What Stadia's pivot tells us about the future of cloud gaming

Publikováno: 3.2.2021

Cloudy cloud calculations...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and wouldn’t you know it, one of the more interesting game platform discovery announcements of the week happened about 15 minutes before we sent out the GameDiscoverCo newsletter on Monday?

Luckily, we had a little time to chew on it. And so here’s our take on Google’s Stadia announcement, followed by a whole bunch of extra news regarding other game platforms, for those not of the cloud-affiliated persuasion:

Stadia, its subscription pivot, & what’s next..

As we all know, pivoting a business can be rough, and provide a lot of stress & negative publicity - not to say the human cost of layoffs that sometimes happen along the way. (BTW, the above image is from this Friends scene, sorry not sorry.)

So, when Kotaku broke the story that Google Stadia was giving up on its plan to build out robust first-party dev studios for its cloud gaming platform, there was plenty of ‘told-ya-so’-ing on social media from folks who have not been a fan of the Stadia model from the start. Just quoting Kotaku, in case you missed it:

“Google will close its two game studios, located in Montreal and Los Angeles. Neither had released any games yet. That closure will impact around 150 developers, one source familiar with Stadia operations said. The company says it will try to find those developers new roles at Google…

Google will continue to operate the Stadia gaming service and its $10 monthly Stadia Pro service. It’s unclear how many, if any, exclusive games will still come to the service, though the company has indicated that it can still sign new games and will bring more third-party releases to the platform. It nevertheless will look to many like a draw down of the plan to have Stadia run as a bona fide competitor to console platforms.”

And the Google announce from Phil Harrison that came out shortly after this confirmed the essence of the story - that Stadia is refocusing as a third-party subscription amplifier, rather than a first-party powerhouse: “We see an important opportunity to work with partners seeking a gaming solution all built on Stadia’s advanced technical infrastructure and platform tools.”

So the pivot is much closer to Amazon’s Luna strategy, which I discussed in this newsletter last September. It’s lower cost and lower risk, with an anchor subscription service full of decent but already-existing third party games that you get with your monthly sub, and then more focused on multiple ‘channels’, much like Amazon sells VOD video channels.

There’s also some third-party dev fallout from this. The Kotaku story does note: “One games industry source told Kotaku that Google was canceling multiple projects, basically any games slated for release beyond a specific 2021 window, though they believed games close to release would still come out.”

And in November 2020, Google revealed it had 400 games in the works from 200 developers. A number of these are simple ‘licensing for Stadia Pro’ deals for existing or nearly-done games. So these should still go ahead. But I’ve heard of multiple third-party games that did get their Stadia funding pulled this week, putting the devs in trouble. Not great news. (That was sometimes the chief funding source for the game, though it was permitted to be released on multiple platforms in addition to Stadia.)

It’s also interesting to see this Stadia pivot in the context of Apple Arcade’s strategy shift back in June 2020. Both Apple and Google have ended up wading into the space with a fair amount of money - great for devs - and ambitious plans. But they ran into distinctly different issues.

Apple’s issues have more been around who the games in its service are aimed towards (since ‘everyone’ is a large target), and some misunderstandings around whether games should be commissioned for standout gameplay experiences or retention. Post-pivot, it’s about retention, across a smaller amount of titles.

Perhaps Apple management presumed that retention and standout gameplay experiences were the same thing, because F2P mobile games that get returned to all the time make more money, so are more successful? Lots to unpick there, maybe for another time!

Stadia’s pivot comes after they started late on building a full console-competitor ecosystem, and encountered enough business model headwinds with early adopters and ‘cloud-only purchasing of games’ that the negatives of staying with an existing 3-5 year plan outweighed the positives.

Ironically, as Network N’s Tim Edwards commented on social media, cloud-only approaches to high-end video games: “will not be viable businesses until there is a game, or game type, that can only really exist because of the cloud platform. Google shutting their content studios is such an own goal.”

But some of the early attempts to show R&D around Stadia, such as the Style Transfer ML tech, were technically-led graphical solutions that didn’t fundamentally change gameplay. And large tech companies have failed in the past to create new genres of games that can only be played on a specific technology platform, & also become hits - it’s a different medium, but Twitch’s attempts to do so never quite worked out.

So the ‘cloud-only megahit’ is an ambitious - and for Stadia, incredibly expensive - goal. This probably seems unappetizing, given the general negative fan reaction & financials for Stadia thus far. (Reminder: if you’re targeting AAA console players as the early adopters who have to get enthusiastic about your game platform, you’d better turn up every day with a flame-proof suit.)

