Video games & the fractalization of attention

Publikováno: 28.11.2022

Also: the latest Xbox Activision shenanigans, & lots more news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Sure, we’re past Thanksgiving now in the U.S., so that means it’s all downhill* (*in a good way?) until the end of the video game discovery year, right? We’ll keep you informed about the state of the market right until the end of the annum, regardless.

Oh, and it’s Giving Tuesday tomorrow (or today, for Europeans!), and I have a personal cause to ask you to contribute to. It’s Prisoners Literature Project, which sends tens of thousands of books directly to incarcerated folks all over the U.S. every year.

I got involved after prisoners kept asking for copies of Game Developer magazine. The U.S. is overincarcerated and has big problems with access to books for learning, inspiration & solace - so please read/watch more and donate here. (The first $4,444 is being matched by myself and others!)

Video games & the fractalization of attention…

Today’s lead story actually comes from three different places: firstly, a conversation with one of GameDiscoverCo’s clients on how we can track what’s going on in the ‘high supply’, aka very busy world of PC & console video games in 2022.

Secondly, there’s this excellent new interview with Jason Della Rocca in which he says of the standalone indie game market: “Success is possible, but I think the chance of success is much lower than it used to be, just because of saturation and the way things go.”

And thirdly, there’s Chris Zukowski’s latest research on the median indie game gross, in which he notes that “the median game [released in 2019 on Steam] earned just $1,136 lifetime”, and “the top 20% (aka 80th percentile) of games earned an estimated ~$34,000. The top 10% of games (aka 90th percentile) earned ~$198,000.”

It is, unfortunately, very difficult to translate these sobering stats into what this means for the average developer or publisher. But here’s some insights that I had:

We’ve been tracking average Steam wishlist/’Hype’ conversion rate for ‘significant’ games, which are variant at different times of year, but what we can’t see is the amount of money put into these games. So we can’t see changing ROI (return on investment) over time, because there’s no game budget transparency.

As often happens on open marketplaces, the sheer amount of tiny/solo dev games is screwing up our ability to easily 'read' the market from a commercial perspective. The line between amateur, semi-pro and professional has been throughly blurred by the fractal democratization of the video game space.

Nonetheless, we suspect that in the last 3-4 years, more 'expensive' games are being created (investment levels appear higher to me!) And many of them are not returning the right $. But they are still supplying more high quality titles that provide market competition.

So what seems to be happening - we’re in search of data to prove it - is that (let’s say!) 5x the direct investment is going into the PC/console game space compared to 4 or 5 years ago. But at the same time, player spending in the space has (let’s say!) doubled.

If that were the case, then the absolute ROI would be 2.5x lower. However, on the high end, the hits can still be massive, and bail out slow results on other games to reach success, profitability, equilibrium, etc. But this hit-driven shift is exacerbated by:

Publishers & developers more aggressively pursuing Steam wishlists and followers is leading to declining quality of wishlists - Goodhart's law, etc - and potentially people having too many games on their wishlists.

Over time, there are more 'evergreen' games that continue to sell well and have people ‘maining’ them. These are taking away money - either directly, or via people playing them and not buying new games - from existing titles.

There’s more in-game monetization (IAP/DLC) in PC and console games, so that the most aggressively monetized games on Steam are also taking away spend from new games, both in similar and dissimilar genres.

For some genres of game, 'should I try it (or a similar game) in Game Pass/my free Epic copy?' may be part of it, especially as Microsoft more aggressively ramps up PC Game Pass - but in general across PC and console.

Large backlogs of unplayed ‘owned’ games have continued to grow (via sale purchases, Humble Choice, etc), meaning people may be incrementally less likely to impulse buy games that seem non-essential.

So, you can see this all as a negative. And indeed it may be, for your company. You’ll need to chart a way to stability via the right portfolio or monetization. (Or getting bought by a platform company - that also works!)

But I wanted to end by noting - this fractal split of attention isn’t unique to video games. There’s so much choice out there in music, for example, that one of my favorite labels, Azure Vista Records, only puts out 500 copies of most of its vinyl. In TV & movies, I dig the Criterion Channel for what it represents, but I presume its subscribers number… in the tens of thousands? Niche is normal.

So with near-infinite choice and a finite player (or watcher, or listener!) base comes questions. The market isn’t going to get less crowded. There’s going to be less switching of games and more established GaaS giants. Are you being realistic about that when you look to a) make games b) have fun c) make money? Please be. Thanks.

Microsoft & Activision* (*and Sony too) - redux?

There’s been a lot happening worldwide as Microsoft attempts to close its $68.7 billion cash offer for Activision Blizzard - and Sony and various government agencies continue to suggest it’s not a ‘done deal’.

