What chance does your Switch game have of being a hit in 2023?

Publikováno: 31.7.2023

Also: lots (and lots) of platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s. Welcome to our first ‘summer holiday’ special edition!]

Well, we’re back from our summer holiday. Just in time for you to go on yours, we presume? Still, we’ll be sticking to three newsletters per week (two free, one for Plus subscribers) for the foreseeable future - hope you can keep up.

And we start off with a longform scrying attempt into one of the least transparent platforms out there in terms of public data for devs - Nintendo’s Switch. Still, we’ve done the best we can with the data that’s out there. And here’s the results…

[PSA: our GameDiscoverCo Plus paid subscription includes our Friday ‘exclusive’ newsletter on specific PC/console game trends, exclusive Discord access, our Steam ‘Hype’ & post-release game performance chart back-end, multiple eBooks & more. Sign up to support us!]

Nintendo Switch in 2023: what chance to hit big?

While all console platforms are shrouded in mystery, sales data-wise, the Switch is particularly so. There’s no review count or public player profiles. So the only reliable data we analyze is ‘top downloads over the last 14 days’ info, viewed via the console UI.

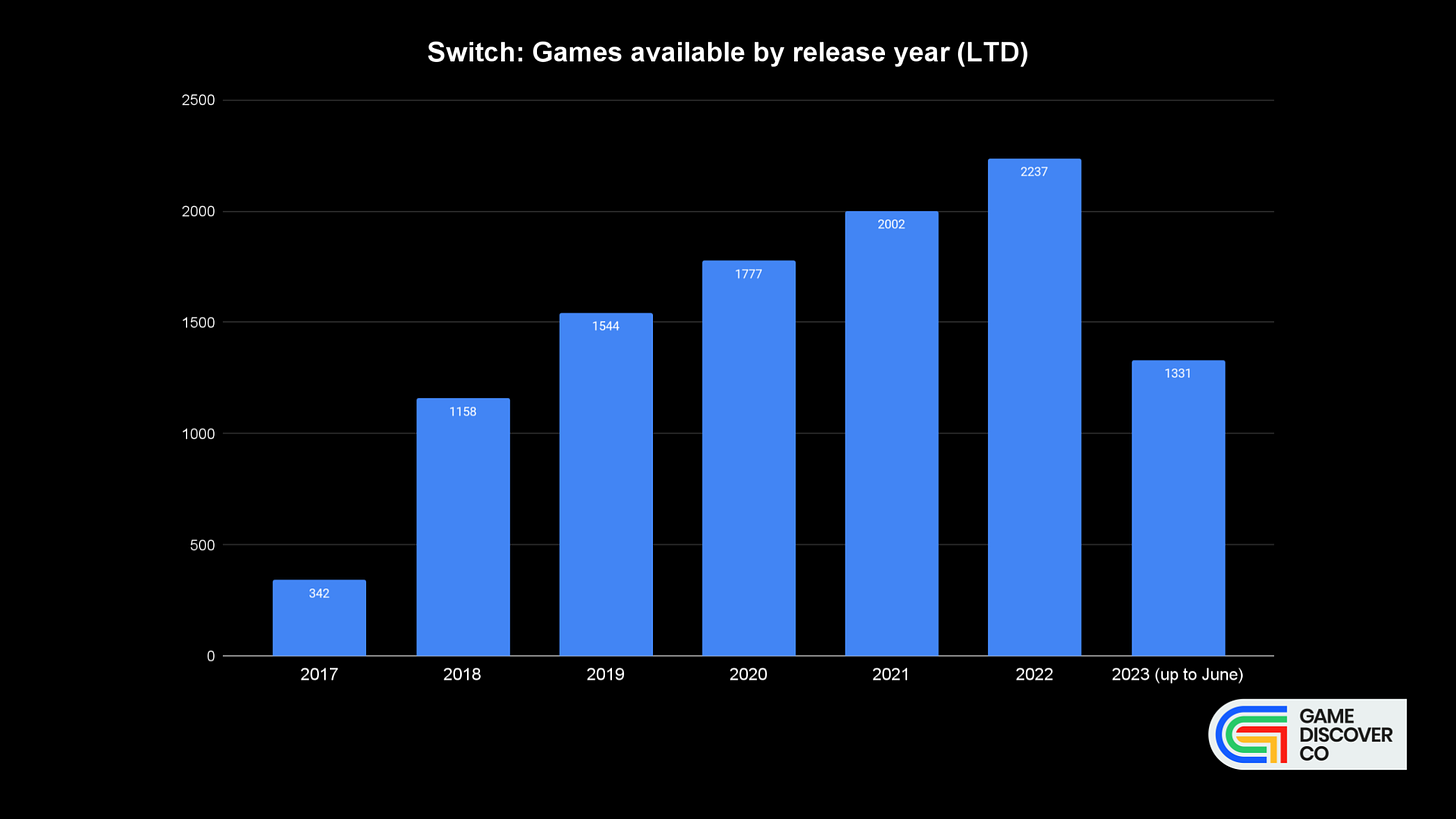

What we do know is that the Nintendo Switch game market has got much more crowded since its launch in 2017. Above you can see the number of releases per year since then. Each year’s been adding more unique games & cumulative titles, and you know we think supply and demand is one of the key metrics for success.

So standout Switch indies, by the end of 2018, had reach into 32 million Switch owners, with only about 1,500 games available & not much discounting. (A great time to launch!) But in mid-2023, there’s 10,000+ games, many discounting heavily for discovery or using F2P biz models, and 125 million Switches (not all active.)

