What Sony’s results mean for PlayStation’s future!

Publikováno: 14.2.2024

Also: lots of game discovery news, and DOOM on robotic lawnmowers...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to a busy mid-week here at GameDiscoverCo, where we had to call another audible at the last minute and pivot to looking at PlayStation’s fiscal results that dropped overnight. Why? Because, well - they are extremely interesting.

Before we start: we thought DOOM running on e.coli bacteria was the ultimate ‘what devices can DOOM run on?’ flex. But we got alerted to this legit commercial for DOOM running on the Husqvana robotic lawnmower interface, and a recent deathmatch tournament with people playing… the lawnmower DOOM… onstage? Wowzers.

[HEADS UP: our upgraded Plus game data suite is here - you can subscribe to Plus now to get full access to it, weekly PC/console sales research, an exclusive Discord, seven (!) detailed game discovery eBooks - & lots more. Check out this newsletter for details on new features.]

What Sony’s results mean for PlayStation’s future

We were planning to cover Sony and PlayStation’s Q3 FY2023 (Xmas 2023) numbers in the news round-up. But the more we looked at them, the more we realized they deserved their own, big section.

Why? Well, for the following reasons, we’re likely to see a further multiplatform pivot in Sony’s business:

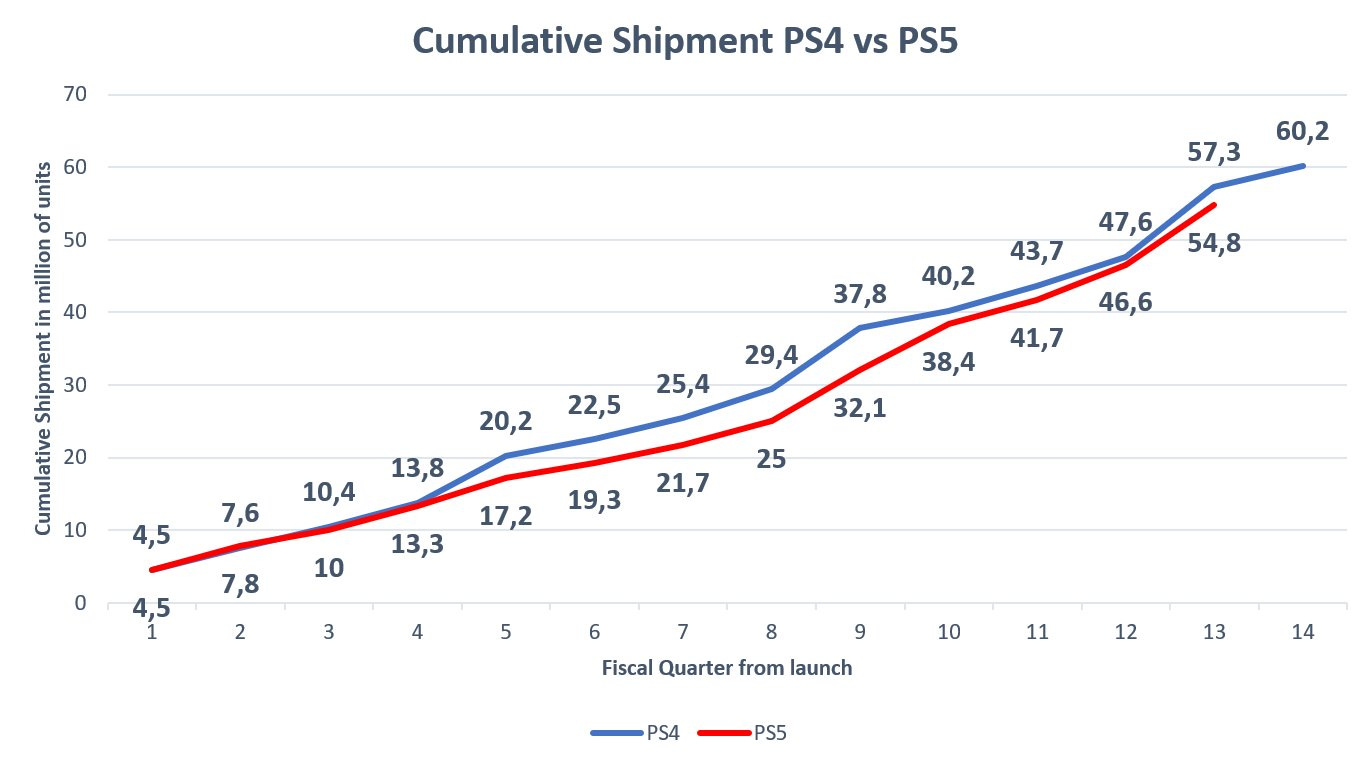

Despite PlayStation 5 finally being non-supply constrained,as Twitter analysts noted, it “shipped 8.2m units this quarter, now over 54.8m to date”, the console was “slower than PS4 for both this quarter and lifetime shipments.” (See above.) And this was meant to be the quarter where PlayStation blew the roof off hardware sales.

