What those studio closures mean for Xbox's future

Publikováno: 8.5.2024

Sigh, we gotta talk about it. Also: a great indie game & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

In the ‘why did the chicken cross the road?’ chronology of the week, we have reached the central reservation and are about to dart back into traffic. Won’t you join us too, as we hotstep between lumbering platform juggernauts and try to, uh, get to the other side?

Before we do, a fashion tip: the official ‘7-Eleven x Tetris’ apparel collection is ‘off the hook’ for those who love convenience stores & block puzzlers (??), and there’s even a playable Slurpee Tetris handheld. (Which you can’t drink out of - jeez, whatever.)

[HEADS UP: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, 8 detailed game discovery eBooks - & lots more.]

What those studio closures mean for Xbox's future

So, we’re starting with the obvious - the Bethesda/Xbox studio shutdowns. Presuming that most of you spotted this, but per Xbox’s Matt Booty, Arkane Austin (Prey, Redfall, part of Dishonored), Alpha Dog Studios (Mighty Doom for mobile) and Tango Gameworks (Hi-Fi Rush, The Evil Within) are closing.

We just covered the Xbox division’s disappointing Q3 financials - with non-Activision Blizzard content service revenue being flat year on year, and console hardware dipping 30%. But we certainly weren’t expecting studio closures like this so soon.

There’s a lot that can be said about this - from “This is sad fallout from a post-pandemic ‘late capitalism’ business model pivot” (me), to “Microsoft is basically the American Embracer at this point” (Chris Dring, much spicier.)

But let’s try to deconstruct what is going on within Xbox here, beyond just ‘divisional $ goals are being missed, so cost cutting is needed’, which is - let’s face it - an inevitable corporate reality. (No matter how much parasocial enthusiasm Xbox execs put out.)

1. Xbox’s studio acquisition spree was done to fuel Game Pass’ growth

First, let’s be straight: Xbox's (pre-Activision Blizzard) acquisition of many of its third-party devs in the late ‘10s was tied to having a good, regular first-party set of games to boost its Game Pass subscription numbers.

In the immediate pre-pandemic era, there was much acquisition and consolidation going on. Xbox wanted to secure devs before they were snapped up by others - understandable, given they wanted stellar content to feed into Game Pass.

So yep, picking up devs that core players adored, even if they’d struggled a bit commercially (hi, Double Fine) was great for Xbox’s player-friendly profile as Game Pass grew.

2. Game Pass growth ran out of ‘oomph’ earlier than execs expected

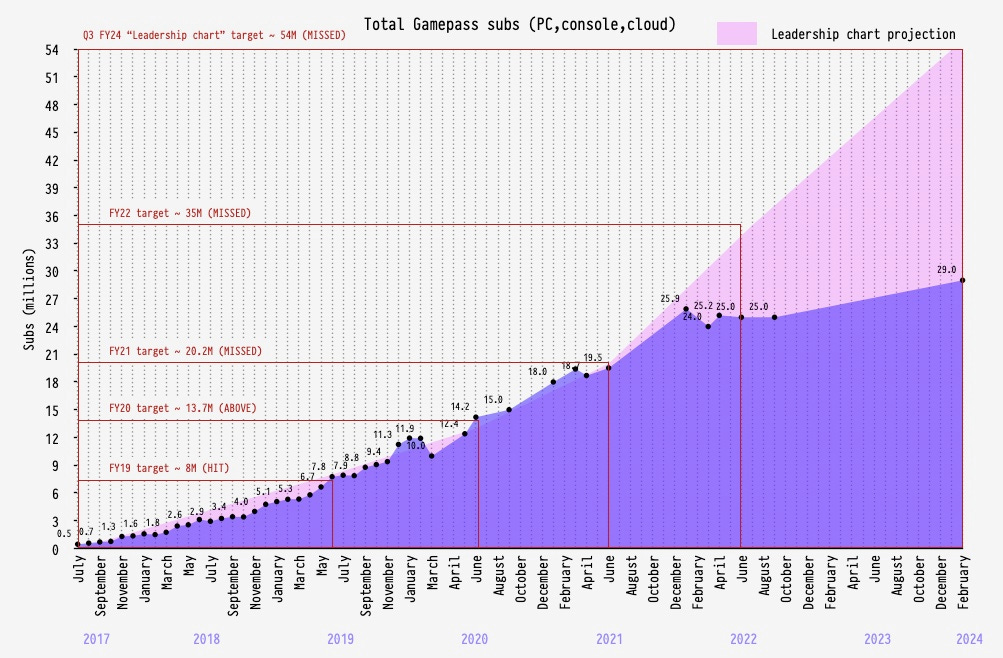

There are all kinds of caveats needed for the above fan-created graph, which we discussed in-depth back in February, and doesn’t include ‘Game Pass Core’ (formerly Xbox Live Gold.) For one: those internal leadership goals may have been ‘stretch’ ones.