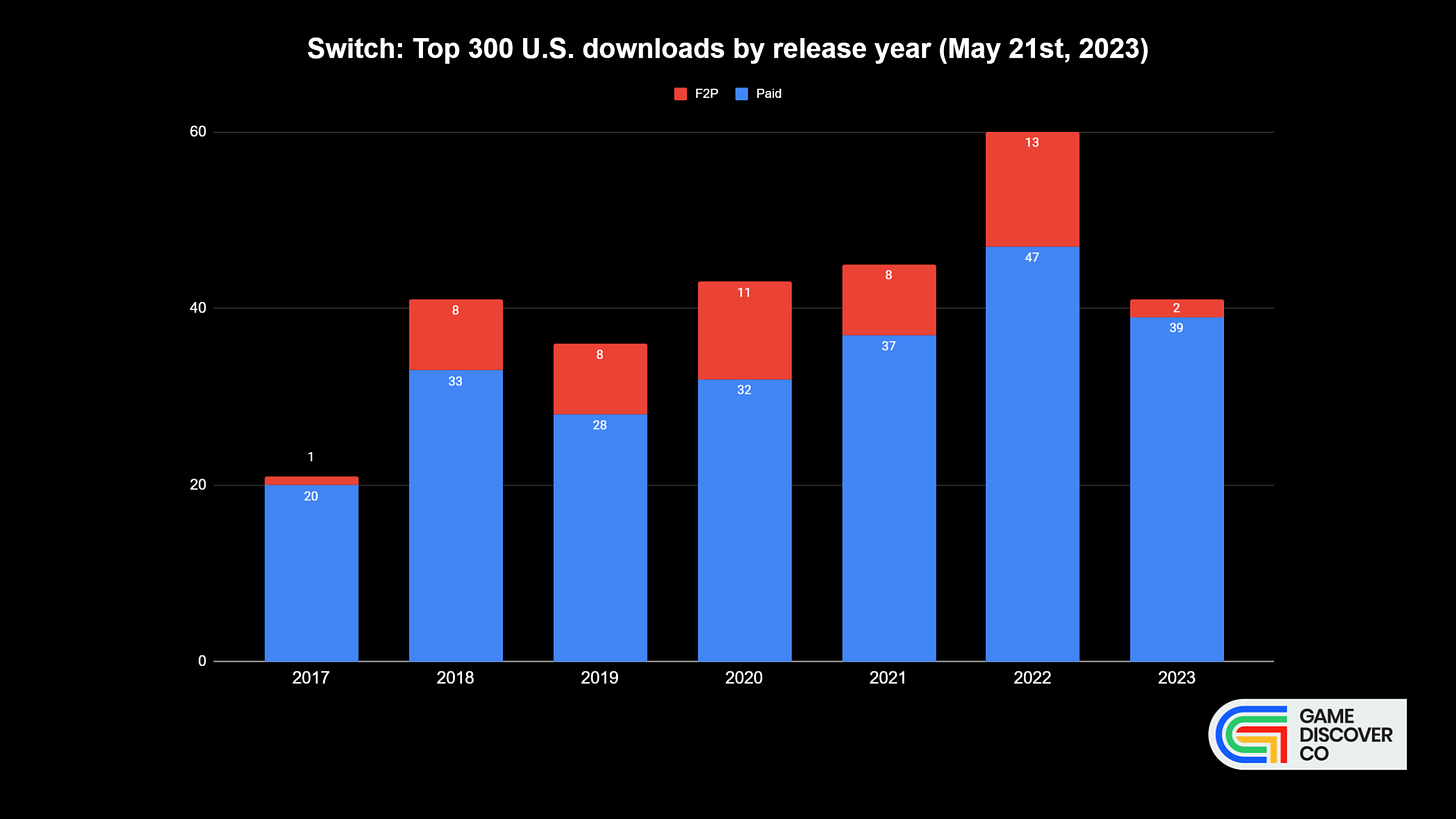

We want to find out performance for new launches in this market! So let’s further quantify using ‘real’ U.S. eShop download charts. We took an example month - May 2023 - and tracked the Top 300 games for a specific date. Here’s the release year split:

So as you can see, only around 40 of the 300 top-downloaded games in mid-May 2023 actually came out that year. In other words, there’s a lot of legacy content - often discounted - doing well. We also tried just looking at the Top 100 downloads:

You’ll see that F2P games have heavier weight in the Top 100, vs. Top 300. There’s just a few successful ones on Switch, and they get lots of downloads because they are free. So that makes a lot of sense! But still - only 10 ‘new’ games from 2023 in the Top 100.

So you can further understand this market (at least via the limited lens we can see it!), we looked at the Top 50 most-downloaded U.S. eShop titles on May 21st, across all vintages. They included:

20 F2P games - including many of the ones you would expect: Fall Guys, Apex Legends, Overwatch 2, Fortnite, Rocket League, Brawlhalla, etc.

13 Nintendo games, all at $60 (full price) - Zelda, Mario Kart, Mario Odyssey, Switch Sports, Splatoon 3, Advance Wars 1& 2, etc.

17 third-party paid titles: two full-price 'catalog' games (Minecraft at $30, Stardew Valley at $15), one launch game (Dokapon Kingdom, 15% off at $43), 10 older but high-quality games at 75-95% off (Inside, Plants Vs. Zombies FPS, Overcooked 2, etc - $2 to $7.50), and misc. other older popular titles discounted less, but still $5-$15 (Unpacking, etc.)

