VR explosion? Examining Quest 2's top genres & games

Publikováno: 24.1.2022

Is the road to the VR promised land finally here?

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back, folks. Hope you had a wonderful weekend, and are raring to go for an exciting week during which, I presume, there won’t be any other $50+ billion acquisitions in the video game space. (For all our sanity’s sake.)

So - we haven’t led many newsletters with VR games recently. Don’t worry, if you’re not a VR aficionado, there’s items on Steam and discovery trends if you scroll down. But given the relative success of the curated Quest 2 store, we thought we’d dive into the game-specific numbers, with the help of a guest.

[Thanks to new members of our GameDiscoverCo Plus paid subscription - only $12 a month if you sign up for a year, and includes an exclusive weekly Plus newsletter, an info-filled Discord, a data-exportable Steam Hype back-end, two high-quality eBooks, & lots more - join them!]

The state of Quest 2 VR - and a call for data!

[We’re delighted to welcome a guest post from Cassia Curran of the Curran Games Agency. Cassia’s background at NetEase, Jagex and Wings Fund has given her much industry insight & she’s presenting research on the Meta VR (formerly Oculus) store, as well as partnering with us for more info.]

Meta's Quest 2 probably has sold about 10 million units since its release in October 2020 - this far outstrips all the other VR headset sales. I believe sales on the Meta VR Store constitutes the vast majority of VR sales in the last 12 months. So I set about synthesizing public data on the Meta VR Store for the benefit of all, thanks to a research commission from Fruity Systems.

The charts below are using a semi-arbitrary ‘ratings to sales’ multiplier of 115 to calculate gross revenue. This multiplier won’t give us accurate revenues in the absolute sense, but we can use them to make general comparisons between games.* And don’t forget - the VR games industry is young and dynamic. Trends present now are highly likely to change in future. (*There will be a survey to collect and improve this data later, please read on!)

Success factors for VR games on Quest 2?

Top-selling games on the Quest 2 seem to fall into one or more of the following broad categories:

A high-quality game that was one of the first VR titles to be available and continues to sell well - e.g. Arizona Sunshine, Job Simulator.

Uses a high-profile movie/TV/game IP intelligently - e.g. The Walking Dead, Five Nights at Freddy’s, Star Wars.

Has great multiplayer - e.g. Onward, Demeo.

Is a realistic or semi-realistic sports or hobby game - e.g. Eleven Table Tennis, Gun Club VR, Real VR Fishing, Walkabout Mini Golf.

Is an already-popular, quality PC VR game that has been polished and then ported to Quest 2 - e.g. Onward, Blade & Sorcery.

Obviously, this is a reductive overview, but it’s a good idea to understand very wider types of games that we think are doing well.

When reading the below, please remember that the Meta VR Store is heavily curated, and getting a slot is key to success. There are a total of 290 games/apps, including demos, released for Quest 2 specifically - though some were originally released for Quest. And Meta often only releases 2 or 3 games per week on Quest 2.