But as we look at this more and more, we’re reminded: Xbox Live Gold ($5/month, gets you access to play multiplayer games) actually existed back in 2017, back when Game Pass launched. And we don’t have many public numbers for that.

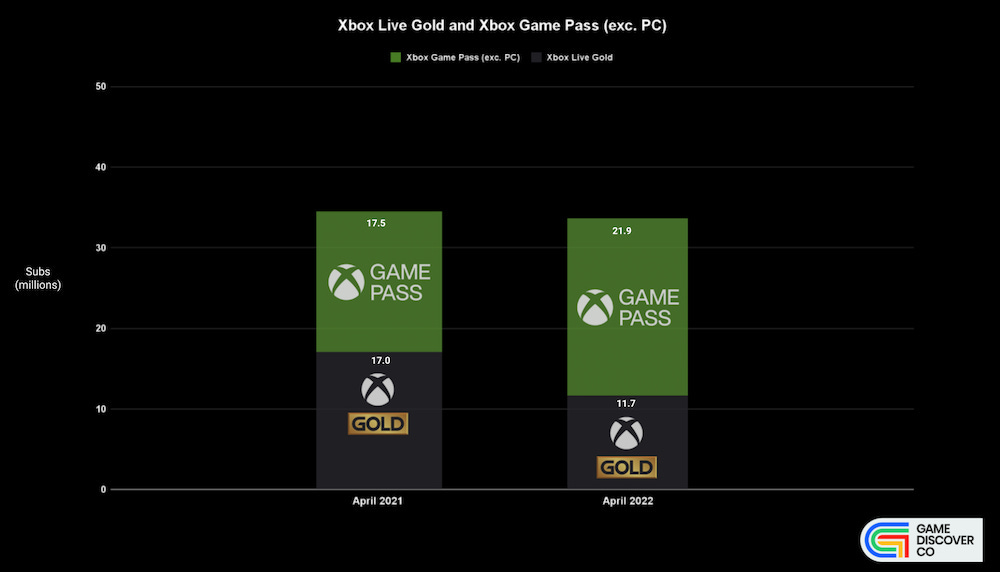

So how many Xbox Live Gold subs were there back in 2017, when Game Pass launched? We genuinely wonder. In our article on ‘the subscriber shuffle’, we noted leaked data from 2021 to 2022 showing flattish (console sub) numbers across both:

Is it possible that Xbox even ‘sleight of hand’-ed themselves, and the core demographic of Game Pass has been ‘core Xbox fans who already had Gold, and now spend 2x to 3x the monthly fee on full Game Pass’? (With some churn in and out on the margins?)

Those spend increases are helpful, mind you, and fueled Xbox’s growth handily through the pandemic. But at that point, it’s not a revolutionary shift of business models - it’s simply a yield play.

And that’s going to run out of momentum at some point, unless off-Xbox platform growth can pick up the slack. (Which is why PC Game Pass has become a bigger priority for Xbox in recent years. Though PC players don’t have the muscle memory of ‘paying a monthly/yearly sub for something’ that Xbox and PlayStation ones do.)

3. In a non-Game Pass centered world, success metrics change a lot

There’s plenty else we can say about Xbox’s post-acquisition execution with its dev teams. (We think the ‘you’ll be 100% independent, keep doing things like you have been’ ethos - plus the COVID pandemic - clashed with the need to set up robust first-party release schedules.)

But let’s concentrate on the outcomes. Xbox first-party games all going into Game Pass on Day 1 means that it's difficult to work out a success metric for these ‘expensive to make’ first-party games.

Is it 'lots of people tried this game?' Is it 'lots of people rated this game highly in reviews?' Is it - 'lots of people were retained in this game, and might pay for extra things in it?' Or is it 'new people signed up for Game Pass because of this game?'