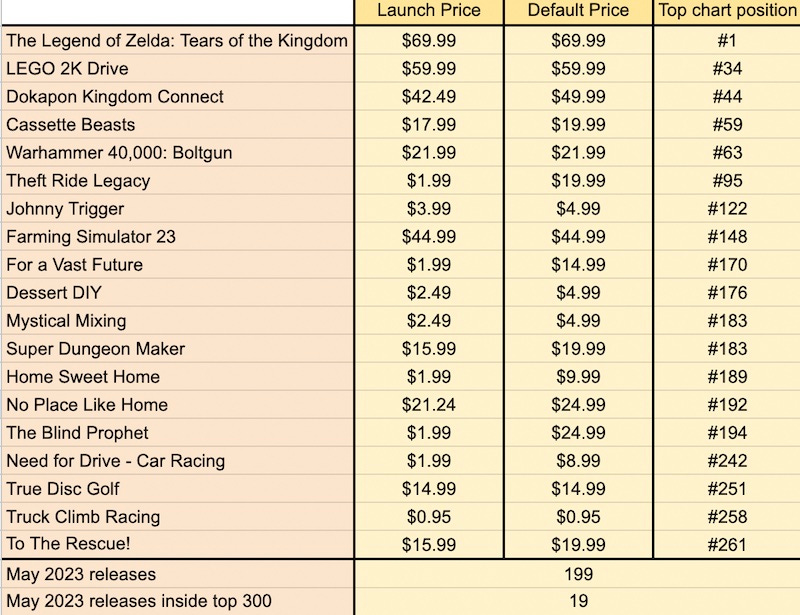

But what does this all mean for brand new releases on Switch? Well, here’s the peak U.S. eShop chart positions, for all games that made the Top 300 in the 14 days after their May 2023 launch:

So yep, <10% of the 200-ish Switch releases in any given month reach the ‘Top 300 most-downloaded’ in any form. As for exact units sold? We think being #200 on the U.S. charts gets you ≈5,000 worldwide unit sales during those 14 days, and being #100 gets you ≈10,000 copies sold in that same time.

So this means that in May, were you to believe our approximations, only six new Switch games did >10,000 units in the 14-day launch window, and just 15 did >5,000 units in their launch window. And a number of those were titles that cost $4 or less.

Does this mean that Nintendo Switch is a lost cause for devs? Nope. For one, this ‘top downloads’ lens, versus total revenue, distorts things a lot. (There are definitely a few ‘evergreen’ Switch sellers at full price - often because they have big YouTube or social media support, and players just search directly for the game name.)

But what this does show - we believe - is that brand new third-party games are having trouble hitting 50k or 100k units in their launch month on Nintendo Switch. (More trouble than on Steam, which is far more internationalized. We’d estimate 10-12 Steam games that launched in May 2023 at >50k units in Month 1, vs. 4 or 5 on Switch. And Steam has a much higher upside potential.)

The culprits for this? A severe lack of organic discovery on the Switch eShop platform is definitely part of it. There’s no ‘Discovery Queue’ or ‘you might like this game’ there, unlike platforms like Steam, and little new development effort. (Nintendo is perfectly profitable not doing this, due to first-party software dominance.)

This leads to all those older, high-quality ‘75-95% off’ games discounting constantly to go viral, since the ‘Most Downloaded’ charts is the highest visibility on the platform. And we hear about Switch games having near-zero units sold - less than Steam’s organic rate, for sure - if not discounted. (BTW, should Nintendo really let games be 90% off at launch?)

And the audience on Switch is, we think:

a massive fan of first-party games, which Nintendo continues to debut at $60, not discount much (rarely more than 30%), and sell just ridiculous amounts of*. (*The eShop charts only cover digital downloads - these games sell loads physically too!)

overall more casual, and less likely to go for non-Nintendo-y niches. Multiple of the top new games in May (Dokapon, Cassette Beasts) are redolent of Nintendo stalwarts, for example.

So that’s the state of the Switch market. It’s still a platform you should consider launching on, but it’s not the powerhouse for new launches it was - for third-parties - 4 or 5 years ago. And that’s almost entirely down to supply-demand changes on Nintendo’s platform. More games, more discounts, more choice - c’est la vie?

The game discovery news round-up..

We have what can only be described as ‘quite a lot of news’ to catch up on, so let’s go ahead and do just that, shall we? Here we go:

Those ‘next Nintendo Switch’ rumors continue, with Chinese manufacturer PixArt, “which provided the SoC powering the JoyCon sensors” on Switch, apparently saying a key customer is launching a new game console in (early?) 2024. And now, VGC just ran a report saying devkits are ‘in the wild’ for H2 2024 release, and the form factor will be the same as Switch - possibly with an LED screen. Believe!