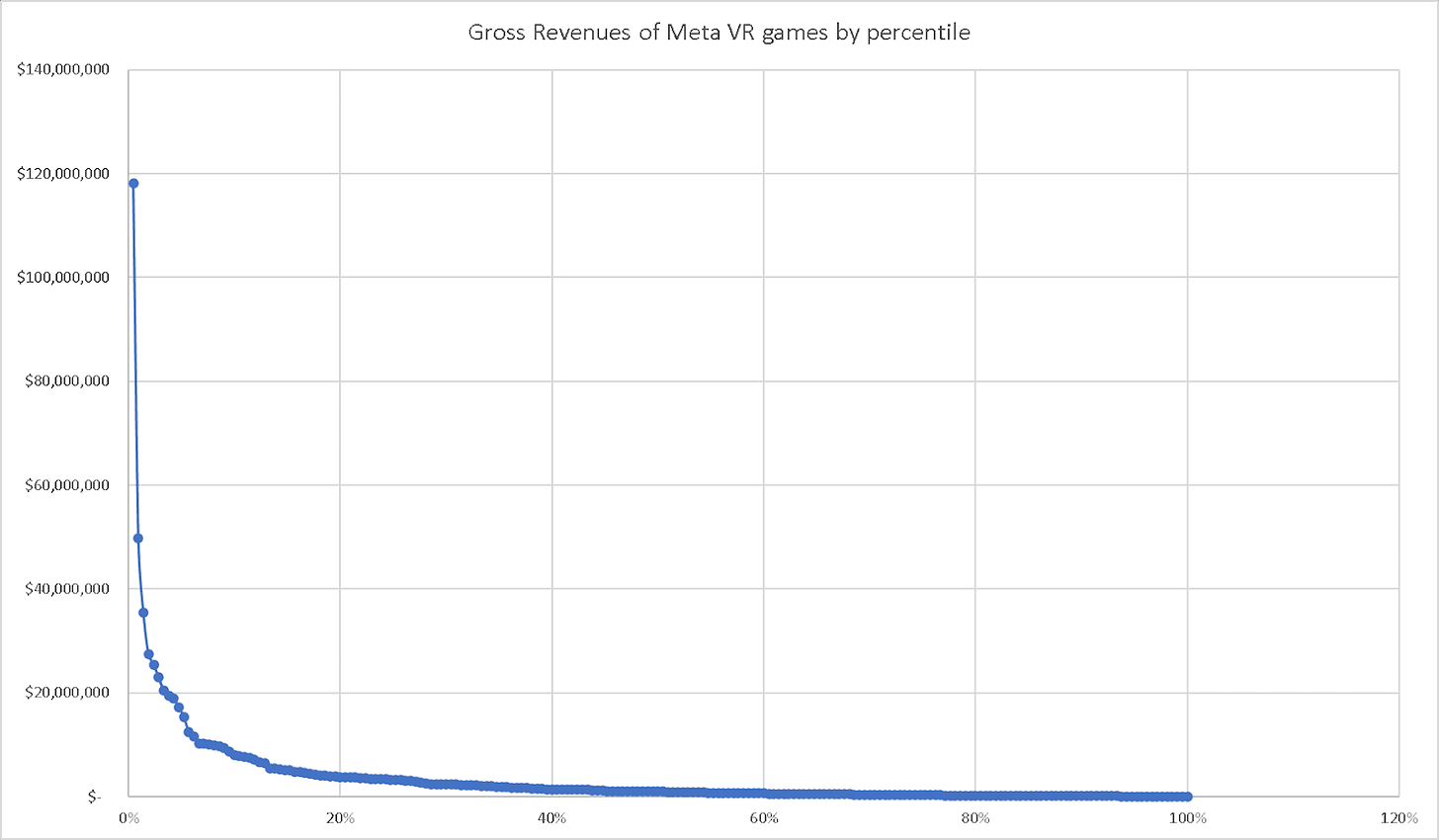

Quest 2: gross revenues spread of all games

This graph gives a general idea of the revenue spread of Meta games - although we didn’t factor in things like discount or regional pricing, so it’s likely overstated somewhat.

Nonetheless, the “hockey stick” graph shape is important to bear in mind when comparing average and median revenue in the below graph. A much higher average revenue compared to median revenue suggests one - or a few - super-high-performing games are selling much better than the rest of the games in that same category.

