What does Epic's Big Bang mean for the future of Fortnite?

Publikováno: 4.12.2023

Also: lots and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, we’re getting into December now - but still a couple of weeks away from the end-of-year slowdown that’ll slide us inexorably into 2024. And we thought we’d start this newsletter out by looking at Fortnite’s big moves over the weekend, and what’s next.

Oh, btw, you too can end the year in style by subscribing to GameDiscoverCo Plus today. Perks? Access to a super-detailed PC game data service, ranking unreleased & released titles - plus weekly PC/console sales research newsletters, exclusive Discord access, six detailed game discovery eBooks - & lots more. (It’s <$20/month, too.)

What The Big Bang means for Fortnite’s future…

Firstly, since this is pretty new (though extensively micro-leaked by data miners), we thought we’d sum it up. Fortnite’s ‘The Big Bang’ live event at the weekend (11 min video) rebooted the universe - with help from an Eminem musical performance - and confirmed three new Fortnite in-world games, launching this week:

LEGO Fortnite (Dec 7th),“the ultimate survival crafting LEGO adventure”, described as follows: “Designed for people of all ages to enjoy together, the game will encourage creativity, experimentation and collaboration through play.” David Taylor says “they’re coming for Minecraft’s lunch”, and we agree. (Remember: Lego’s parent company invested $1 billion in Epic in April 2022.)

Rocket Racing (Dec. 8th), “a supersonic arcade racer where players drift, fly, and boost with friends through an ever-growing selection of tracks”, made by Rocket League creator Psyonix, who have been owned by Epic since May 2019. (There are unconfirmed reports you can use Rocket League cars in Rocket Racing, too.)

Fortnite Festival (Dec. 9th), “a new music game where players can play in a band with friends or perform solo on stage with hit music by their favorite artists.” This one is made by Rock Band creator (and long-time music game innovator) Harmonix, who were bought by Epic in November 2021. Oh, and “The Weeknd will kick off Fortnite Festival Season 1 as the game’s first Music Icon.”

And if you believe - as we do - that Fortnite and Roblox are the real metaverse*, since that’s where the actual users are, you’d better be sure that we’ll be keeping an eye on Epic’s biz model evolution. (*if you even want to use that cursed phrase!)

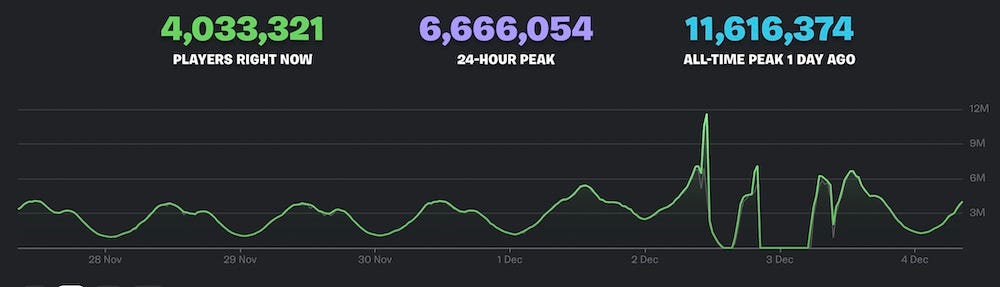

Anyhow, if you check out sites like Fortnite.gg, which charts global CCU (concurrent users) for Fortnite, you’ll see quite a CCU commotion around this announce:

Basically, Fortnite, which had 100 million unique players in November, hit an all-time CCU high of 11.6 million (!) around the time of the first showing of The Big Bang live event, which had long queues that disappointed some.

Just to give some context on scale? We covered the top Steam debuts of last week for our Plus subscribers on Friday, and the top games in there (HoloParade, Apocalypse Party) hit a launch CCU maximum of 5,000-7,000. That’s 0.06% of Fortnite’s 11 million CCU high at the weekend. Blimey.

The aftermath of the event also had some significant downtime, as people hustled to see the event live before it disappeared forever. (The servers were then brought down for a few hours for an updated game patch, ahead of this new season start.)

