoupable revenue hit $100 million, and 820,000 new Epic Games Store users were created. Epic might struggle a little to recoup everything because of the non-recoupable money and EGS’s 12% revenue share, but that’s not what they wanted. Job done - in the short-term.

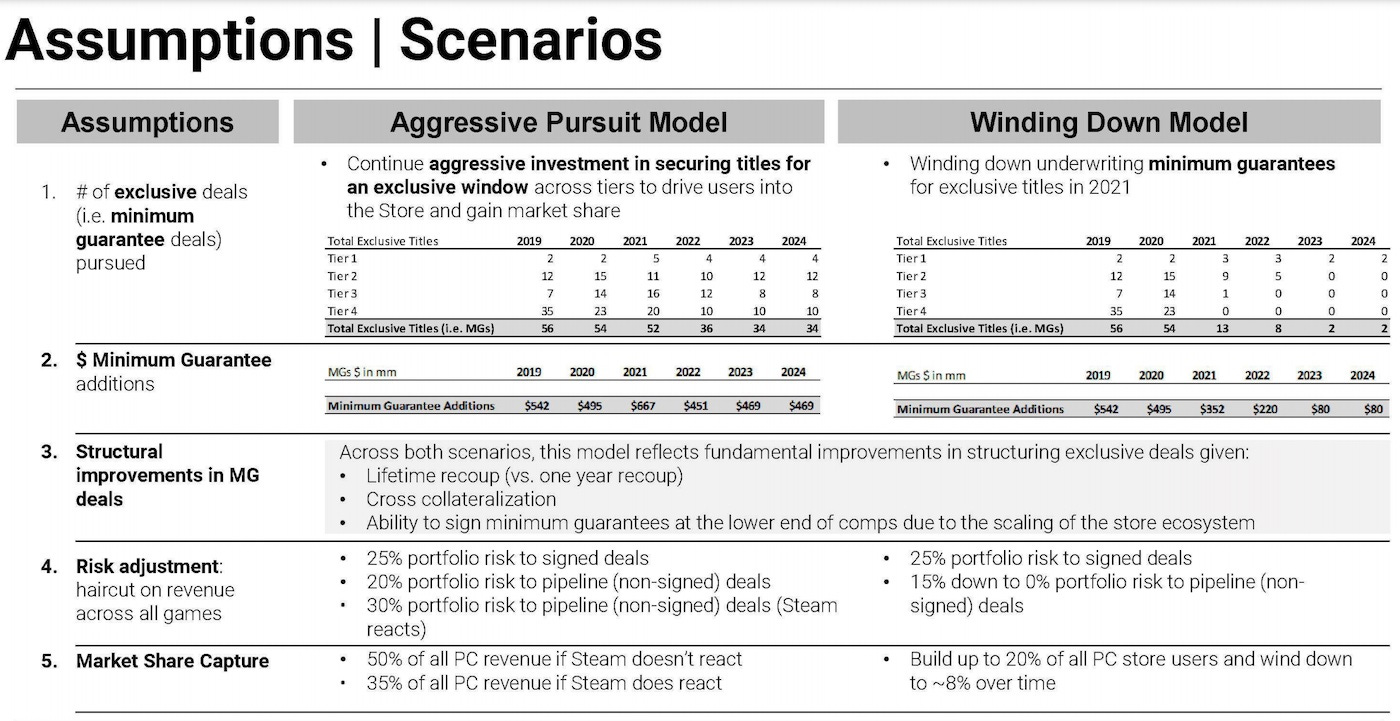

There’s so much other fascinating stuff in the full deck. But one thing I wanted to highlight in particular. We believe that EGS ‘minimum guarantee’ deals are winding down. The catalog is widening, and many more publishers/devs have been let onto the Epic Games Store to publish games with no exclusivity, but no advance.

There were two scenarios in the late 2019 EGS revenue model - ‘aggressive pursuit’ and ‘winding down’. And we’re pretty sure that Epic’s plans are skewing closer to the latter than the former:

We see the announcement of Epic co-publishing with Playdead, Remedy, and genDESIGN back in March 2020 as a hint towards this change in tactics. And we’re sure that EGS titles are not being actively signed at the rate of the ‘aggressive pursuit’ option.

This doesn’t mean that EGS has given up - or the store isn’t helpful in aggregate. The trailblazing on ‘fair cut’ for platforms is admirable. But in the far future, we think EGS will function more for Epic as a PC ‘hub’ for its owned products (Fortnite, Rocket League, Fall Guys), plus these co-published exclusives.

Of course, Epic Games Store will still exist as a modest alternative to Steam for third-party PC game developers and publishers. But we’d put its market share for simultaneously released PC games at 5% or less right now - above any other PC store (including the Windows store, GOG and Itch), yet still struggling against Steam. And absent exclusives - which are loss leaders anyhow - it’s not really even quite making its ‘winding down’ model case.

#3: EGS free games - best negotiated how?

Yes, we featured this ‘Epic Games Store free game $ in first 9 months’ chart - also from the EGS store document - briefly in the last newsletter. And I feel a little bad about it for a couple of reasons.

Firstly, that the developers had this information exposed without permission. That might be educational, but it might also be privacy-invading. Sorry - all I can say is that Epic didn’t push for this to be redacted, for whatever reason. And secondly, that my Tweet about it went so viral (over 5,000 likes) that it got a bit decontextualized.

So let’s kick back and work out what we can learn from it. Firstly, just so we’re all on the same page - these are games that were offered for free on Epic Games Store for one week in 2019, up to the end of September.

‘Buyout price’ is the lump sum the dev was paid for an unlimited amount of game downloads. ‘Entitlements’ is the number of times the game was added to the EGS library by a player. And the other items are fairly self-explanatory - ‘UA cost’ is number of new Epic accounts divided by cost of buyout, etcetera.

So, here’s the lessons that I would take from this:

The ever-opinionated Rami Ismail has a rather correct one, here: “INDIES - DEMAND MORE MONEY FROM CORPORATIONS FOR YOUR SHIT.” It’s maybe subtler than that, but there’s fundamentally no difference in free game download numbers between - for example, not picking on anyone, Fez ($75,000 payment) and Celeste ($750,000 payment).

So why didn’t everyone get $750,000 for their title to be free on EGS? Well, Epic likely didn’t have the budget to do that. (The average cost across all games is about $290,000.) And Fez is a much older game, so you might expect a different upfront cost at that time in its lifecycle. And we know nothing about how these parties were approached. Did Fez and Celeste both start with the same offer on the table?

But could EGS free games that accepted $100,000 have got $200,000, in this case? I’m going to say yes. And something I hear repeatedly - whether it be for Apple Arcade, Google Stadia, Xbox Game Pass or other services - is that smaller devs didn’t take into account that there might be a higher range of possible ‘lump sum’ payments from the platform holder. (So yes, ask for more money!)

And this is where negotiations and valuations get weird. Because a lot of the time, things like ‘being paid for your game to be free on Epic Games Store’ are just found money for most devs. And how do you value ‘found money’?

This isn’t like Netflix where you are negotiating to make a TV show ahead of time, and you know how much the TV show costs, and you need that amount of money. This is just a part - sometimes an unexpected one - of the overall revenue picture for your game.

So what we’d suggest you do is forget about the ‘free money for me, so an arbitrary amount is OK’ angle, and try to put yourself in the eyes of the platform-holder. What do they want, and what are they prepared to pay for it across a whole range of companies, big and small?

If the platform holder can walk away, then sure - being too aggressive might be a problem. But you probably have more negotiating wiggle room than you think. Use it.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides.]