As Game Pass growth has slowed in terms of total subscriptions, I think the focus has increasingly gone from the first two of these metrics to the second two. And that is quite a different lens. (But this is tied in to Xbox’s shift to ‘gaming for everyone’, which adds another metric - ‘how well can this game sell standalone on other platforms?’.)

Conclusion: where the Xbox boat sails from here, absent new storms…

Let’s give Xbox some credit - both its legacy studios (Rare / Sea Of Thieves) and newer ones (Obsidian / Grounded) are making games more suited to today’s ‘retention is king’ large-scale game biz. (And buying Mojang & Minecraft in 2014 is one of the all-time great pickups.)

But yes, there’s a problem for a chunk of the medium-sized game devs that Microsoft bought while trying to beef up its Game Pass catalog, either directly or ‘as a package’. (For example, Tango Gameworks came with Bethesda, but wasn’t the main dish.)

Those studios aren’t ones that massive-scale public companies like EA or Activision would own in today’s market. Some make high quality - but expensive, compared to third-party licensing titles into Game Pass - prestige games. Others make long-in-dev AAA-ish titles which are very much ‘one and done’ in terms of gameplay.

Let’s say Xbox’s direction is increasingly towards the ‘have a few big franchises that monetize very well crossplatform, plus a subscription business’ end of things. And they can get plenty of high quality games for Game Pass more cheaply, without needing to own the studios?

It does call some of those studios’ presence as part of Xbox into question, esp. if their next titles were many years away from launching. That’s maybe not the bargain Microsoft promised when they bought these companies. But it’s where we are now.

Minishoot Adventures: clever genre mash-ups win!

So we were chatting with Mylène Lourdel from Raccoon Business recently, and she mentioned SoulGame Studios’ game Minishoot Adventures, which she’s been helping with biz dev. She thought it might be a good mini-case study for us.

As it happens, we’d been tracking the game - which launched with only around 28,000 Steam wishlists - because it was one of those titles which actually grew CCU after launch - from 419 CCU on Day 1 (April 2nd!) all the way up to 1,367 CCU on Day 6.

That kind of post-release CCU increase is rare, and it’s clearly down to the game’s premise and quality. (It has 1,783 Overwhelmingly Positive Steam reviews at this point!) So we thought we’d grab some stats from the team, starting with top-line #s:

A few things that jumped out: impressively low refunds (only 5%), extremely good median playtime (almost 9 hours, with 68% of players playing for >5 hours and 40% >10 hours), and great revenue for a small two-person team after only a month on sale.

It looks like the Chinese publisher (IndieArk) really helped with the local market, with China selling 33% of LTD units, followed by the U.S. (22%), France (11%), Germany (4%), Canada and the UK (3% each), and Japan, Russia and South Korea (2% each).

The standout thing re: Minishoot Adventures is the fiendishly clever genre mashup. As Buried Treasure’s John Walker notes: “Oh my goodness, Minishoot Adventures is an amazing game. Here we have a Zelda-like RPG, except played like a bullet-hell twin-stick shooter, and how on Earth was this not already a thing? It’s a perfect combination...”

Minishoot Adventures is self-published besides China, so we chatted to SoulGame Studios’ co-founder Adrien ‘Argl’ Sele about why the game’s doing well. The main takeaways around the concept and execution, we think, are these:

The concept’s the thing, and Minishoot Adventure is just a great game idea: Adrien says: “I simply love minimalist shooter gamefeel, and when I played Zolg years ago, I thought ‘boy, how cool it would be to explore an entire world like this, unlocking places and stuff while shooting stuff’. That's how deep my game design document was.”

The original NES version of Legend Of Zelda was a big inspiration: he explains that the classic “resurfaced randomly in my life and really inspired me again”. How so? You can “go out, on your own, fight… find stuff, even secrets, be rewarded… it's okay if you die [since] you won't lose stuff, get back out there, be brave, overcome. [It’s a] simple but super, super powerful fantasy.”

Although it’s ‘bullet hell’ shmup-derived, the game is super accessible: Adrien says: “Whenever I died during playtest and was annoyed with it, I tuned down the combat encounter responsible… making sure combat wouldn't become a thorn in the side of the exploration experience, while still ensuring a certain degree of tension.” The duo also added 3 difficulty modes, extra control modes, and more accessibility options.