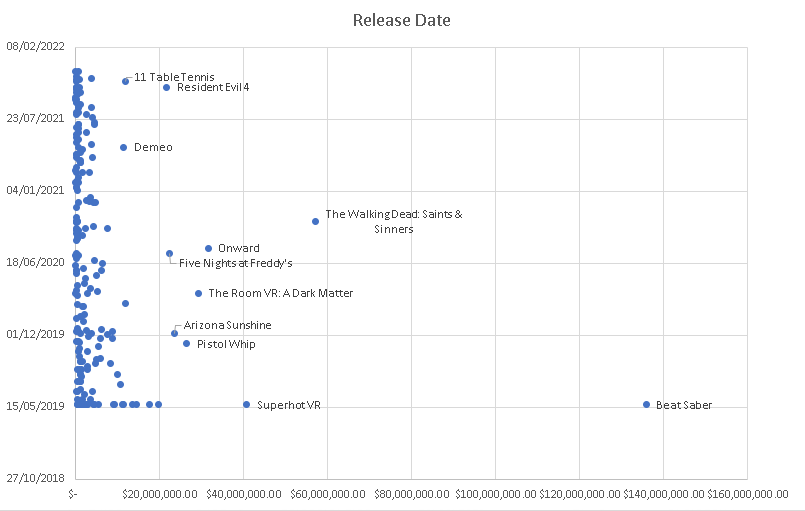

Gross revenue of Quest 2 games vs. time of release

It’s great to see some recent VR games break out and perform very well. For example Resident Evil 4, Blade & Sorcery: Nomad, and Medal of Honor: Above and Beyond have released in the last few months, and are selling very well despite the short time on the store.

And obviously, games available on the Meta Store from May 2019 have had a distinct advantage - both more post-release development time and ‘launch game’ advantages with scarcity of product for the first Quest.

