Which games hit big in Steam's Oct. 2024 Next Fest?

Publikováno: 22.10.2024

And how have things changed from previous Fests? (Also: lots of news!)

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s the week after the week before! Thus, GameDiscoverCo returns. So, we’ve been tracking Steam Next Fest demo showcases for a few editions - here’s our pieces from June 2024, February 2024, October 2023, June 2023, and February 2023, if you missed ‘em. And our lead story this week is a look at October’s jampacked Next Fest.

But before we kick off, here’s an interesting move by PlayStation. Turns out its recent emulated re-issue of Capcom’s PS1 survival horror game Dino Crisis is only available to PS+ Premium subscribers, and not even buyable standalone. (Intentional upgrade fodder, or they just didn’t get around to offering a standalone SKU?)

[PLZ NOTE: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get base access to a super-detailed Steam data suite for unreleased & released games, a second weekly newsletter, Discord access, eight game discovery eBooks & lots more.]

Oct 24’s Next Fest: how did the format change up?

Before we get started here, let’s explain - the format of Steam’s October 2024 Next Fest was quite a bit different from previous events. How? Well, responding to some of the ‘rich get richer’ visibility criticism, Valve created a randomized, auto-advancing showcase atop the event page for its first 3 days (Mon-Thurs).

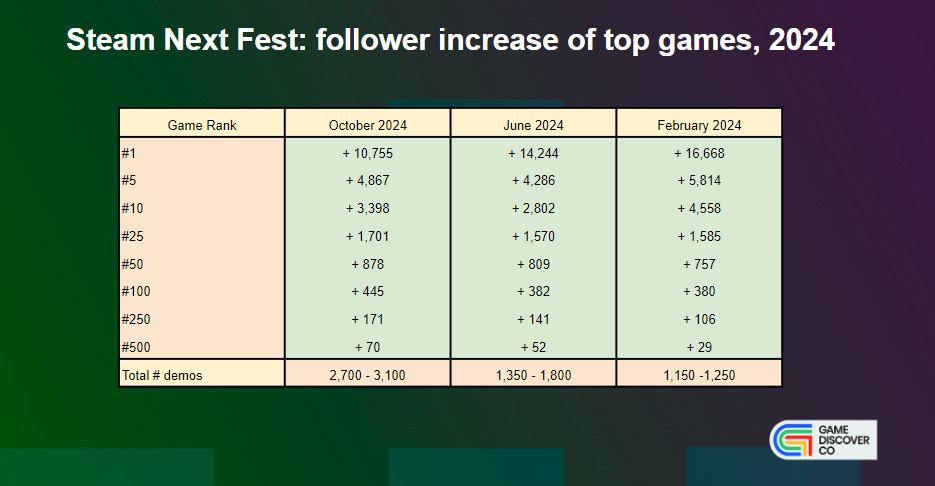

Even beneath that, there were tag and browse-based views showing a giant variety of the 2,700-3,100 (!) demos* that showed up in Next Fest this time around. (That was a big increase from the 850-950 in June 2023, and even 1,350-1,800 in June 2024.)

The Next Fest page changed on Thursday, according to Valve’s Alden Kroll: “Next Fest now uses recommendations generated from the first few days of Next Fest data. The new trailer carousel, and exploring by genre, are personalized toward showing games wishlisted by people who play similar games to you.” We’ve seen some game’s ‘wishlists per day’ increase later in the Fest - this is likely why?

However, Alden did clarify: “This new recommendation model doesn’t necessarily favor games with more wishlists or more demo plays, but instead personalizes the display toward recommending games wishlisted by people who play similar games to you.” (Still, it’s likely there are some clusters of favorite genres, so some games did better than others.)

But this is a big change to how things worked before. A lot of devs used to launch early to influencers, to try to get into high visibility Next Fest front page charts. Well, those charts still exist, but they are much less high visibility. So let’s talk results…

This latest Next Fest: so which games performed?

Yes, Next Fest is a lot more crowded. And our impression is that this is because devs - and increasingly larger ones - are understanding that putting a demo in Next Fest is a necessary and helpful ‘marketing beat’ for discovery, rather than ‘let’s get people to try our game, to see if they want to buy it’. (That’s the archaic view of demos.)

Once again, we’ve compiled our giant Steam Next Fest results document (Google Drive doc). The first couple of tabs are the Top 50-60 games by CCU (concurrents) and Steam follower increase during the Fest, followed by all 3,000+ games - look for yours!

And here’s our chart of the Top 10 games by Steam follower increase during Next Fest:

Some notes on the top games in here, some of which are more surprising than others:

Big F2P games are flooding into Next Fest: given the success of new free to play Steam titles like The First Descendant and Throne & Liberty, F2P titles like Battlefield-like Delta Force (#1, above), intriguing top-down MOBA/hero shooter Supervive (#3), and anime tactical shooter Strinova (#10) are also vying for interest.