Tracking can help understand how discovery happens, but in the case of Owlcat’s Pathfinder: Wrath Of The Righteous, adding mandatory AppsFlyer monitoring way after release on Steam didn’t go well: “Players who refused to accept the updated EULA were unable to play the game”, so review bombing, swift removal again, etc… (In general, Steam players aren’t happy with this level of monitoring…)

It true: there are 40 million PlayStation 5 consoles out there in the world, according to Sony. Circana’s Mat Piscatella adds: “On a time-aligned basis… as of May 2023 PS5 unit sales in the U.S. were tracking 3% above PS4 and 83% higher than PS3.” (Now supply issues are behind the PS5, it should accelerate.) Also: “Sony is running a PS5 sale in the UK, India, Ireland, and Germany” - about 15% off.

In PC/console game land, we talk less about retention numbers, but it comes up a lot in mobile. Successful mobile titles, for hypercasual → hybridcasual publisher Voodoo: “should have at least 45% D1 [Day 1, i.e. the next day after playing for the first time] retention, 15% D7 retention (20% for puzzle titles), and 10% D30 retention.”

Analysis of ‘graduating’ Early Access games on Steam is tricky, due to incomplete data & biig survivorship bias. Still, the HowToMarketAGame folks crunched the numbers: games that went Early Access and also 1.0-ed since 2019 have median revenue of $2,850, vs. $600 (straight to 1.0 launch) and $847 (Early Access only so far.) For games with >100 reviews it’s more ambiguous - but interesting data...

Console OS updates: Xbox has rolled out its new ‘home screen’ update to Series X & S consoles, including a ‘quick access’ menu & personalization; the latest PlayStation 5 OS Beta includes a new ‘party UI’ update and easier way to join friends’ game sessions; Microsoft now lets you buy Xbox games and Game Pass subscriptions with Venmo.

Interesting to see Dreams as a PlayStation Plus Essential pick for August, alongside “Media Molecule’s latest [in-Dreams] game, Tren”. Dreams has had adoption issues - GameDiscoverCo estimates it at 1.5 million LTD owners & just 40k MAU, currently. So it’ll be good to see the innovative creation medium go out big as it EOLs.

