TikTok: how data changed one dev's discovery tactics

Publikováno: 30.11.2022

Also: a 'premium mobile' lesson, and plenty of new platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the latest GameDiscoverCo newsletter, folks. Although most of these missives are written by myself (Simon!), did you know that GameDiscoverCo has four and a half full-time workers now, helping build out our Pro offering and data set?

In the meantime, we appreciate your time and attention. And as the year winds down, we’re excited to keep bringing you views, data and news from the increasingly complex world of video game discovery.

[We need your support! Sign up to help us fund our work via a GameDiscoverCo Plus paid subscription! This includes Friday’s PC/console game trend analysis newsletter, a big Steam ‘Hype’ & performance chart back-end, eBooks, a member-only Discord & more.]

TikTok: you saw the data, but what to do about it?

Although I’m claiming ‘you saw the data’ in the headline, perhaps you did not! So, a recap. A few weeks ago, ‘TikTok, socials & numbers guy’Jared J Tan made a Twitter Thread and a full blog post about a survey he did of video game TikToks.

As he noted: “I gathered data from over 1500 TikTok videos by game studios. This analysis includes detailed stats from their best performers, totaling 700 million views.” Although Jared notes this isn’t ‘scientific’, it sure is indicative - which is our fave thing!

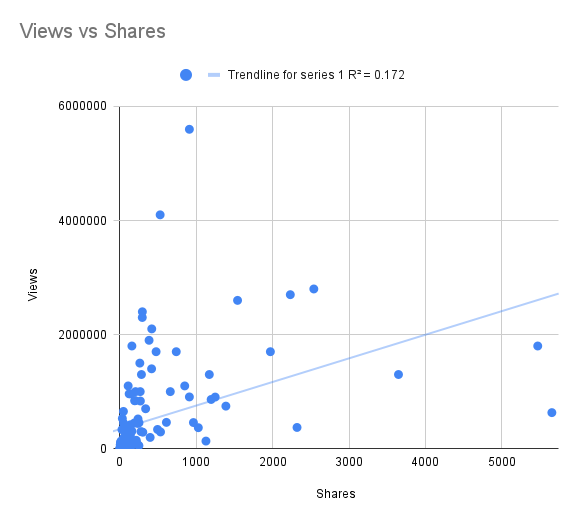

You may have already read the thread, but summing up very briefly: “[TikTok] Likes and Favorites have a strong… correlation with Views. Comments also have a moderate correlation, while Shares do not.” Makes sense, though we’re a bit surprised about Shares.

And beyond that: “Videos with higher views get Likes at a faster rate… [and] better performing videos are Favorited twice as often as less viewed videos.” We found his average data point across all of the TikToks interesting: “489k views; 25s video length; 15s avg watch time; 37% full watch; 7.8 views per like; 859 views per comment; 205 views per fav.”

But beyond that mass of data, I wanted to drill into concrete takeaways. So I chatted to Jared about how he changed his own social media tactics, based on the survey results! Here’s what he took away from the data dump:

Q: What surprised you the most about the results of your TikTok survey?

I didn’t expect the average video length of the best-performing videos to be as long as they were. In my data set, videos over 50k views have an average video length of 28.21 seconds, while over a million views is 26.75 seconds.

I have been trying to make mine between 10-20 seconds, and so far that’s been pretty successful for me. It’s always a challenge to keep viewer interest as high as possible, when you’re also trying to show a new product or game that many viewers won’t be familiar with.

A common recommendation I’ve seen is only to include one topic per video. But I think it might be worth trying to add a second topic from time to time, to pump up the average watch time. But really, none of this is an exact science. And the most important thing is conveying the most interesting part of your game in an appealing way.

Q: Are you directly changing any of your TikTok tactics because of the results of the survey?

A: Along with extending certain videos to include a second topic, I am intrigued by the correlations between views and active engagements. I had previously heard that Shares helped videos go viral, but my data didn’t show that.

For an active engagement call-to-action, comments are the most straightforward to ask the audience for. “What animal should we add next? Let us know in the comments!”

Until now, I hardly ever asked for Likes or Favorites as a CTA, but I’m definitely going to give that a shot to see if it helps performance in the algorithm.

Q: Some people say that popular games have popular TikTok videos, and so it's more correlation than causation when it comes to creating interest. What do you say to them?

A: It’s undoubtedly much easier to get TikTok views if your game is already popular. However, there are numerous examples of games that gained much more visibility through TikTok. You’ve covered a number of them in your newsletters already.

The inverse also doesn’t hold up. A big game definitely doesn’t automatically lead to success on the platform. There are AAA studios with wildly successful titles that are outshown by indie teams and solo devs.

But that also brings up the common question, “how valuable is TikTok visibility”? This is almost impossible to measure, but I fall back on the Rule of 7 from old-school marketing. It suggests that a potential customer will need to hear an advertiser’s message 7 times before they’ll take action to buy a product. A viral social media post on any platform adds to that number, and brings many people one step closer to buying your game.

I know that game devs everywhere are short on time, so this is how I’d do a real push at TikTok with efficient time investment: build up a catalogue of 5-15 strong videos that show your game in its most appealing way. Post all of them regularly within a short time frame leading up to a key part of your campaign.

If it works, then you’ve got your game in front of many more eyes! Keep posting, and you’ll be building relationships with the viewers that could lead to the one thing more valuable than sales; fans of you, the developer. If it doesn’t, you can reevaluate whether you’ll iterate on the content to try again - or maybe your game just isn’t a good fit for the platform.

Mobile indie game dev: it can be rough out there..

Recently, Act None’s Adam Gerthel was kind enough to reach out to share a postmortem of his indie game studio, which had specifically targeted mobile with two ‘text-based RPGs’, but never quite managed to scale enough to survive.