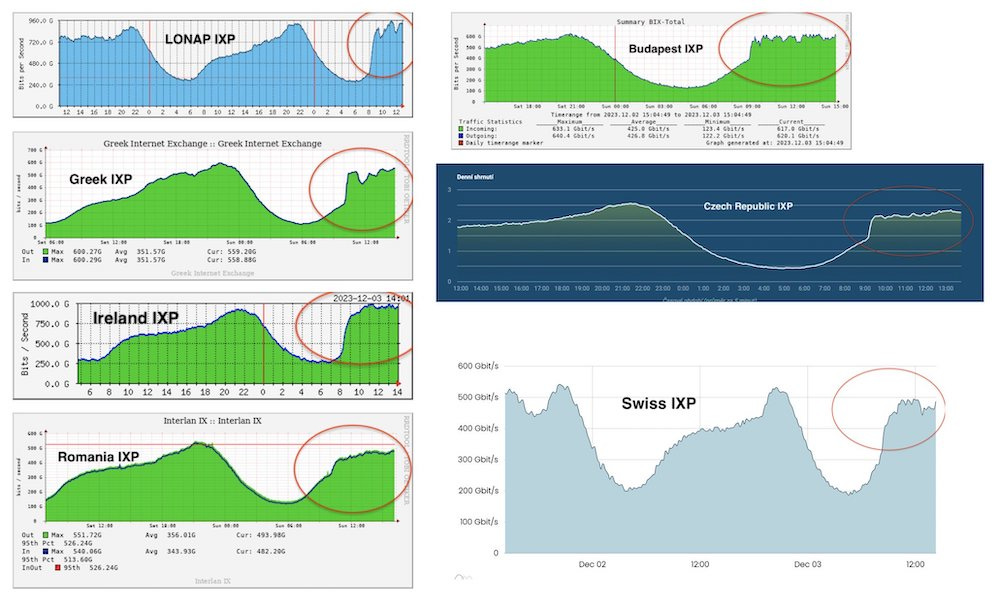

Talking of the new Fortnite patch, which is between 16GB and 26GB, depending on the PC/console device, it’s so popular that it had a notable spike on IXP (Internet Exchange Point) traffic worldwide, according to bandwidth expert Flavio Luciani:

So it’s going to be very interesting to see what the global CCU for the game does after these new modes launch (and interest settles down.) It’s definitely been our impression that the fairly monolithic gameplay of Fortnite is both a strength, but has prevented it scaling.

And while the new ‘Creator Economy 2.0’ third-party revenue-sharing shift is significant, the current top third-party Fortnite islands are mainly smallish, more ‘hardcore’ mods on top of the existing experience, from long-time amateur/semi-pro modders. (It hasn’t been majorly increasing overall CCU - at least not yet.)

But we’ll be able to see what happens to Fortnite players over the next few days as these new modes roll out - even the CCU of the individual modes! And it should be fascinating to see if new players are attracted, retained - and monetized - over time. (Compared to some mobile games, Fortnite’s current monetization is pretty tame.)

Where do players go, when not playing Fortnite?

Talking of ‘where CCU goes if Fortnite isn’t available’, the long event queues and subsequent downtime on Saturday meant that some players flocked to play other games, some of them on Steam. This is a fascinating data point to explore.

We were alerted to this on our Discord by GameDiscoverCo Plus subscriber Gilles from Oddshot Games (of casual F2P multiplayer ice hockey game Slapshot: Rebound), whose CCU graph on Steam looked like this over the weekend:

That big CCU spike on Dec. 2nd/3rd coincides with Fortnite players either being queued, crashed, or unable to play ‘regular Fortnite’. (That’s a 176% CCU increase in Slapshot Rebound’s CCU from Dec. 2, 17:30 UTC to Dec 2nd, 22:10 UTC.)

Since GameDiscoverCo grabs CCU data for all Steam games, we checked just those with >100 base CCU and mined which ones had a large CCU increase between those times(Google Drive document), sorted by % increase.

This provides an excellent look at which Steam games have overlapping users with Fortnite. Here’s what we saw:

Fortnite ‘fast follow’ 1v1.lol was the hands-down ‘winner’: this is actually a Fortnite-style in browser web game, with a similar biz model to games we’ve profiled like Shell Shockers. (Students with Chromebooks or limited download access can play.) But the Steam version of 1v1.lol saw a 477% usage boost on Saturday in Fortnite’s absence, from 1,800 to 10,500 CCU.

Casual ‘hangout’ sports & board co-op games also saw big boosts: some of the notables besides Slapshot Rebound included Golf With Your Friends (up 185% to 2,200 CCU), card game UNO (up 230% to 700 CCU), and, uhh, FPS Chess (up 151% to 950 CCU).

The biggest games affected were Among Us & Lethal Company: the CCU peak on Saturday for co-op social deception classic Among Us on Steam (12,900 CCU) was about 36% higher than Sunday’s, with CCUs up >100% in the period we surveyed. And we bet the console and mobile versions saw a spike, too. The current micro-indie smash hit co-op explore-y thing Lethal Company also saw a >100% boost, adding about 45,000 CCU on Saturday compared to Sunday’s high.

