What do Devolver's results tell us about game discovery in 2024?

Publikováno: 22.4.2024

Also: how Dungeon Clawler gets 'hook' right, and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to another week in game discovery! We’re starting by covering Embracer Group splitting into three ‘baby Embracers’, right? Well, we’re going to point at it, but this melange of IPs, divisions & performance is just too mingled (mangled?) to parse.

So we’re left-turning, to cover publicly traded indie rebels (!) Devolver Digital, whose very transparent financials handily illuminate some of the advantages and headwinds that game publishers are seeing in 2024’s busy, busy game market.

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data site for unreleased & released games, weekly PC/console sales research, Discord access, eight detailed game discovery eBooks - & lots more.]

What Devolver's results say re: game discovery…

Late last week, veteran indie publisher Devolver put out its 2023 financial results. And it was a quiet year for the rebels, with revenue down 31% to $92 million, and a statutory net loss of $12.6 million.

BTW, some context: before floating on the AIM stock market in London in November 2021, the company bulked up a lot from its historically lean-ish 20 person operating structure, acquiring dev teams Croteam, Firefly, Nerial, Dodge Roll and Artificer, and semi-sister publishing organization Good Shepherd.

We couldn’t find updated staff counts (Artificer has had some layoffs since), but as of the 2022 Annual Report [.PDF], here’s how Devolver was set up, people-wise:

So: public companies without GaaS-ish revenue are finding it rough in today’s market. There was a lot of ‘exuberance’ around game company valuations at the height of the post-COVID/zero interest rate period. We looked at Devolver back in June 2022, and the stock was off 35% to 142p. Well, it’s now all the way down at 24p.

And while bulking up and going public did allow companies (and sometimes individuals) to get paid out, depending on their stock vesting timing, we’re very much over the ‘after the party is the after-party’ stage. (Yes, we’re in full hangover territory.)

Devolver still makes and publishes great games, though. And they’re trying to reposition in this tricky market. So let’s take some Alka-Seltzer and dive in to some key points:

‘Back catalog’ saves the day, but is getting overwhelming: During the year, “back catalogue titles accounted for an unusually high 83% of total revenues in 2023”, with Cult of the Lamb (Aug. 2022) and Inscryption (Oct. 2021) getting called out as particularly high performers.

Subscription deals are making less sense for Devolver*: the company says “we declined certain subscription deal offers that we considered undervalued the proposed games' value and revenue opportunity.” These revenues halved in 2023 to around $15 million, and they “expect lower levels of revenue” from them going forward.

The company’s open to buying great GaaS teams with profitable back catalog: during 2023, Devolver acquired Astroneer dev System Era for up to $40 million (with $22 million up front.) Notably, System Era had revenue of $7 million and EBITDA of ~$3.8 million in the 12 months to June 20th, 2023. Good profit multiple, and Devolver say the deal will also let them “expand outside our core strength of indie titles into expandable games.”

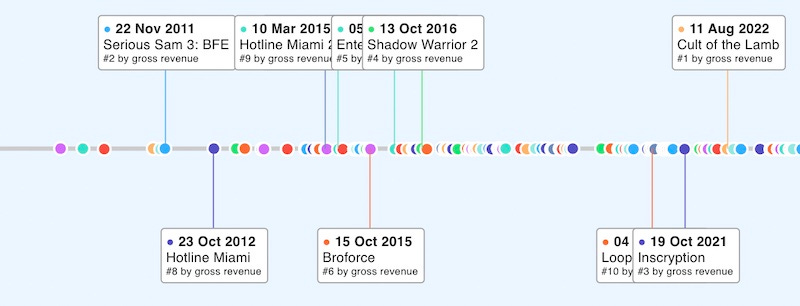

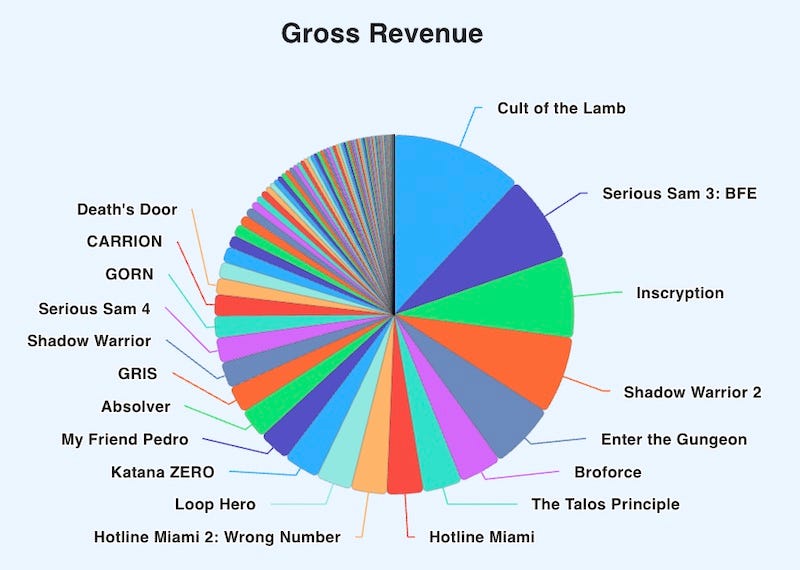

Some further points of color on this? Our Plus back end has publisher/developer pages nowadays, and here’s the (Steam-only) look at Devolver’s top lifetime titles:

We also have a timeline view, and yep, Cult Of The Lamb (which we have at $45 million Steam gross) and Inscryption ($28 million Steam gross) are big wins - esp. given that’s only ~50% of Cult Of The Lamb’s total revenue, since it excludes console.

What you can also see in this view is that 2023 has no Devolver titles in its Steam Top 10 grossing yet. You need >$12 million gross to hit Top 10, and Terra Nil ($5.4m Steam gross) and The Talos Principle 2 ($4.1 Steam gross) are the closest 2023 releases.

The headline news here isn’t really a headline, but worth restating: it’s really difficult to have a smash hit indie game every year as a public company. That’s what you need to keep your revenues up and shareholders happy. (This is not unique to Devolver.)

At least Devolver has been optimizing $ via its 120 classic games, with “back catalogue revenue growth at over 15% a year for the last five years”. But if you don’t get big new hit games, the long tail is difficult to ‘tease out’ via discounting. That’s the dilemma.

Anyhow, it has titles in 2024 it hope will scale - The Plucky Squire, Anger Foot and Neva are particularly called out. They did note that “Human Fall Flat 2, the anticipated sequel to the global hit, will not now be released in 2025”, however.

And while Devolver has $42.7 million in cash, that’s a hefty reduction of US$37m compared to its 2022 year-end balance, thanks to ongoing dev costs, the System Era acquisition, and share repurchasing. Need to keep an eye on that, going forward.

So our conclusion: if even Devolver is buying GaaS-y companies for more guaranteed recurring revenue, you know that the best A&R in the world still makes it difficult to predict which of your games will be a breakout hit. And this is going to continue.

(*On subscription payment decreases: are there a lot more indie titles in the latest PS+ Game Catalog because Sony is favoring a more royalty-heavy model based on playtime - so lower or no upfront payments? We don’t know, but we suspect, based on previous reports.)

Dungeon Clawler: 30k Steam wishlists in no time…

We were intrigued to note that Stray Fawn Studios had announced 30,000 Steam wishlists just two weeks after announcing, in a ‘how we did this!’ Twitter thread for its new game Dungeon Clawler, a “roguelike claw machine deckbuilder.”

You probably know Stray Fawn as the creators of ‘city-building simulation game on the back of a giant, wandering creature’The Wandering Village - also a great idea. And GameDiscoverCo wrote up a detailed GDC 2023 report on that game from company co-founder Philomena Schwab.

So we thought we’d reach back out to Philomena, not least because - this is such a freakin’ good concept for a roguelike. One YouTube commenter on the above video agrees: “Who the hell comes up with these ideas for games? Absolutely brilliant combo that nobody was thinking of.”

But we wanted to understand how it was planned, how much of her studio was working on it, and the key reasons it’s already got much YouTuber interest. Here’s what we found out:

The game is a 2-person project, originally made in ‘20% time’: the other eight Stray Fawn employees are on The Wandering Village, but “declared Monday and Friday afternoon 'do what you want' afternoon, which has led to multiple small prototypes”, after a studio survey said the team wanted to make smaller games. And now some of them get to do just that, full-time!

Dungeon Clawler is inspired by a real-life trip to Japan: Philomena noted that their whole team “went to visit Japan (Tokyo Game Show + vacation) and spent a lot of time in the arcades playing the claw machines.” They wondered if a game using a claw machine mechanic would be popular in Asia. (Or, indeed, the West.)

The game’s pitch seem very well honed for swift dev & virality: Clawler has a combination of “silly physics”, super simple visuals for quick iteration, an “interesting mix of strategy and chance mechanics”, using “great advice on progression and mechanics” from Brotato dev Blobfish, who lives near the team in Switzerland.

This whole concept reminds us a bit of Deep Rock Galactic: Survivor’s decision to make a ‘tight gameplay loop’ title with a minimal team, as discussed in Chris Z’s excellent postmortem of that title. This is the new ‘short, fast iteration’ model on Steam.

We’ll see how Dungeon Clawler does on release, but ‘demo available on Steam page launch’ x some smart PR partners x announced timing just before Steam Deckbuilders Fest x lots of streamers jumping on the game made for a great start for the title, which is still updating its demo and has pretty decent demo CCU.