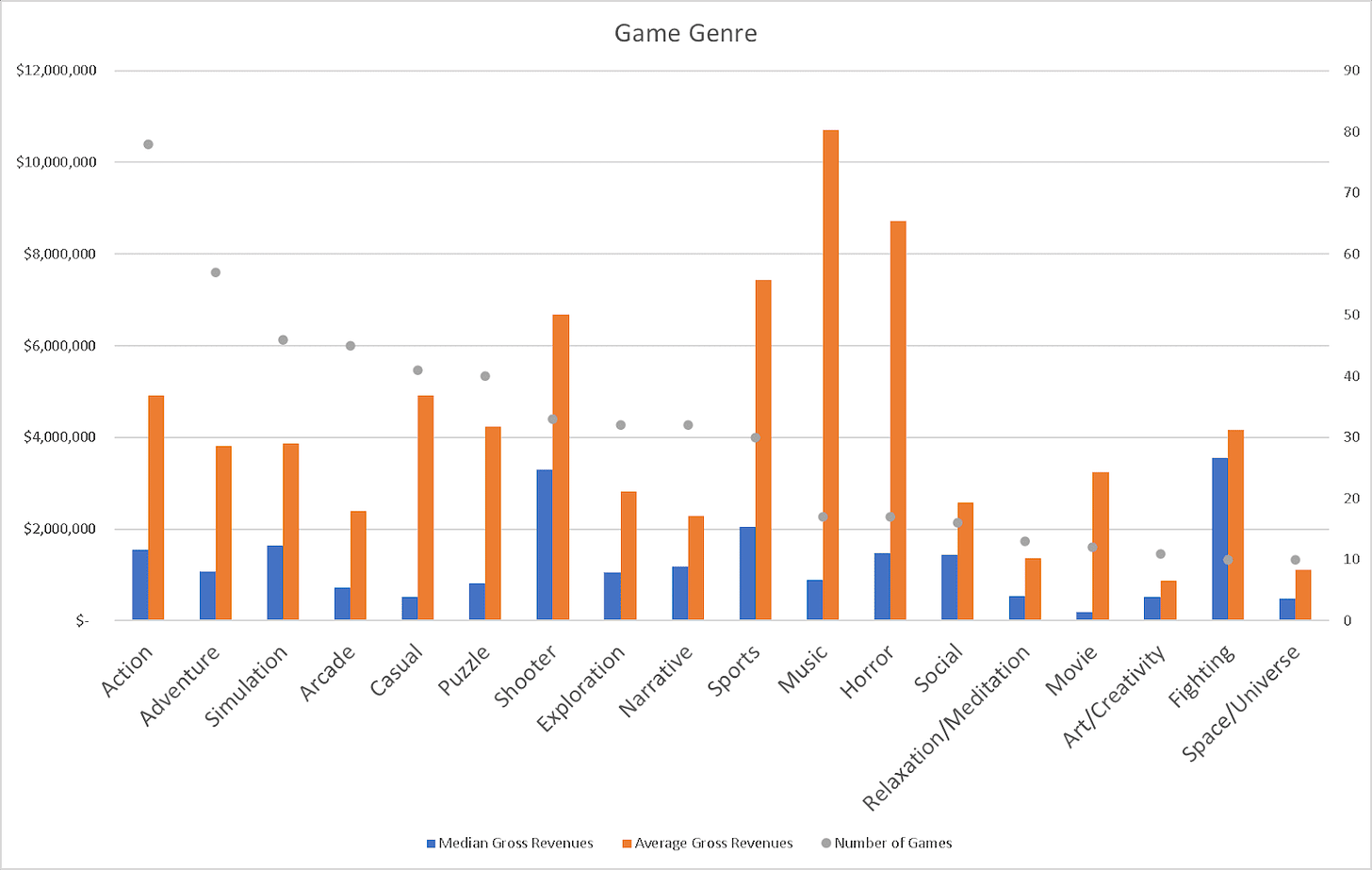

Quest 2: game genre vs. gross revenue estimates

This graph is intriguing - though please note that genres with less than 10 games are not represented here. By the way, Beat Saber’s genres are listed as Casual, Music, Sport, as can be easily seen in the spikes for those average gross revenues.

Overall, arcade, casual and puzzle genres look quite crowded and relatively underperforming. On the other hand, shooter and fighting genres overperform. And it looks like music & horror games either perform massively well, or not that well at all.

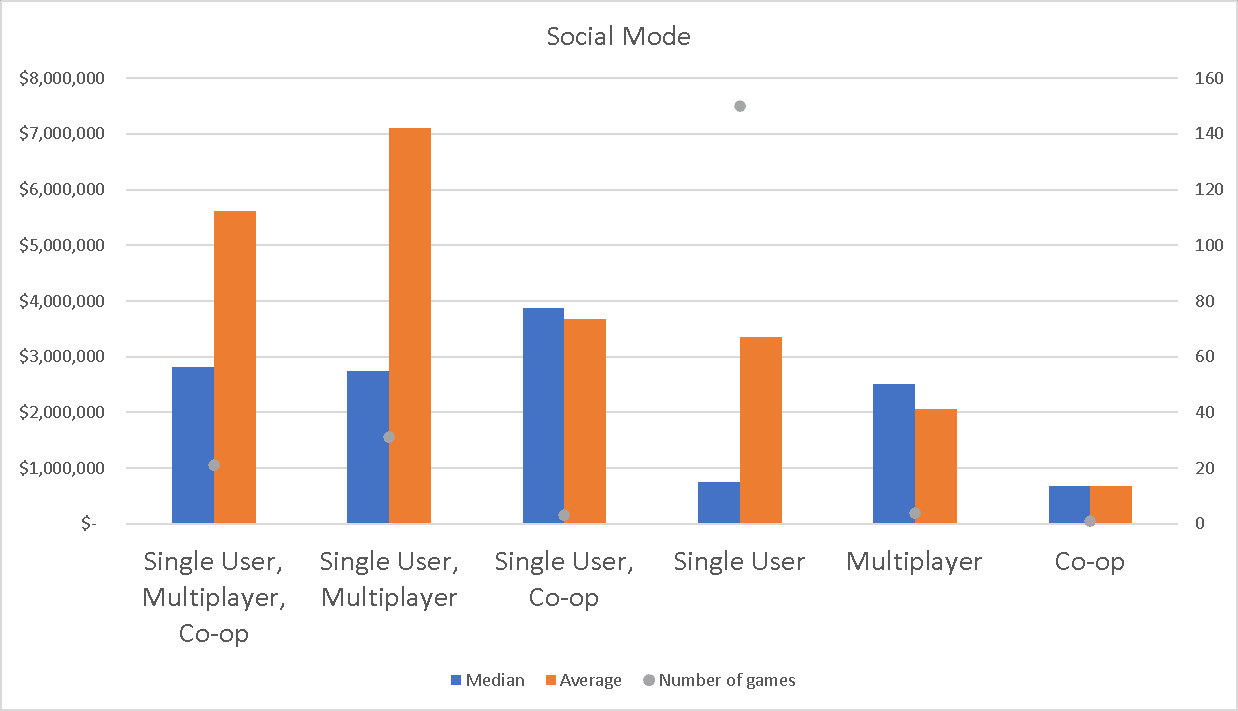

Quest 2: single vs. multiplayer ‘social mode’

