Validate, 'hype', release: The Wandering Village's successful discovery approach

Publikováno: 27.3.2023

Also: alternative app stores on Android & lots of GDC news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and we hope everyone survived GDC in one piece - or at least with a minimum of ‘conference crud’. Time to continue our fine newsletter, starting with writing up a GDC talk actually visited in person at the event last week…

[Reminder: due to popular demand, we brought back our 25% off all ‘Plus’ subscriptions deal for the next 11 days. It’s got good stuff: Discord access, an extra weekly game analysis newsletter, ‘live’ Steam Hype dataset, 2 excellent eBooks, and more - details here.]

Validate, hype release: lessons from Stray Fawn..

While we mainly had meetings at GDC, we also showed up to a couple of talks. And we were delighted to catch Philomena Schwab of Stray Fawn Studio’s talk ‘Validate, Hype, Release: A Strategic Approach To Reduce Your Next Game's Risk to Flop’.

There’s three games released by the Swiss team so far - ‘genetics survival game’Niche (300k copies out there, inc. bundles), ‘space drone construction sim’Nimbatus (200k copies), and the third game we’ll discuss shortly, The Wandering Village.

Philomena and team do a great job of staying intensely practical around ‘going to market’. And here’s what we learned from her GDC talk:

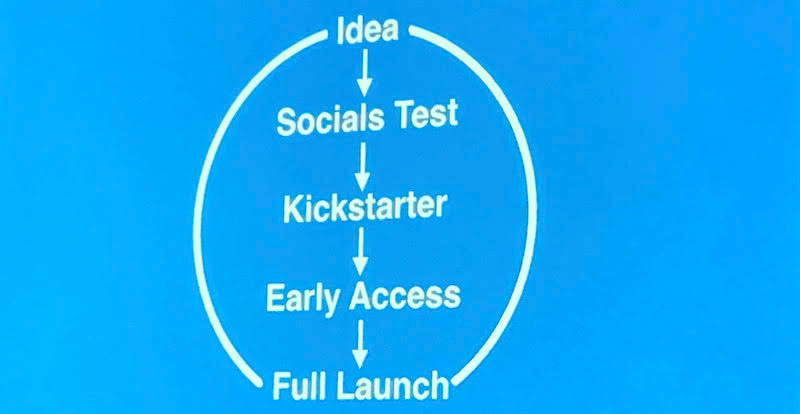

Validation is an important part of the process for Stray Fawn: as you can see from the above slide, the team has an idea, tests it out (as much as possible!) on social media, then takes it to Kickstarter and through to Early Access, full launch & beyond. No idea validation? No go! (Supercell has killed 30+, lest we forget.)

Methodical community-building is the order of the day: Niche needed evangelists, and the team found teachers excited about genetics. Also: the overall community was given ‘shared goals’ around spreading the word about the game, so dev updates could continue. Careful, thoughtful interactions, in other words.

A few specific, actionable tips stood out: in particular, making it so you could only download a demo of Nimbatus if you signed up for their newsletter grew lists & Kickstarter momentum. And the idea that Stray Fawn’s Discord assigns different roles based on custom invite links, to track attribution, is very clever!

The Wandering Village was ‘special’, hook-wise: at one point during the talk, Philomena said of the title, which is a Nausicaa-inspired ‘you’re building a settlement on the back of a giant beast’ sim: “This game is just doing all my work for me.” What did she mean by that? Outstanding game hook - way less ‘heavy lifting’!

We would say - btw - that all Stray Fawn’s games have been suited for PC players because they are complex, interesting simulations. But The Wandering Village moves them into the mainstream. Here’s how they got 500,000 Steam wishlists before launch:

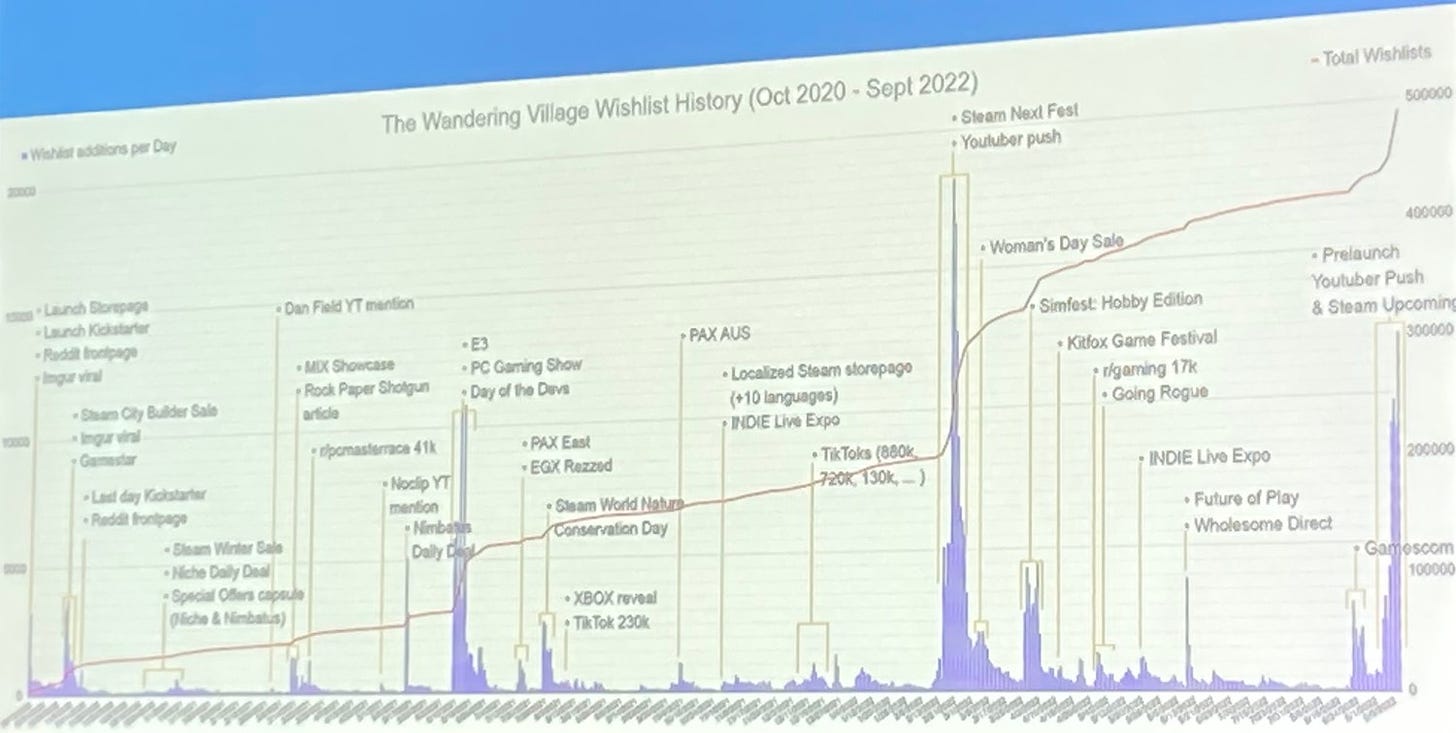

Among the highlights here? Great engagement on Kickstarter, but a strong showing at E3 (with editorial features in the PC Gaming Show and Day Of The Devs), and in particular, a killer Steam Next Fest/YouTuber push in February 2022.

But the team really put the work in on appearing in third-party Steam festivals, too - how many do we count here, 10+? Oh, and TikTok was the game’s biggest first-party social media channel - though Reddit, 9Gag, and various reposts also did well.

Along the way, the game got delayed a few months, due to the amount of trailers the team had to make for various showcases, the realization they had to localize more fully for Early Access launch, and a LOT of feedback from the demo & streamers.

So the above wishlist graph is a pretty picture - but conversion is key! And when the game launched in September 2022, after 1 and a half years of full development and $1.5 million in dev costs… the title converted great, with 224,000 units sold so far.