The full piece has a lot more detail, but there are a few useful things to take away, if you’re making a mobile game as an indie:

‘Free to try’ at least gets you more scale than paid: Adam notes: “We chose a model where the game was free to download and try, with a paywall preventing the player in progressing in the story unless they unlock the full game.” The first game, Eldrum: Untold got to 277,000 lifetime downloads using that method, with $57k in revenue.

The team got ambitious for the follow-up: Act None spent 2 years working on Eldrum: Red Tide, because: “We figured that if one game [Untold] could generate $3.000 a month [in IAP], then a second and a third in the same series could generate enough income for us to be able to get a decent foothold.” (And another concern: Untold’s recurring revenue gradually dropped to $1,500 per month.)

The greater complexity of the sequel didn’t pay off: despite longer dev time and Apple featuring in ‘New Games We Love’, “the total number of downloads [in the first month of release for Red Tide] was around 22,500 and our proceeds amounted to about $4,500.” That doesn’t sound super sustainable as a $ run rate, since it’ll drop off from there.

Issues were exacerbated by a worse IAP conversion rate: Adam says: “Roughly 5.5% of everyone that downloads Untold will eventually buy [the IAP upgrade to unlock the full game], but the same number for Red Tide is only around 3.5%.” Slightly unclear why that is - the sequel has a 4.6/5 rating on Google Play, and players dig it.

In any case, Red Tide has had almost 40,000 free downloads since its late September launch, and lots of happy players. But since it monetizes modestly, the devs can’t afford paid acquisition - or to continue running Act None as a full-time concern.

At the end of the postmortem, Adam mentions: “I’ve had great use of the insights and data shared by Eric Farraro of Slothwerks and Arnold Rauers / Tinytouchtales over these years.” These are some mobile-centric indies who’ve managed to make it work by staying super-lean, and building up a portfolio of games to incrementally monetize.

But as Act None found, it’s difficult to make a professional living on mobile with a title that has one-off ‘upgrade’ IAP. To thrive, many have to explore the ‘how can you spend $100 or $1,000 in this game?’ route. Which isn’t everyone’s idea of a fun time…

The game discovery news round-up..

OK, here’s the last game platform & discovery round-up of the week for you free subs (Plus subscribers will hear from us on Friday with a big catch-up!) Let’s go for it:

Sony is officially launching PlayStation Tournaments on PS5 today, which “streamlines competitive play with shorter tournament times, seamless on-console sign-up, easily discoverable tournaments, all-new UI, real-time match updates, and more.” Launch games for the platform feature include Guilty Gear - Strive, NBA 2K23, and FIFA 23 - we’ll see how people dig it.

Steam’s top releases of October got its customary special event page, and most of the big titles are obvious (if interesting!) But it’s cool to look at the top 5 new DLC tab (Rimworld! Planet Zoo! Stormworks!), and the Top F2P launches for a look at the evolving monetization strategies on the platform.

In ‘best practices from mobile’ news that PC & console devs should poke at - GameRefinery looks at how mobile game devs are using in-game collaboration events to boost player retention, highlighting Mobile Legends Bang Bang x Kung Fu Panda, PUBG Mobile x Evangelion & even Cookie Run: Kingdom x BTS.

Apple’s yearly App Store Awards for 2022 are announced, and Games Of The Year go to Apex Legends Mobile (iPhone Game of the Year), League Of Legends eSports Manager (China Game of the Year), and Moncage (iPad Game of the Year) & more, plus neat farming life sim Wylde Flowers getting Apple Arcade Game Of The Year. (And some cool ‘Cultural Impact’ award-winners.)

In the continued ‘no lootboxes for kids’ gov battle, Australia is the latest to step up, with an MP filing a proposed bill that “calls for any game with loot boxes to require a R18+ or RC (refused classification) label, restricting sales, purchases, and viewing to consumers aged 18 and over.” (Unclear if it’ll pass in its current form.)

A panel about selling your game studio in 2022 at MEGAMIGS got to the point, per Agnitio Capital’s Shum Singh: “A lot of buyers want to conduct those deals at much lower valuations since they know the market has come down significantly. The share prices of most publicly listed game companies have gone down from their highs anywhere from 50% to 85%.” Yup.

Microlinks: interesting NYT piece on why interest is there, but profits are lacking in eSports; the Epic Games Store is reportedly doing its ‘free game a day’ promo for Xmas again; Sony (not PlayStation) is launching the Mocopi motion tracking system for personal avatar mocap operation, as you do...

We mentioned job cuts in Amazon’s Luna cloud gaming division the other week, but a source tells us that “a large chunk of the Luna third-party team” were affected, and, some ‘minimum guarantee’ deals with game publishers were rescinded, too. And looks like Luna is losing a lot of games at the end of December, also. Hmm.

Did you know you can set up your Steam forums so the default forum can only be posted to by people who own your game? SpyParty is the only game I’ve seen doing this, and not sure if I would recommend. But hey, it’s technically possible…

Microlinks, Pt.2: Amazon Prime Gaming’s December selection of free games/add-ons includes Quake (woo!) and FIFA 23 IAP; some notes on how video game Tweets went viral & how to do it again; Matej Lancaric’s speed-run through quarterly mobile game UA tips is action-packed, as ever.

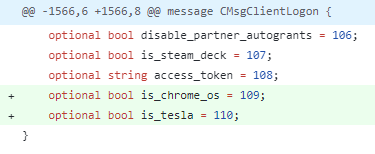

Finally, even though Elon Musk is not everyone’s favorite person right now, a lot of people still drive Teslas, and, uhh, that Steam functionality is coming along, we guess?

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]