We thought it’d be interesting to group Quest 2 releases so far based on multiplayer or single-player. For what it’s worth, most games are single-player; very few are multiplayer or co-op only.

Overall, you can see that multiplayer games perform significantly better than single-player games in VR. However, this may partly be down to multiplayer games often being higher-budget, higher-effort affairs, so actual ROI is difficult to track.

We need your help!

Finally, myself and GameDiscoverCo would like additional data - and opinions - from you, if you’ve shipped VR games on Quest, Steam and other VR platforms recently, to help us get a more accurate picture of relative sales. We’ll present the results back to everyone in the near future.

We’ve made an anonymous survey for you to fill out, which should only take 5 minutes to fill out. You don’t have to tell us your game’s name or its sales numbers - we’re just interested in review to sales ratios, your sentiment on the VR biz, and relative sales percentages. You have until February 4th to send us info - please help out!

Case study: Steam ‘Hype to reality’ disappoints

Not to be Debbie Downer, but we think it’s good to cover honest post-release retrospectives, when game launches didn’t go as well as people hoped. So we appreciate Victor Burgos discussing the launch of Neko Ghost, Jump! over at Reddit. And here’s the background re: the 2D/3D platformer hybrid:

As he explained up front: “Our game, Neko Ghost, Jump! launched into Early Access on both Steam and Epic Games Store on Tuesday [Jan 11st]. We were in Popular Upcoming for less than a week. We have a 10% launch discount going. We had a demo up since 2019 on Steam.”