That adds up to a gross of $3,555,000 so far, according to Schwab (so using rough gross to net converters, maybe $2 million net, before local taxes?). Country split-wise? 25% of buyers were from the U.S., 13% from Germany, 12% from China, 5% from (allegedly) Turkey, 4% from (allegedly) Argentina, and 3% from Japan, Canada and France.

And this was all done with fairly minimal marketing spend, too - $16,000 on Facebook ads around launch, $3k on a Dare Drop campaign, and some additional $ on targeted Kickstarter-backer Facebook ads during the KS campaign, which returned >100%.

Most importantly, The Wandering Village is still in Early Access, and has only discounted a maximum of 20% so far. So we would expect many more millions of dollars of gross revenue to come. Well-executed discovery x ‘the right game’? Big win.

Other Android app stores: handy for big games?

We don’t often cover mobile game discovery, leaving it to folks like Matej Lancaric, who understand the ‘dark arts’ of UA there far better than us. But we got intrigued by what Flexion Mobile are doing on Android, because it’s a neat discovery angle.

Basically, the two biggest platforms on mobile are the iOS App Store, and Google Play on Android - which you would expect, Google having invented Android and all. But there are plenty of other smaller Android stores out there to target.

So we chatted to Jens Lauritzson, CEO of Flexion, and here’s how the company - which has ‘other Android store’ deals with games like Hill Climb Racing 2 (above), Evony the King's Return, Matchington Mansion & many higher-profile NDA-ed titles - approaches this problem:

The company targets major alternative Android app stores: Jens notes: “We take games to new platforms where they have not been before (e.g., the Samsung Galaxy Store, Huawei AppGallery, Amazon Appstore) and generate incremental revenue.” The company says that the other stores combined add an average of 10% to a game’s Android revenue.

10% extra sounds like a small amount, but can really add up: one or two of Flexion’s announcements have numbers attached, for example a Amazon Japan App Store deal with Clicktouch’s Call Me Emperor, which “already earns US$6 million in monthly gross revenue on Google Play [as of Sept. 2022]”. So yep, we’re not saying all deals are 10%, but 10% of $72 million per year = $7.2 million? Not bad…

Discovery boosts focus on platform relations: as you might expect, Flexion has good relationships with Amazon, Huawei and Samsung and other partners like ONE store in Korea for featuring on their platforms. (Normally, these alternative app stores get short shrift - so having a sympathetic partner must be exciting.)

Other discovery angles include ads, marketing & more: The company also does paid user acquisition on these Android platforms themselves, manages payments, does some monetization optimizing, and even sometimes some ‘influencer marketing’ specific to these app stores.

So sure, this isn’t necessarily a high-margin business for Flexion as a company. From their 2022 financials [.PDF], it looks like 1.8 million UKP ‘adjusted profit before tax’ in 2022, on 68.5 million UKP in revenue.

But it’s a very rapidly growing one - revenue up 110% YoY. And we may agree with Jens that: “Given the size of the stores, it is always going to come at a high opportunity cost for [bigger mobile game] developers.” So just outsource it and pocket a % of the extra $?

The game discovery news round-up..

And wow, the end of GDC really delivered. We have 23 links and counting ready to be concatenated down into today’s (and Wednesday’s!) round-ups. So let’s start right now:

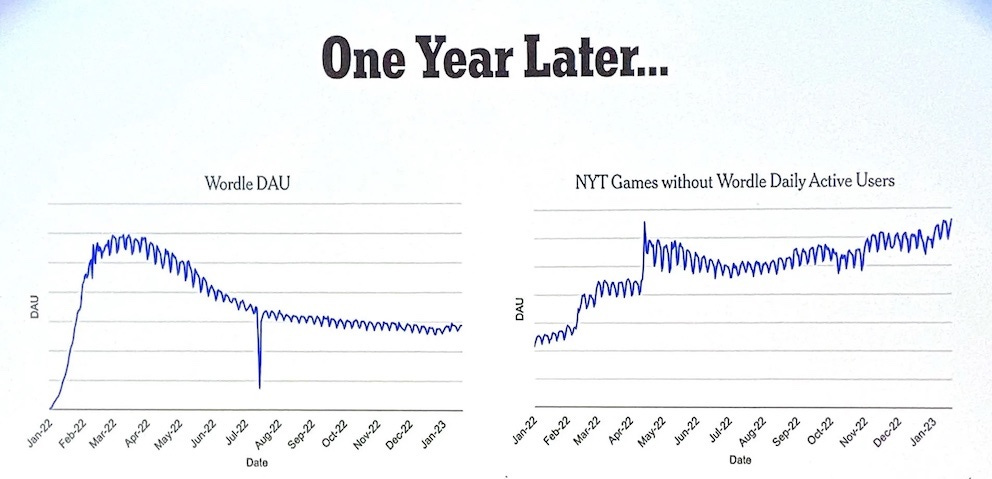

Axios got a hold of the New York Times’ Wordle (and overall) DAU for its puzzle apps (above) as part of a GDC session write-up, and the NYT’s Zoe Bell said the game’s post-acquisition DAU surge was actually a surprise: “We thought people would think that Wordle had peaked and how long can exponential growth go on?”

You know how Ubisoft said it would be attending E3 2023? They had a little change of plans, and ‘not-E3’ it is: “While we initially intended to have an official E3 presence, we’ve made the subsequent decision to move in a different direction, and will be holding a Ubisoft Forward Live event on 12th June in Los Angeles.”

More Microsoft x Activision news? Yep - the UK’s CMA has decided that Call Of Duty being owned by Microsoft “will not result in a substantial lessening of competition in relation to console gaming in the UK”, due to new data that making CoD Xbox-exclusive would be “significantly loss-making under any plausible scenario.” Major win for MS, and late April is when the non-FTC decisions arrive.

Steam sale things: firstly, we heard the storewide Steam Spring Sale was a little underwhelming compared to Winter. But perhaps not surprising, since it’s new? Second, this SteamDB link shows you every single Steam sale page*. (*But be aware that they have various levels of featuring, some are Steam F2P homepage specific, etc.)

The venerable New York Times are the latest to cover Apple’s impending move into the AR/VR space, which they do by suggesting, uh, that the company isn’t very sure about it: “Even leaders at Apple have questioned the product’s prospects.” And indeed: “Some internal skeptics have questioned if the new device is a solution in search of a problem.” Get… hype?

We covered most of the Epic x GDC announcements, inc. that sweet UE5 demo, last week. But Tim Sweeney & Saxs Persson’s chat about ‘the metaverse’ at The Verge is worth reading: “Not every ecosystem has to be a place for world discourse. Just you and your friends together is a much more enjoyable experience, always.”

One bigger GDC 2023 announcement from Meta was the unveiling of Oculus Publishing. It already existed - at least Meta co-funding “more than 300 titles” and helping with “game market fit and conceptualization… production, technology advancement, game engineering, promotion and merchandising” did. But it now has a formal - endearingly throwback-y - name and a higher profile.

We don’t really cover individual games, but WB’s licensed F2P Smash Bros-like fighter MultiVersus “closing the MultiVersus Open Beta on June 25, 2023” and taking it offline until full launch in “early 2024” seems like another example of GaaS titles struggling with retention, given it’s running at 0.6% of launch CCU on Steam.

Nobody cares about Metacritic any more* (*until they do, obviously), but the latest Metacritic ‘top-rated publishers in 2022’ chart is out, and VGC sums it up: “Sony came out on top [with a 85.6% rating], ahead of Paradox Interactive, Activision Blizzard, Focus Entertainment and Take-Two Interactive.”

Microlinks: congrats to Elden Ring for GoTY at the Game Developers Choice Awards & Betrayal At Club Low for winning IGF Grand Prize last week; Amazon Luna is now available in the UK, Germany and Canada; Microsoft is stopping the $1 trial offers for Game Pass Ultimate and PC Game Pass, at least for now.

Finally, we’ve mainly avoided AI chatter in this newsletter. But when we had a chance to check out Google Bard, couldn’t resist plugging in ‘newsletter stuff’ & got this output:

Thanks to Valve’s Alden Kroll for making me feel better by noting: “It's probably trained with words from your original writing anyway”, lol. Until next time!

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]