Oh, and before we go, we clowned on Philomena a bit for absolutely not following the advice to keep ‘creating the same game, over and over’ for this title, and she had a good response:

“We have never made a game in the same genre. This is not a business decision. it's just what we're most interested in playing/making currently. Chances are high it would have been smarter to stick with what we already know. But this is what being an indie studio is about for us!”

Honestly, you can get away with this if you a) know what you are doing and b) are appropriately scaled. And looks like Stray Fawn ticks both of those boxes! Plus, Philomena also noted: “All three games that we signed with our new publishing branch [Earth Of Oryn, Flotsam & Airborne Empire] are very similar to The Wandering Village”, for synergy and cross-promotion purposes. So there’s plenty of strategy lurking here!

The game platform & discovery news round-up…

Finishing things off for this fine Monday, let’s cogitate and meditate on all manner of game platform and discovery news, as follows:

Meta Quest updates: the company “gives the Quest 2 its second permanent price cut in four months”, as the base 128GB headset will cost $199; and the company is opening the Meta Horizon OS to third-party manufacturers, including ASUS/Republic Of Gamers (“an all-new performance gaming headset”), Lenovo (mixed reality devices), and, uhh, Xbox (“a limited-edition Meta Quest”.) They’re also in process on “removing the barriers between the Meta Horizon Store and App Lab.”

We don’t get to see behind the scenes of Fortnite too much, which is why Stephen Totilo’s interview with former Epic Games CCO Donald Mustard(paid link) is so interesting. Highlight: the Fortnite ‘battle royale’ pivot was done in the back of a car on the way to a Disney meeting: “A school bus is going by us in traffic, and I’m like: ‘Players are going to be on a bus in the sky and we’re going to jump out of it’.”

Nintendo will be skipping exhibiting at Gamescom 2024? On the one hand, not surprising, since it’s the end of a hardware generation. And on the other hand, a further indication that physical events are optional for game companies nowadays.

Here’s a fascinating expose of a Steam ‘paid reviews’ website based in Russia, where “the ‘reviewer’ is asked to initially pay the price upfront, however this gets reimbursed back to them with a small extra fee on top in exchange for the review.” (Yes, this isn’t allowed, and Steam will ban your games if they find you doing it.)

Netflix’s recent, very positive financials (partly off the back of ‘password sharing’ crackdowns) were backed by almost zero mention of video games in their results, besides a pledge to continue to develop “a stronger slate of games” alongside great TV & movies. (Not saying this is bad, just calling out the absence!)

This Naavik piece on the rise of ‘games as platforms’ notes that the Fall Guys-ish Eggy Party - a mobile smash hit in China - has “an Among Us-inspired social deduction game, a full MOBA mode, a PUBG clone, and even a single-player Vampire Survivors experience.” (And Supercell’s Brawl Stars “has soccer and basketball modes”, and could add more.)

Xbox things: the much-vaunted Star Wars Jedi: Survivor joins EA Play (for PC/Ultimate Game Pass members) on April 25th; Xbox Cloud Gaming is getting more mouse and keyboard compatible games, including Slime Rancher 2, Terraria & The Sims 4; IGN x ID@Xbox Digital Showcase returns April 29th, with Vampire Survivors, Dungeons of Hinterberg, 33 Immortals, Lost Records & more.

An interesting evolution to crowdfunding site Kickstarter is its new Late Pledges feature, which “allows [select] creators who successfully meet their funding goal to continue collecting pledges after their campaign officially ends.” Of course, tabletop games is an obvious place to intro this. But it could be handy for video games.

If you can handle Matej Lancaric’s typical ‘maximum chaos’ newsletter layouts, this look at what mobile standout Supercell is doing right nowadays is a good, punchy one. He also grabs a few of their UA creatives - from the amazingly animated Brawl Stars one(above) to far more practical gameplay footage.

Some more useful stats out of the United Kingdom on physical vs. digital for top console games: "[The] top 20 UK video game sales are 38% physical. Diablo 4 was 85% digital, while Spider-Man 2 was just 46% digital." Obviously this doesn't include some key digital-only games that don't get tracked by GSD or GfK, but interesting.

Microlinks: U.S. retailer Target isn’t cutting physical video games completely, as rumored, just being way more selective on TV and movie discs; quirky handheld Playdate's Catalog storefront “has sold over 150K games since March 2023. This has resulted in $544K in gross revenue for developers”; Final Fantasy 7 Rebirth was the biggest-selling game at Japanese retail in March, shifting 310,596 units.

Finally, Merritt K’s new book LAN Party is an amazing visual look into the ‘in-person computer party’ of the late ‘90s and early ‘00s. Aftermath has a book excerpt discussing the cultural context of “young people - primarily young men - goofing off and playing games.” And let’s sample the vibes, courtesy of this 1998 pic from Erwin de Gier:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]