As a result, “The Q3 miss means that Sony will not achieve its 25 million PS5 [full fiscal year] sales target, and the company has reduced this forecast to 21 million units.” And we’ve also seen some people suggesting that 21 million - which needs 4.6 million in Q4 - will be tricky, if you look at similar Q4s in the PS4’s life cycle.

Sony management is now downplaying future growth on the PS5, saying in the earnings call: “Partially due to entering the latter half of the console cycle, we’re aiming to optimize sales with a greater emphasis on balance with profits. So we expect a gradual decline in unit sales from next fiscal year onwards.” (The gradual unit sales decline after Year 3 also happened to PS4, btw - it’s not unusual.)

To be clear, PlayStation 5 is still a leading game console, and we’d expect it to end its lifecycle with at least 100 million in its install-base. But it looks to us like the ‘wants an HD console for that price’ market isn’t expanding majorly.

And Sony made comments in the earnings - this is a paraphrase, btw - that a “drastic price cut on PS5 similar to what Sony did on PS4 is difficult, as room is limited to cut [the] production cost of PS5 vs PS4.” The console is sophisticated, and there’s been a lot of inflation, so you’re not going to see PlayStation 5s at $199 in the near future.

There was good news for Sony, too in PlayStation’s results. Here were some of the things that worked:

Sony’s big, marquee game franchises are paying off: Spider-Man 2 has now sold 10 million units, solely on PlayStation 5 - and the Spider-Man game franchise as a whole is more than 50 million sold across both console and PC.

PlayStation Network is still expanding reach: as the detailed data [.PDF] revealed, a record 123 million unique accounts accessed PSN in December 2023, up from 112 million in December 2022. That’s also a larger quarterly jump (+16 million vs. +10 million) in YoY comparisons. (Wonder how many are PS4, still?)