Obviously, there’s other ways that ‘word of mouth’ spread, including good organic YouTuber pickup. Heck, we even saw GameSpot/Giant Bomb alumnus Jeff Gerstmann playing the $15 title last week, and he’s loving it: “it’s awesome… a really good game.”

Concluding, we like it when ‘make a good game & people will play it!’ is a simple takeaway. And that’s what’s up here, with Adrien noting: “So far, 50% of players have beaten the final boss so far, 37% have beaten the true last boss (who is actually hard), and it has been amazing to see 5 years old having fun along side bullet hell veterans.” Score!

The game discovery & platform news round-up…

Let’s finish things off with a look at game platform and discovery news. And we’re taking a stop-off in Nintendo-land for the first item:

So yes, Nintendo confirmed “it will announce its next-generation console during its current fiscal year, ending March 2025” as part of its financials, which saw Switch LTD hardware sales“at 141.32 [million] as of March, after shipping 1.96M in this latest quarter. That marks 15.7M for the fiscal year, above its 15.5M target. For Fiscal 2025, management set an initial 13.5M forecast.”

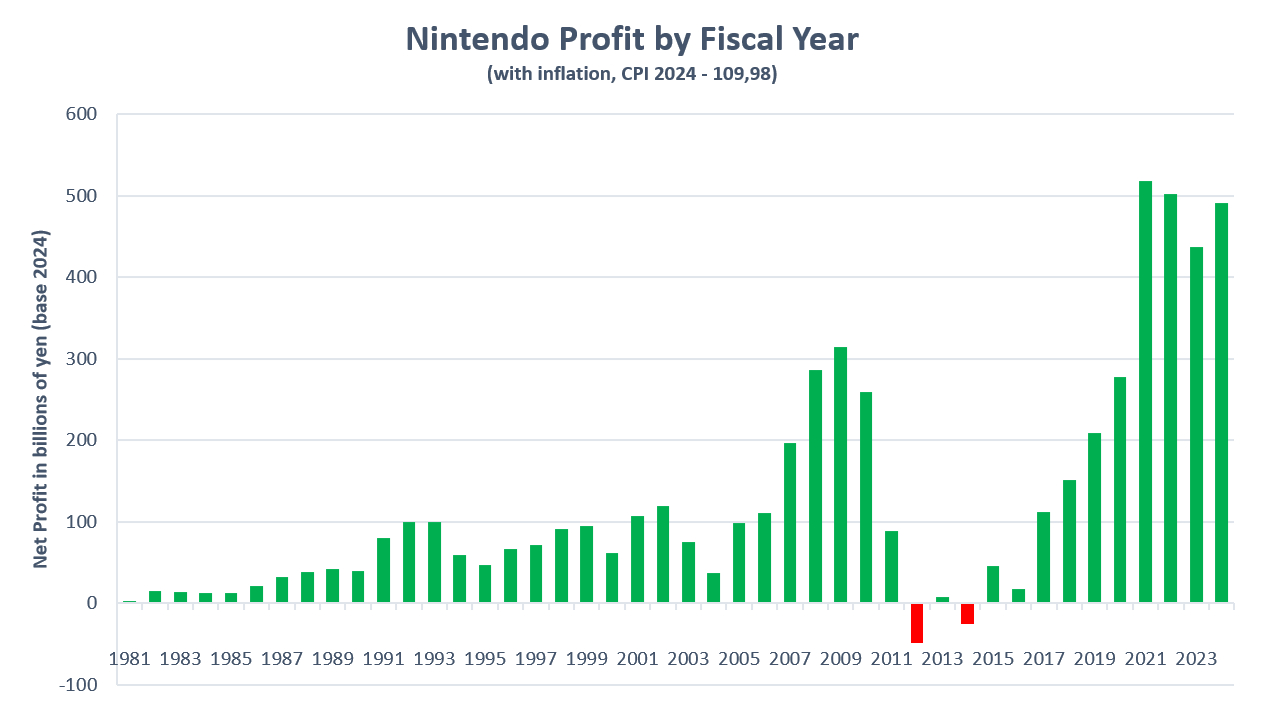

A couple of other Nintendo results notes: its profits during the Switch era ahve surpassed the company’s combined profit from 1981 to 2016(above, wow!), and Nintendo Switch's “digital [game] sales ratio has now, for the first time, surpassed 50% globally” - by far the last of the game consoles to go minority physical.