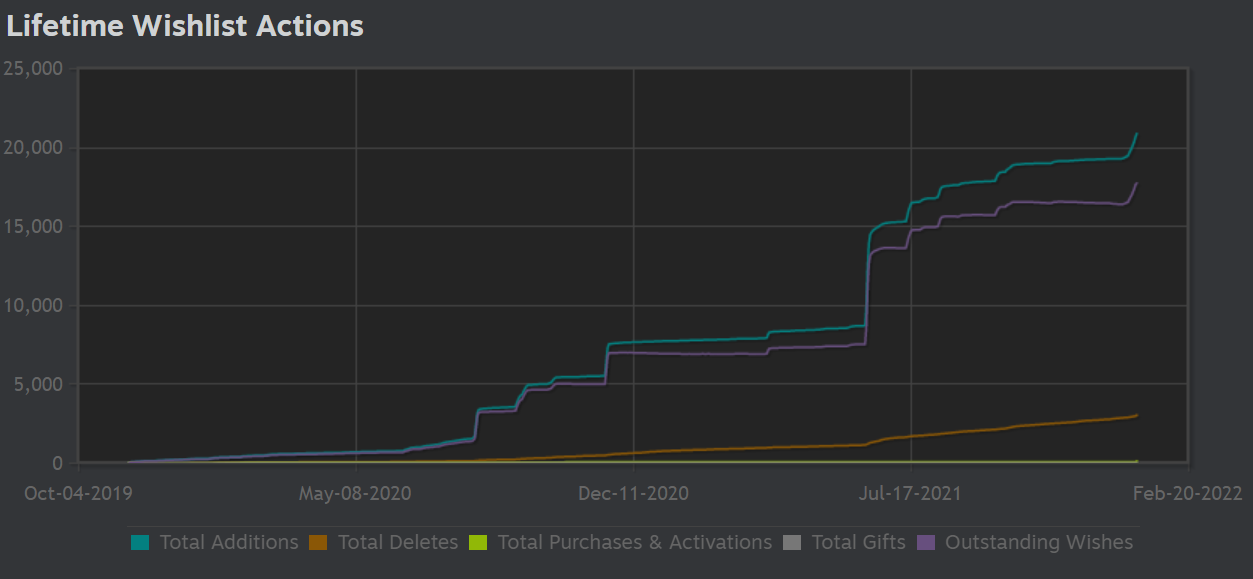

The title had 17,000+ Steam wishlists on launch, and Victor says: "This is what I expected on Day 1: 500 sales; 50 reviews; At least one tier 1 media outlet to pick it up... what actually happened: 100 sales; 3 refunds; 8 reviews." So the game’s conversion rate was 0.7%. And roughly ~80% of his sales are coming from wishlists.

Victor speculates on some reasons this could be: “Although I knew this during development, working on a puzzle platformer was asking for trouble. Then launching a puzzle platformer in Early Access against all known advice?! Blasphemy. Lastly, I shipped less than a week after a Steam Sale.”

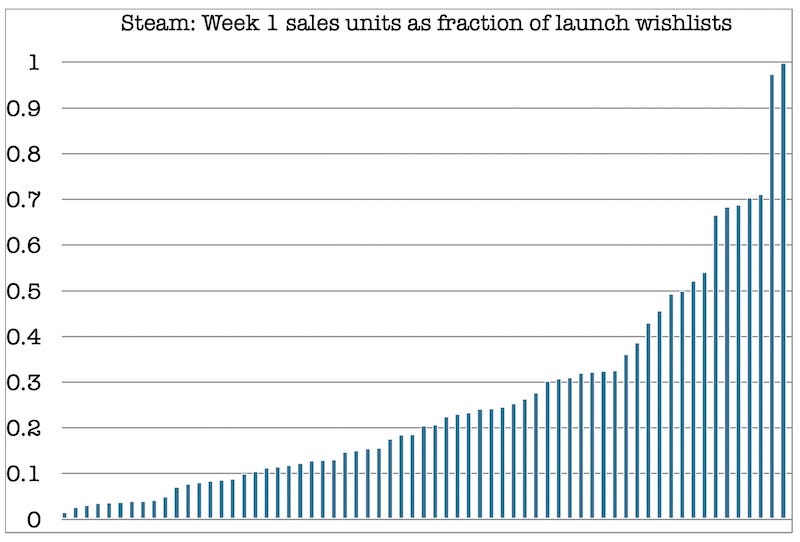

So while we don’t know Neko Ghost, Jump!’s exact final Week 1 sales numbers, they are probably going to be around 1-2% (0.01 to 0.02) of launch wishlists - around 150-300 units. With a starting point of nearly 20k wishlists, that’s certainly a disappointing result.

As you may recall from the research we did a few weeks back - spanning Steam games released in 2019, 2020, and 2021 - that’s on the low end of (a very high range of!) results:

So, a couple of comments on why that might be. Firstly, I think execution-wise, Victor and his team really did a good job of pushing Steam wishlist accumulation via pre-release Steam events and festivals (he lists 19 in his Reddit post, wow!)

But if you look at the Steam wishlist graph he posted below (his public follower graph is similar), it exhibits very flat periods between those festivals/features. There’s even one 4 month period where only 20 followers were added. This may indicate lack of organic interest in the game which ‘softer’ Steam feature wishlists can’t paper over:

Secondly, I think no matter how many wishlists you accumulate, there’s a launch question: ‘Am I going to buy this game now, for $X, given that I wishlisted it?’ The answer depends on a combination of perceived depth of game, how excited people are getting about it, its replayability, and how much similar games are already available.

There’s often a ‘snowball’ effect, if you get all of these right AND people are getting excited about the game. And I’m afraid Neko Ghost, Jump! just didn’t trip that switch for people - especially given it’s an Early Access game in a genre that doesn’t 100% make sense to me for EA. (You want to reserve EA for GaaS-style games that have ‘layers’ of features you can add on top of an existing game design.)