As I’ve said before, I think cloud gaming can be helpful to broadening audience. But right now, it works best as another delivery method for convenience. And Microsoft has done the best job of this so far with Xbox Cloud Gaming as part of Game Pass: “Just make the game playable across all platforms (including multiple Xboxes, PC and xCloud, ideally!) and players can decide what hardware they want to run it on themselves.”

And so, as monthly subscription services like Ubisoft+, EA Play and others (I presume there will be others? Antstream?) roll out on cloud platforms, they will come to Amazon Luna and Google Stadia at the same time. And players will be excited. Or not. But this service-led approach should ratchet down the pressure on Stadia to succeed, or else. And I’m truly sorry for the employees and studios getting caught in the fallout.

The game discovery news round-up..

Let’s bring home this final free GameDiscoverCo newsletter for the week (reminder: paid subscribers get another game-specific one on Friday, full of great insights!) with a look into some of the other things going on around here:

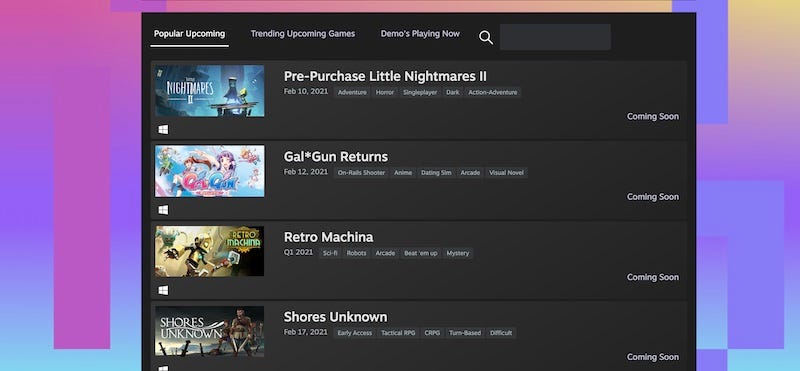

So yep, the Feb. Steam Game Festival is indeed up and running right now, and it’s looking like a finely honed machine, with improved UI and interface again. After the last Festival had too many similar tab outputs, the algorithms this time are ‘Popular Upcoming’ (sorted by imminent release date), ‘Trending Upcoming Games’ (some kind of mysterious mechanism!), and ‘Demos Playing Now’ (not sure, either.) Each one features different, interesting games - so dat gud.

One of my favorite news writers on Chinese-related game matters is Josh Ye from the South China Morning Post, so was delighted to find out he has a personal newsletter and is talking about his Chinese game biz predictions for 2021. The first of which is Tencent buying even MORE stuff: “These two early deals may well be just a prelude. Reports in January said that Tencent is looking to raise US$1 billion to buy game companies.” Invaluable insight here.

Couple of notable Oculus things: this Oculus Quest 2 boast-a-thon blog actually has some things worthy to crow about, with “more than 60 titles generating revenue in the millions, nearly twice as many as a few months ago.” (Nice going!) The blog also mentions a couple of specific games - the VR battle royale Population: One and the multiplayer mil-sim FPS Onward - that have grossed more than $10 million on the Quest store alone.

Secondly, individual Quest games have been doing well partly because the store is being heavily curated. Oculus’ answer to those being locked out is to make App Lab, where your game can be found on the Quest Store if you search specifically for it, but not if you browse for it. That’s… pretty weird. But a super intriguing attempt at splitting the difference between a sparse, curated store and a busier non-curated one. And partly a reaction to a popular ‘Sideloading’ store and generalized partner discontent, it looks like?

After ‘one-tap investing’ platform Republic acquired game funding firm Fig a while back, we wondered what would happen next. And a couple of people tipped me that game investment is now happening on Republic itself, starting with Marauder, which is billed as “currently the fastest growing Open Access title on FIG.co.” Not sure what this means long-term, but you can invest $500-$100k now!

Seems like Steam China is going to start up officially on February 9th, according to a coupleof Tweets from SteamDB’s xPaw. Given it’s starting with a migration of DOTA 2’s Chinese launcher from Valve’s Chinese partner Perfect World, and describes “a growing collection of great games on Steam China”, we think this will be a parallel store - for now - to ‘using the regular Steam client in China’. We’ll see!

Microlinks: the GameConfGuide website now makes it easier to spot deadlines for festival submissions; fairly popular indie game Crying Suns reveals its funding split - & yep, it had gov $, crowdfunding, publisher $, bank loan, and self-funding all at once; Sony results reveal 4.5 million PlayStation 5s sold so far - though they would have sold a bunch more, if they’d been able to make them.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides.]