For those looking for upcoming game release calendars, besides obvious ones like Metacritic, and ‘scraped’ ones like GameDiscoverCo Plus’ Steam release heatmap, there’s now Releases.com’s game calendar Beta, which looks early but promising.

Summer Game Fest’s normally media and creator-only Play Days boutique physical event (L.A., June), which has >30 exhibitors (Annapurna, Bandai Namco, Capcom, EA, Netflix Games, PlayStation, Sega, Xbox & more) is getting a small-scale (paid) ‘industry day’ with the AIAS. (Baby steps towards something bigger?)

Game File’s Stephen Totilo has a good piece about non-Steam storefronts not properly crediting who made the game, which is one of those curious metadata issues that is a) rarely discussed openly, and b) genuinely kinda insulting to developers. Bravo.

News out of China translated by the Niko Partners newsletter: "[Genshin Impact & Honkai: Star Rail dev] MiHoYo.. will launch its own PC game distribution platform called MiHoYo Launcher in China and HoYoPlay outside China… The platform is similar to Blizzard's Battle.net or Ubisoft's UPlay, which are primarily focused on distributing self-developed games.”

The a16z Games newsletter gets into the trends driving VR’s growth, and here’s the 5 bullet points: “Both hardware and software will become more inviting; the Roblox generation is coming; smaller, faster devs will break new ground; more cross-platform experiences; VR is here to stay.”

Designer Phil Summers is drawing attention to publishers continually re-issuing the same game on the Switch eShop, which led us to find out that third-party site DekuDeals actually filters those games out of its own ‘browse’ view as default. Good hackfix, but how about just dealing with it, Nintendo?

Checking in on EA’s Q4 results - which were down YoY, with the full fiscal year inching up - to goggle at this quote in CEO’s Andrew Wilson's prepared remarks: “25 years ago there were dozens of major independent publishers in the video game space. Today, there are only a handful.” (Who’s Professor Plum with the candlestick?)

Steam Data Suite crunched numbers on ‘gross to net’ for Steam games, based on $35m of transactions: "8.6% of all Steam sales end up a refund [or] chargeback... publisher/developer cut is not actually 70% but 63.5%... thanks to VAT... [after Steam’s 30% cut] 58% will be paid out to you [on average]." Ties in nicely with our 2020 estimate of 57.75%, huh?

Microlinks: Wholesome Games’ Wholesome Direct streaming event is happening on June 8th; here’s some biz dev-related pitch decks thanks to Raccoon Business; some wishlist to Day 1 sales bars from Yogscast Games show things ain’t so linear, in abstract.

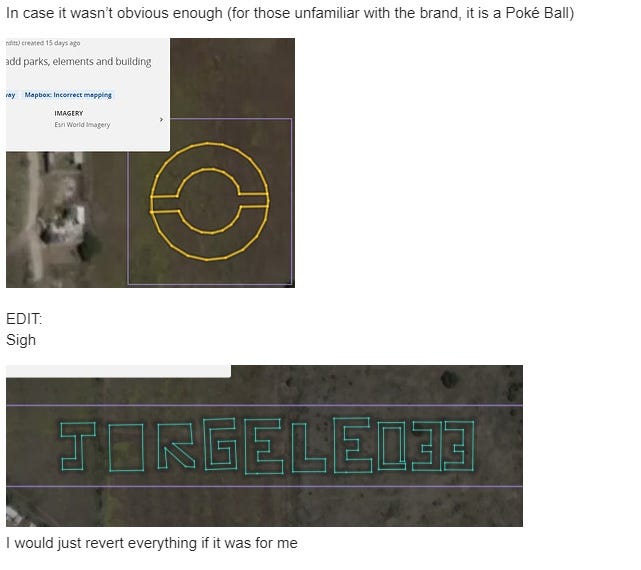

Finally, we gasped at this 404 Media story revealing that “volunteer maintainers of the widely used OpenStreetMap are battling Pokémon Go players who are vandalizing the map with fake data in order to cheat in the game.”

Apparently, they’re “adding fake beaches where they don’t exist in hopes of more easily catching Wigletts, a Pokémon that only spawns on beaches”, also ‘tagging’ some of the maps with graffiti tags & Pokeballs. Jeez, get off my (virtual) lawn, Pikachu freaks:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]