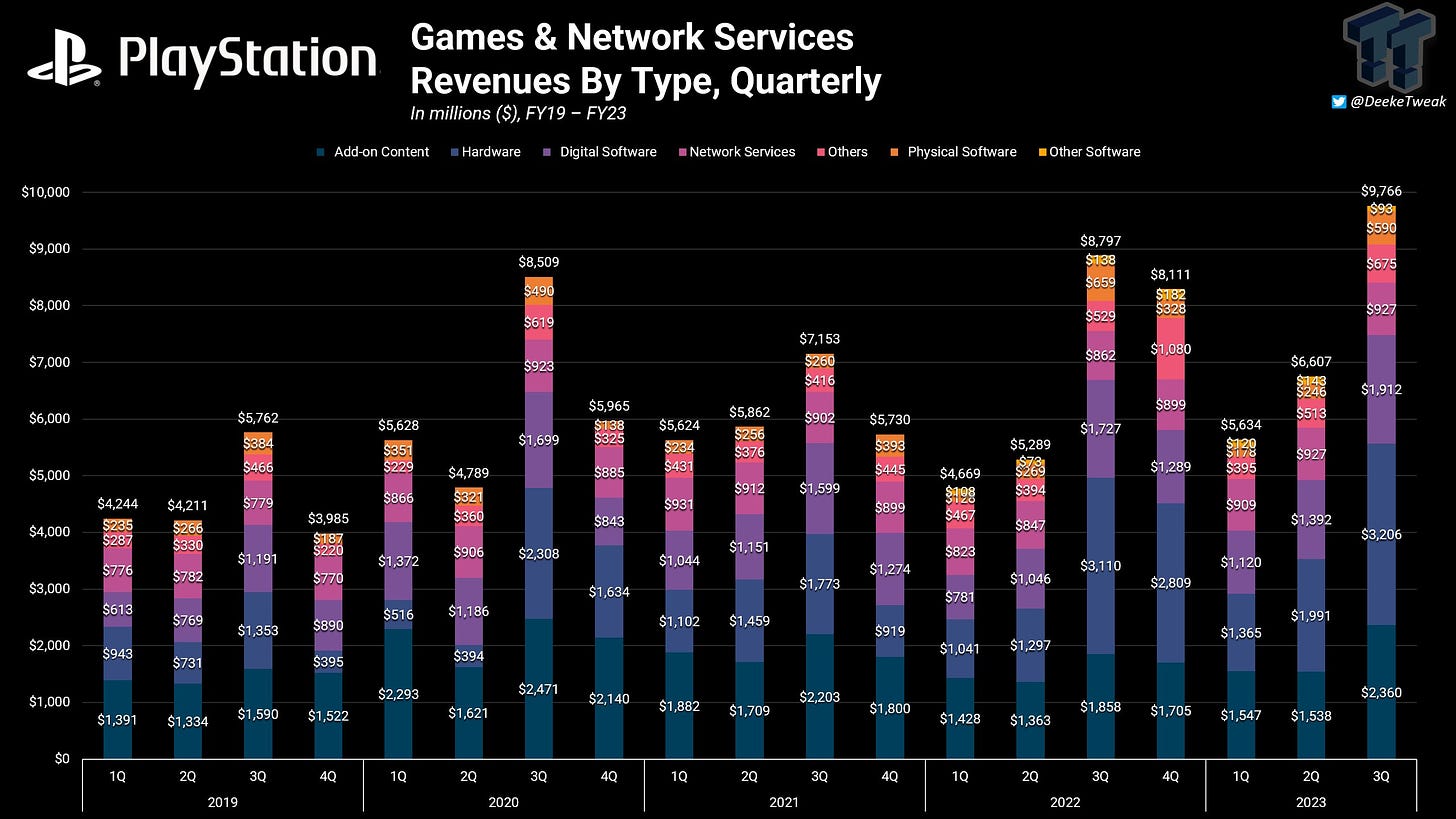

Sony (and PlayStation) posted record revenue: CNBC notes that the company’s overall revenue and profit beat analyst estimates, with revenue of $24.9 billion for the company as a whole, and $9.6 billion for ‘just’ PlayStation’s chunk of the business. That’s good going!

But strategically, the next couple of years are looking tougher for the company, for the following reasons:

PlayStation 5’s ‘supply floodgates’ opening haven’t led to a giant expansion: the market is different from the heyday of the PS4. Mobile games are even better, PC gaming reaches a giant-er international market, and, look, (an eventual!) 100 million PS5s, vs. 8 billion+ people on the planet is big. But we’re not going to see a 150 or 200 million unit ‘expensive non-portable console’ any time soon, it’s clear.

There’s no ‘major existing franchise’ first-party game releases in the next fiscal year: Sony’s Hiroki Totoki confirmed: “While major projects are currently under development, we do not plan to release any new major existing franchise titles [until at least April 2025] like God of War: Ragnarok and Marvel Spider-Man 2.”

Totoki isn’t sold on PlayStation’s revenue/profit growth plans: in frank remarks, the Sony president said that Sony’s first party devs are “very highly motivated, they’re very good people”, but in terms of getting to “overall growth and sustainable profitability [with] increasing margins… I don’t think people understand that deeply.”

As the game market continues to get squeezed by great legacy titles and so much choice, this isn’t surprising. Many companies - not just Sony - have this issue. But not many companies have - and haven’t pulled - the ‘put games on more devices’ lever.