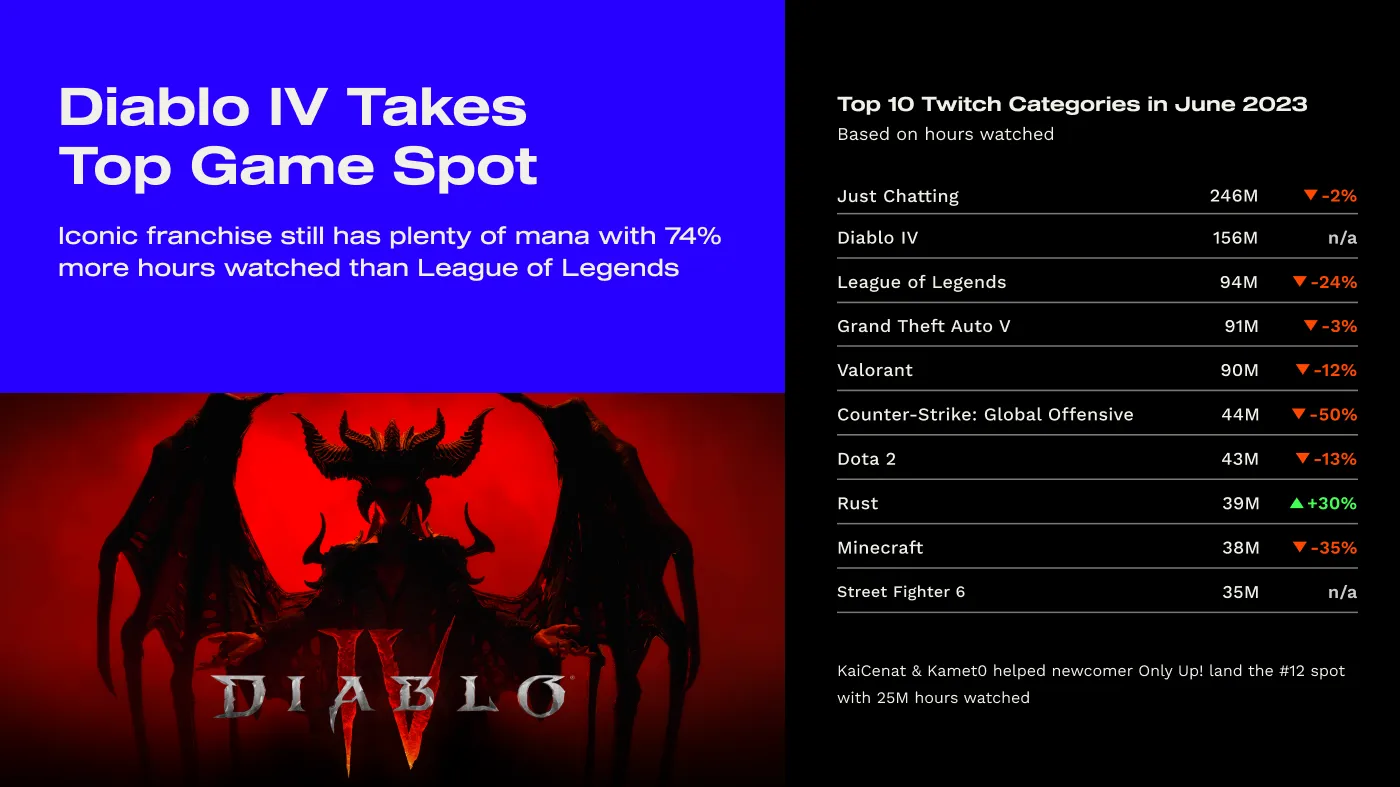

If you look at Streamelements/Rainmaker.gg’s June 2023 analytics, you get a real idea of how big Diablo 4’s launch was for the Twitch audience (above), with 156 million hours watched: “In addition to being the top game of the month, [Diablo IV] had the biggest debut week of the year to date. Compared to last year, Lost Ark and Elden Ring barely surpassed Diablo IV.”

Xbox’s FY23 Q4 results were late last week, and were ‘just OK’: “Xbox gaming revenue rose 1% in the quarter. Below estimate, which was ‘mid single digits’. Quarterly sales were ~ $3.49B, still its 2nd best Q4 ever behind FY21.” Microsoft’s CFO said the estimate miss was in direct 1st/3rd party game revenue, but CEO Satya Nadella noted that Xbox set Q4 records for on-network MAUs, as well as engagement on Game Pass, with “hours played up 22%.”

Microlinks: 16-bit inspired RPG Sea Of Stars“is the first game to launch Day 1 on both Game Pass and PlayStation Plus Game Catalog subscription services” on August 29th; Amazon’s Prime Gaming freebies for August include Star Wars: The Force Unleashed™ 2 for free and DLC for Call of Duty: Warzone & Diablo IV; Meta’s Horizon Worlds mobile app might actually be launching soon, according to the latest Lowpass.cc interview with a Meta VP.