Takeaways? A lot of Fortnite’s success has been built on its relatively low-skill, optionally ‘chill hang-out’ gameplay. (It’s just not a frantic game, if you don’t want it to be - which is why it’s so metaverse-adjacent.) So these alternatives make sense, even the genres are different - they’re ‘places to be with people you know’ online.

And if nothing else, it shows the kind of games that Epic or third-parties might build within Fortnite. Although perhaps this is simply ‘games that appeal to the existing audience’, and not new audiences that Epic might want to cultivate. Still…

The game discovery news round-up…

And after that data dump, we’ll get on and take a look at all the excellent game discovery and platform news that happened since last week. Let’s see:

After Xbox CFO Tim Stuart said that“our mission is to bring our first-party experiences [and] our subscription services to every screen that can play games”, even rival consoles, Phil Spencer had to do some clean-up: “We have no plans to bring Game Pass to PlayStation or Nintendo. It's not in our plans.” Dreams, but not plans?

Also: a notable Game Pass data point from that Windows Central interview with Xbox’s Spencer: “We have a service that is financially viable, meaning it makes money, in Game Pass. We've put… over a billion dollars a year supporting third-party games coming into Game Pass.” First time we’ve seen a third-party $ number for Game Pass, implying some of the bigger deals must be, uhh, ‘top-heavy’. (Bonus: “Brazil is our second-biggest PC Game Pass market right now”.)

In some big VR news, Valve has revealed that “the streaming technology of Steam Link is now available on the Meta Quest 2, 3, and Pro, allowing you to wirelessly play VR games from your Steam library.” You need “a router with a wired connection to your PC, and a 5GHz WiFi network for your headset”, but that’s it - here’s the Quest app.

There’s an interesting Konvoy newsletter claiming the game biz is leaving $ on the table: “As of the end of 2022, the global gaming industry earned ~$59 per gamer to generate ~$183b in revenue. This $59 per gamer is relatively flat over the past 4 years since 2019 (peaked at $61 in 2021), yet the gaming market has expanded by ~400m gamers and $30b in revenue over that same time period.” Is the answer more $ per hour of gaming? (And how do you even do that?)

Can’t believe that the Epic vs. Google Play lawsuit is still going (albeit off for a break this week, as the parties discuss a settlement.) Short round-up: the judge is mad at Google for not keeping internal IMs/chat, Epic admitted to solely creating the ‘Coalition for App Fairness’ (lol!), and even Activision Blizzard had a competing app store idea ready to go, before a ‘big $’ Google deal sidelined it.

A data-point on ROI in today’s discovery-tricky market? Much-awaited Souls-like reboot Lords Of The Fallen, which we know cost $42 million to make & $19 million to market, has announced it’s sold 900,000 copies so far (shipped & sold?), and “the game's largest sales channel is PlayStation.” Looks like it’s not profitable yet - the devs hope for $100 mil in sales over time, but had “higher expectations in terms of revenue”, referencing competing blockbusters like Spider-Man 2 as an issue.

The latest Xbox Game Pass debuts in December? A lot of quality games that didn’t debut Day 1 in Game Pass (Remnant II, Goat Simulator 3, Against The Storm), as well as some notable Day 1 debuts like Steamworld Build - plus Chivalry 2 and Totally Reliable Delivery Service coming to the base Game Pass Core.

We have real numbers from Amazon’s U.S. physical hardware/game sales for all of November, and it’s super interesting: Switch physical games are dominating (including a much-discounted Mario & Rabbids and Super Mario Bros. Wonder, which both did 100k units.) And hardware-wide, Switch bundles (170k+), Meta Quest 2 (130k+), PS5 bundles (120k+) & Quest 3 (50k+) win things.

Seen a big increase in positive Steam reviews for your game? That’s the Steam Awards nomination process during the Autumn Sale, as documented by Potion Craft’s dev: “82% of the ~300 recent reviews (posted in the last 30 days) for Potion Craft were positive before the start of the Autumn Sale and the Steam Awards 2023. Since Nov. 21, the rating has jumped to 97% (Overwhelmingly Positive), based on >3,600 reviews.”

Microlinks: Amazon Prime Gaming in December adds free Deathloop (redeemable via Epic Game Store) & free Luna cloud playing of Fortnite; PlayStation’s lapsed deal with Discovery for bought videos is causing a ruckus; as of February 15th, “Steam will officially stop supporting the macOS 10.13 (High Sierra) and 10.14 (Mojave) operating systems”, so no more 32-bit Mac OS games.

Finally, with the smash (off-Steam, crazily) PC success of extraction shooter Escape From Tarkov, many other studios (like Bungie, with Marathon) are looking into the extraction genre. And this video, from game designer Andrew Chambers, does a great job of explaining the game mechanics behind the subgenre:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]