And this is clearly what Sony is planning. Per Sony’s Totoki: “In the past, we wanted to popularize consoles, and the first party titles' main purpose was to make the console popular… [but] if you have strong first party content - not only [on] our console but also other platforms like [PC] computers, first party can be grown with multiplatform, and that can help operating profit to improve.”

And profit is something we haven’t talked about during this overview. But PlayStation’s is down, partly due to low-margin hardware,, In fact, “operating profit dropped 26%… [to the] lowest trailing 12-month profit of the PS5 era.”

Especially after the great performance of Helldivers 2 on PS5 and Steam, can we expect to see more ‘Day 1’ or swifter converted multiplatform games for Sony, given high margins on digital game sales? We very much think so… and might this be what Xbox is ramping up to announce tomorrow, too? Big shifts are in progress.

[Side note: it’s interesting that there is basically nothing about ‘live service games’ in here as a biz strategy. We’re presuming that Sony believes - ‘we need to release smash hit games and if some have a bigger long tail, great’ - vs. the previous ‘hit GaaS titles or bust’ attitude?]

The game discovery news round-up..

After that giant Sony analysis, let’s finish things up - for free newsletters, at least - with a whole bunch of other notable game discovery and platform news:

After our exhaustive look at February’s Next Fest, Valve put up a special page with the top 50 most-played demos by unique players. (We added a tab in our Google Doc which compares it to our ‘top CCU’ charts. The Top 25 are similar, but it does start to diverge lower down the charts!)

PlayStation’s most-downloaded games for January 2024 include evergreens like Grand Theft Auto V and Call Of Duty atop the PlayStation 5 charts; the PlayStation Plus Game Catalog entries for Feb. 2024 include Need for Speed Unbound, The Outer Worlds, Tales of Arise, Assassin’s Creed Valhalla and more.

In the absence of a physical E3 show in June, media site IGN “has announced IGN Live: an in-person, three-day fan event in Los Angeles this summer featuring gaming and entertainment creators, developers, publishers, and enthusiasts.” It’s timed with IGN’s Summer of Gaming - and also probably Summer Game Fest, of course.