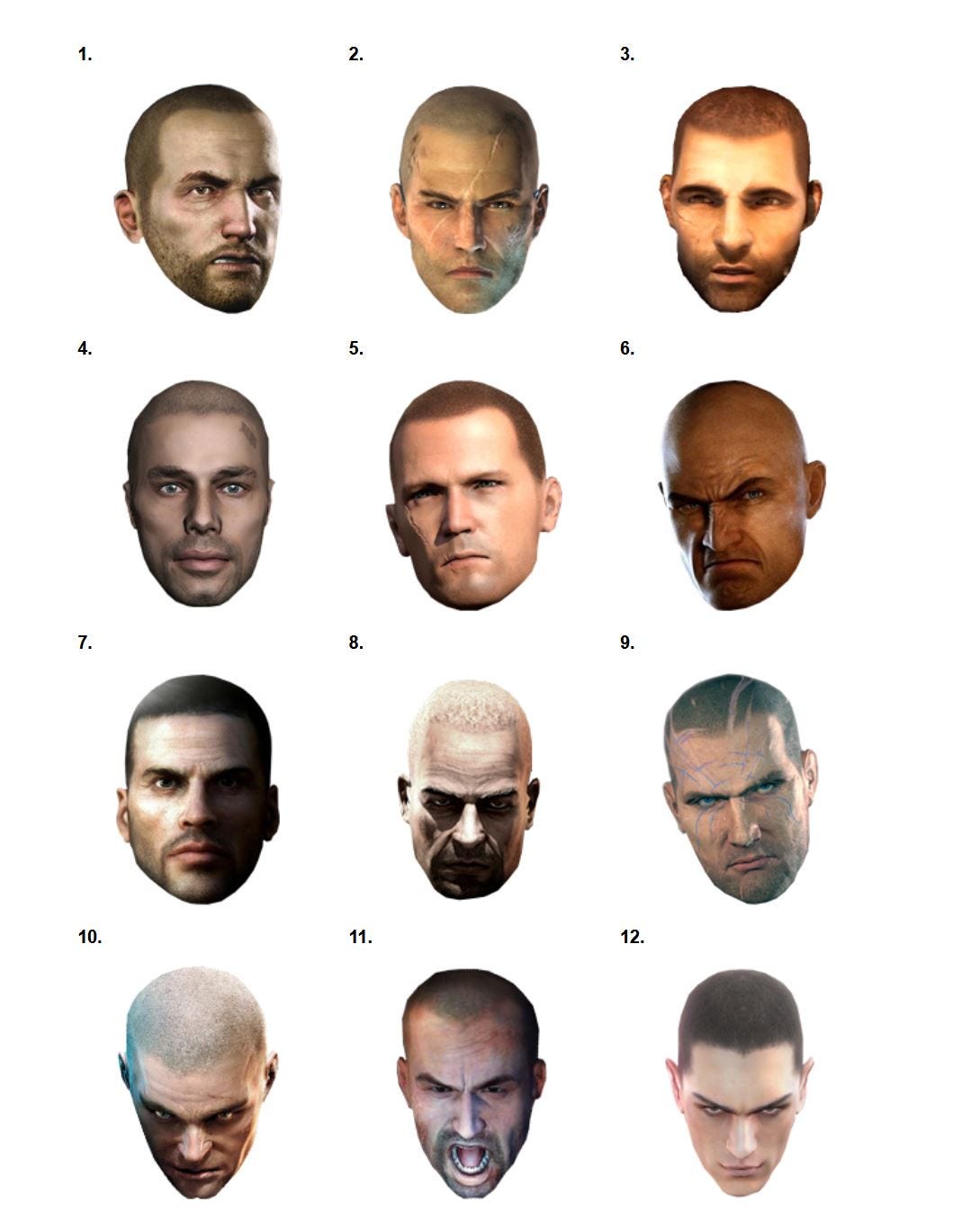

Finally, this is a 2020 repost of a 2012 quiz from Andy Kelly (nowadays of Devolver), but we just had to reprint it. Can you name these “angry bald video game men”?

These aesthetics are sooo redolent of a certain eras of (very homogenous) late ‘00s console action game, right? Ugh. Anyhow, here’s the answers, guaranteed to include at least one game franchise you haven’t thought about in at least a decade...

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]