We’re presuming you are somewhat up to date on this. But we wanted to point out some particularly notable updates since last week:

Politico ran a story suggesting that “The [U.S.] Federal Trade Commission is likely to file an antitrust lawsuit to block [the takeover], according to three people with knowledge of the matter.” A big deal if true, right? We’ve seen some complaints that this article seems overblown or premature, though.

So yes, that same story says: “A lawsuit challenging the deal is not guaranteed, and the FTC’s four commissioners have yet to vote out a complaint or meet with lawyers for the companies.” But “the FTC staff reviewing the deal are skeptical of the companies’ arguments.” If it goes there, Microsoft could still prevail in U.S. court - but that could take years.

Meanwhile in the UK, redacted versions of earlier filings to the Competition and Markets Authority from Microsoft [111 page .PDF] and from Sony [22 page .PDF] are now available, and have been keenly pored through by many of us.

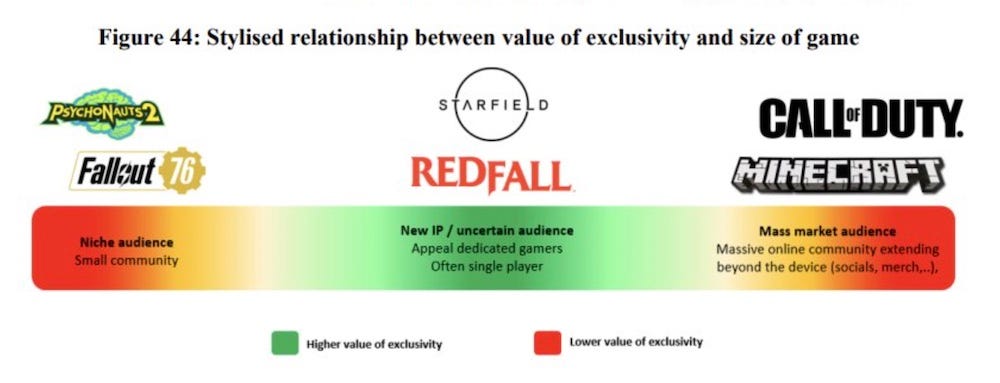

Some highlights: Axios’ Stephen Totilo points out the above Microsoft chart, which says that Redfall and Starfield are Xbox exclusive cos they’re a ‘new IP & uncertain audience’ and are ‘often’ single-player. I’d see this mainly as a post-hoc justification (uncertain audience for Starfield? really?), with a grain of truth added.

At FOSS Patents, they took a scan through the filings, and note that Microsoft seems to be admitting thatFortnite iOS on Xbox Cloud Gaming (absent Apple’s support!) hasn’t gone great: “Xbox’s experience with Fortnite highlights the challenges.” (This is making a political point, tho - see later in newsletter.)

Other things to note: Sony seems to be claiming that Game Pass has 29 million subscribers in the filing; you can intuit from a complaint that Sony made that the next PlayStation console isn’t planned to launch until after 2027; Microsoft points out it hasn’t added exclusivity to any existing Bethesda games, post-acquisition.

So what does this all amount to? The Verge says that both Sony and Microsoft are having to make odd, non-PR/relationship friendly arguments in order to fight for (or against!) the deal. ‘Sony says Battlefield isn’t doing well vs. CoD!’ ‘Microsoft says it isn’t good at competing against Sony!’ It’s weirdsville, folks.

And just as we go to press, we see sources close to Microsoft leaking that it “is likely to offer remedies to EU antitrust regulators in the coming weeks” to attempt to stop European Union-level scrutiny of the deal, since other authorities are swarming all over it.

That piece says: “Microsoft's remedy would consist mainly of a 10-year licensing deal to Playstation owner Sony”. Presumably that’s the same 10-year Call Of Duty deal offered on November 11th and mentioned in this New York Times article last week? By now, Microsoft probably wishes it had started with this offer. Will it be enough to quash UK, U.S. or European action against the deal from regulators? We’ll have to see…

The game discovery news round-up..

That’s the primary chunk of this newsletter dealt with. Let’s finish things off in style with all kinds of useful game platform and discovery round-ups, shall we? Like this:

Spotted by GameDiscoverCo’s own Alejandro, “Steam just reached a new CCU milestone [on Sunday] (again), with 31.9 million simultaneous users connected to the platform.” This comes after 30 million CCU was reached in late October. Not all of them are ‘in-game’ - around 9.6 million are, we think - but it’s still impressive.