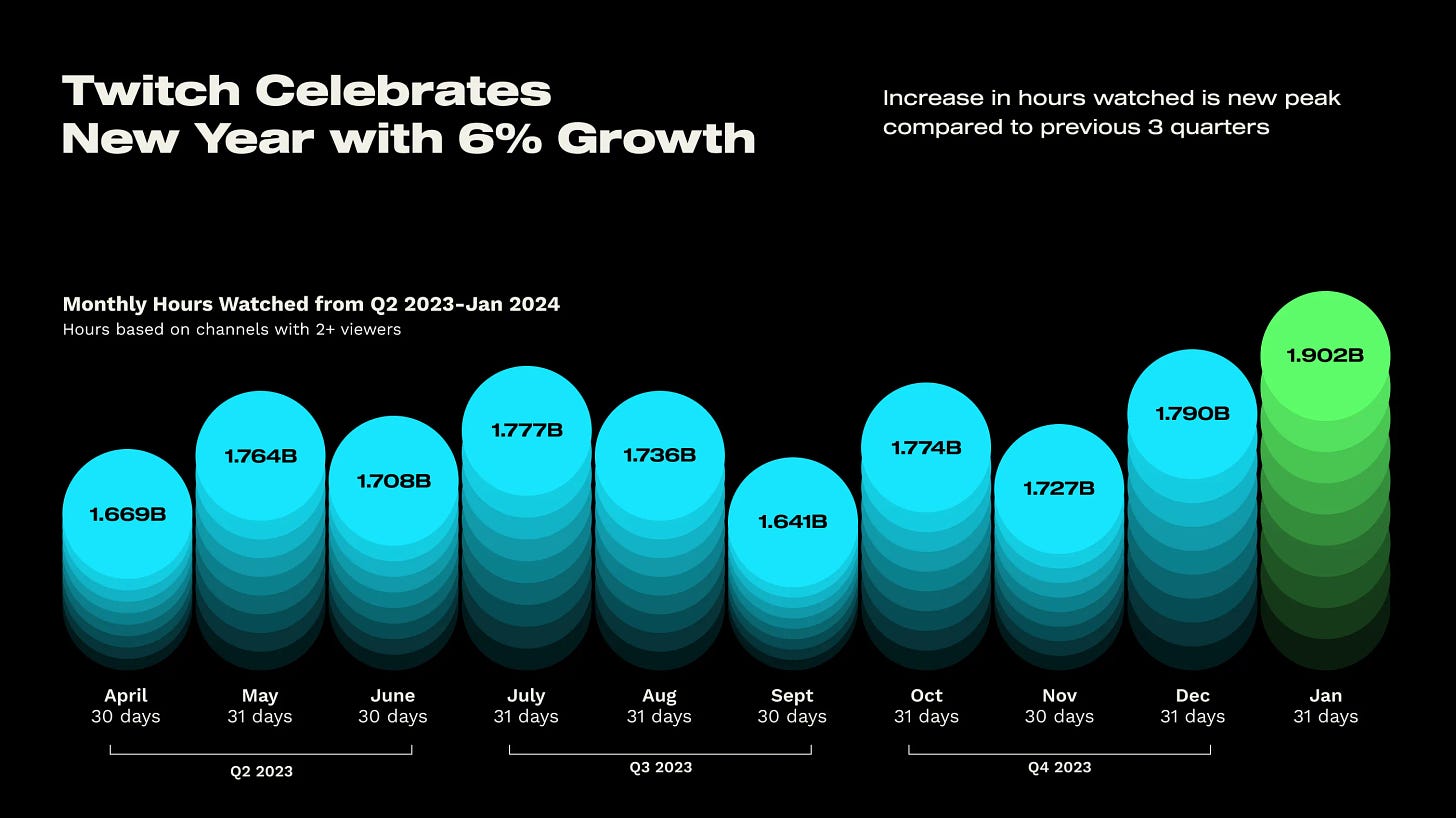

What’s up on Twitch and other streaming game services in January? The latest ‘State Of The Stream’ notes that: “Twitch started the new year with 1.902B monthly hours watched in January 2024, which is a 6% increase compared to December 2023’s 1.790B. More notable are the five consecutive months of growth in daily hours watched.”

Something to ponder - from Ted Gioia and then W. David Marx (via Garbage Day) - is the idea there are “two warring groups: Macro (i.e. mass media, legacy media) and Micro (i.e. influencers, creators, new media platforms).” The idea: “micro cultural figures such as Mr. Beast are posting revenue and viewership numbers that rival the major studios and publications.” So - which video game hits are macro, and which micro?

Here’s a good ‘what to do in Next Fest’ dev primer from Ryan T. Brown: “Your goal at SNF should be 1) Wishlist growth 2) Influencer awareness 3) Growing your community 4) Press awareness (via best-of round-ups, etc) probably in that order… if you do well at Steam Next Fest, you could add 1/3 of your current wishlist numbers in this event alone.”

Looks like the boutique-y Playdate handheld has “shipped more than 70,000 of the tiny yellow gadgets - up from 50,000 last April - and that there is now a “limited number” in stock to purchase right now on Panic’s site.” It’s interesting to see niche hardware devices like this ‘succeed’, on their own terms, right?

Dejobaan’s Ichiro Lambe has animated a full ‘Steam releases over time’ graph, “from 2005 (around 20) to 2024 (around 80,000).” That’s a big change, folks! (Ichiro has also been expanding his ‘We Love Every Game’ site recently to include easy alternate ways to browse Steam sales.

Roblox news: David Taylor recently spotted that “Roblox just announced their developer payouts for the year at a whopping $740.7 million. That's up 18% year-over-year… [though] DevEx was less than 20% of bookings this quarter, meaning less share going to developers.” Also: Roblox has been discussing its multi-lingual real time text translation tech, which is neat.

Small correction from Monday’s Next Fest newsletter: Never Grave was actually the Metroidvania from the Palworld folks, not Deviator, oops - though both were a) popular in Next Fest b) drawing some comparisons to games like Hollow Knight and Dead Cells.

Finally, we featured veteran game designer Andrew Chambers’ YouTube channel a few weeks ago, and he’s back with a look into Palworld’s key success factors, design-wise. We found it pretty interesting:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]