And overall, I think the market is getting tough in general if you don’t get that ‘snowball’. Looking at December 2021 post-release results in our GameDiscoverCo Plus back end (sign up for access!), I see a number of veteran IP titles underperforming.

This is an issue whether it be the latest Sam & Max remake (49 Steam reviews in week 1, 87 total), a new A-Train game (39 W1 reviews, 60 total), or even the new Asterix & Obelix beat ‘em up (38 W1 reviews, 51 total.) All have probably sold <2,500 copies so far on PC. Perhaps they feel like games from a slightly different era, if you compare to the top-grossing Steam titles right now? And maybe that’s the point - there’s a tectonic shift in process that we need to eye carefully.

(Oh, and I gather the Reddit comments gave Victor a hard time about his $15 pricing, and he edited the post to justify that pricing, which some said was too expensive and affected sales. I agree with him - $15 is perfectly sensible pricing, & that wasn’t the main issue.)

The game discovery news round-up..

OK, let’s play us out of here with a large selection of relevant game platform and discovery links, shall we? Let’s go:

Very soon after its ‘28 million CCU’ milestone, Steam hit 29 million simultaneous players - likely helped by PUBG going free to play, among other things. And with both Elden Ring and Dying Light 2 coming up soon, surely 30 million can’t be far away?

Well, the Epic/Apple lawsuit isn’t 100% done yet, since Epic called on the appeals court to overturn the App Store monopoly ruling in a new filing, since the original verdict had Epic win only a small percentage of its anticompetitive claims. And if you’d like to read 91 pages on why “the judgment accordingly should be reversed” (phew!), it’s embedded in the linked article.

Steam Deck compatibility ratings are rolling out on Steam (here’s the games that have them so far), and Ars Technica did a piece on some of the titles having trouble making it work: “Persona 4 Golden… seems to fail because in-game videos use a problematic Windows Media Player codec that could be difficult to implement through Steam Deck's Linux Proton compatibility layer.”

Always great to see the GDC State Of The Industry report out, and lots of interesting stuff in here: “Fifty-five percent of respondents said that workers in the game industry should unionize… but 18% believed that the industry will unionize.” Also: “When asked who they felt was “in the right” in the case of Epic Games v. Apple, over one-third of respondents (34%) sided with Epic… while the least popular [response] was Apple (8%).”

Microlinks: looks like Google has an AR headset, Project Iris, that it’s also worth keeping an eye on; good news on Easy Anti-Cheat now being much easier to implement for Proton & Steam Deck; The MIX folks have another indie games showcase timed for GDC 2022, if you want to submit your game.

Intriguing to see Xbox’s Phil Spencer commenting on Microsoft’s ‘we care about games’ status vs. other big tech marauders: "Nintendo’s not going to do anything that damages gaming in the long run because that’s the business they’re in. Sony is the same and I trust them... Valve’s the same way. When we look at the other big tech competitors for Microsoft: Google has search and Chrome, Amazon has shopping, Facebook has social, all these large-scale consumer businesses."

Returning to ‘Netflix tentacling its way into video games’, its latest earnings comments explain: “In 2022, we’ll expand our portfolio of games across both casual and core gaming genres as we continue to program a breadth of game types to learn what our members enjoy most.” And the latest ‘use a Netflix login to access’ mobile apps are a bit of an odd melange of things. Still - things stick to walls!

We spotted that the official Chinese Switch eShop has only seen 6 games released in the last 6 months of 2021 (!) due to gov licensing restrictions. Surely people aren’t buying many official Chinese Switches? Perhaps the ‘Asia’ region - which includes Hong Kong, Taiwan, Singapore and Korea, is an unofficial source for Switch consoles ‘leaking’ into China? (Hit us up if you know wassup.)

Microlinks, Pt.2: how many TikTok wishlists did Adapt get after ‘going viral’ on the platform?; despite shortages, U.S. console hardware sales reached $6 billion last year, up 14% from $5.3 billion in 2020; finally, here’s 22 indie games to look forward to in 2022, a number of which I hadn’t spotted before.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]