Continuing its ‘broad church’ approach to the game market as a platform, Netflix is “hiring a game director to work on ‘a brand-new AAA PC game’ at a new LA studio led by former Overwatch boss Chacko Sonny.” No “competing design constraints due to monetization” is mentioned, too. Interesting ambitions, huh?

Another government regulator probe into games, you say? This time, it’s the UK’s Competition and Market Authority “launching a full market investigation into Apple's restrictions against cloud gaming services on iOS”. This is the investigation that Microsoft wants rulings on in order for Game Pass/Xbox Cloud Gaming to thrive on iOS, of course.

If you’re wondering why your game’s Steam review count rocketed during the Autumn Sale, it’s because the Steam badge process for the 2022 Steam Awards specifically asked players to “review (or update your review) for a game you’ve nominated.” So fan-acclaimed games just got a very pleasant review boost!

As noted by PC Gamer: “In yet another sign that Beijing might be gearing up to ease its ongoing crackdown on the games industry, China's top gaming industry association released a report declaring that the problem of gaming addiction among Chinese youth has been ‘basically resolved’.” Foreign game licenses still not happening, though…

Sheridans’ Tim Repa-Davies did a great ‘lawyer’s point of view’ on PC/console game publishing contracts, called ‘Contract Killers: What Developers Should Eliminate From Their Publishing Agreement’, for GDC 2021, and it’s up on GDC’s YouTube channel now for free.

In reading this MobileGamer.biz interview with Metacore (Merge Mansion), I discovered Playtest Cloud is a thing. Basically, the company picks out remote players for you, video records their Android & iOS gameplay & comments, and more. (Mobile folks already know about this tool, I’m guessing, but FYI!)

PlayStation “said it plans to expand a programme to identify and incubate Chinese-made games, in a race with Microsoft… to tap China's gaming market.” And others are pointing out there are more consoles in China than you may think, thanks to unofficial imports.

Following up on Marvel Snap, Deconstructor of Fun has a particularly good breakdown of the game’s monetization. Notable for me? Details on the ‘Nexus event’ gacha during soft launch which got lots of backlash, and seems to have contributed to the game’s conservative launch approach to monetization.

Microlinks: within Meta, “over 50% of the [Reality Labs] spending is going to the research & development of AR glasses, around 40% to virtual reality, and around 10% to first-party content such as Horizon”; the latest ‘state of the stream’ notes that Overwatch 2 made it to #3 on Twitch (better than Overwatch ever did!); remember when Alexa was meant to be big for games? Now it’s losing $10 billion this year.

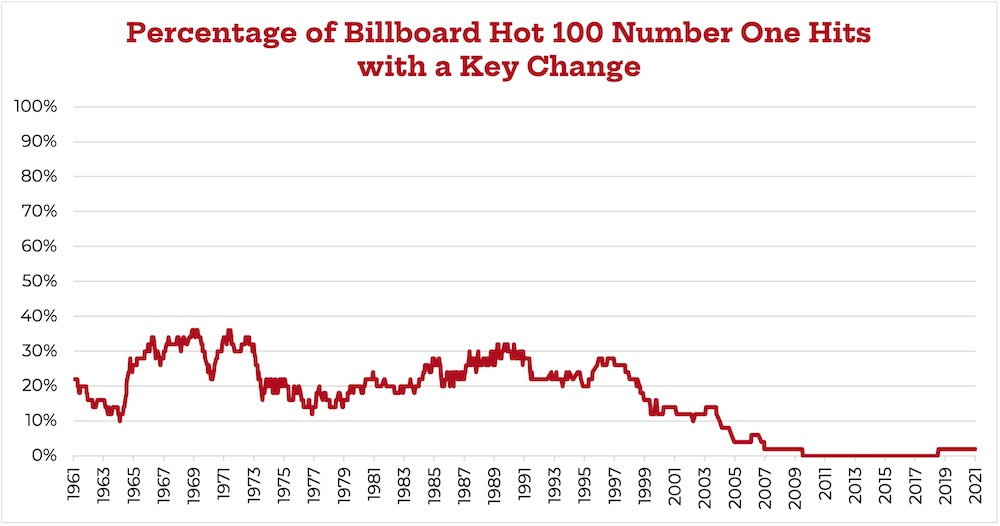

Finally, you may recall that we love ‘big data’ around creative industries. So here’s a spectacular one: the percentage of Billboard U.S. ‘Hot 100’ Number 1 music hits with a key change in them, mapped over the last 50 years (!), via a great Tedium post:

Yes, it’s the rise of hiphop that led to this, and as author Chris Dalla Riva notes: “the only number one hit to use a key change during the 2010s is also one of the most iconic: Travis Scott’s “SICKO MODE.”” As featured in his Fortnite in-game performance, btw!

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]