Multiple ‘games you haven’t heard of’ are breaking out: did you spot action sandbox cop sim The Precinct (#2), snowy survival crafter Permafrost (#4), or creepy island survival title Project: Mist (#8)? Probably not, and they all look pretty intriguing.

A handful of cozier or pixel-adjacent games made the Top 10: specifically, adorable farm/explore title Luma Island (#7) and 2D pixel-y road trip management game Keep Driving (#9, people love road trip games!) neared the top of the charts.

Otherwise, this particular Top 10 lens includes promising-looking PvPvE steampunk desert explorer Sand (#6), and Code Vein-ish third person ARPG AI Limit (#5). In other words, there’s a diversity of game types in here.

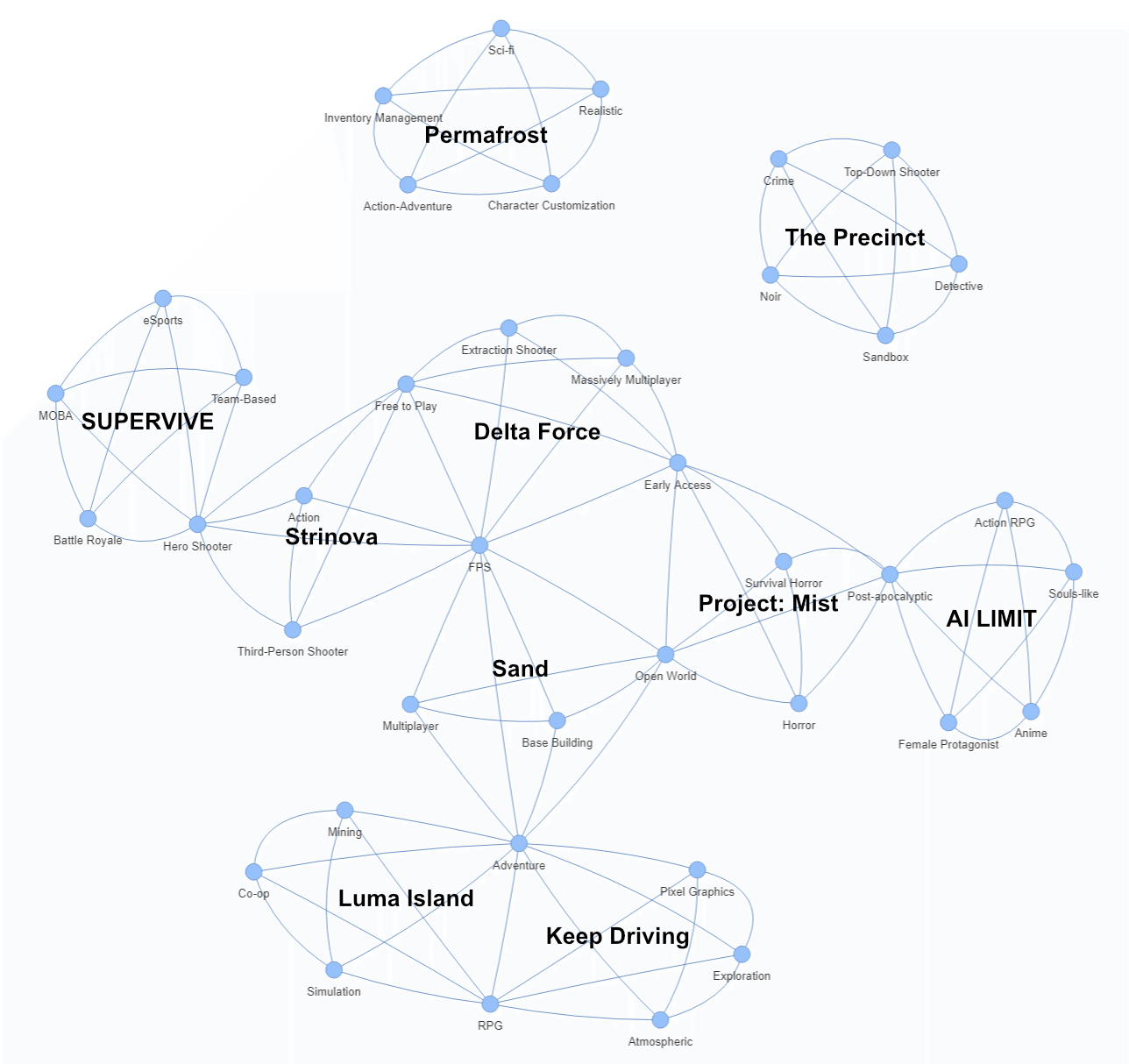

To show this off, here’s the Top 5 tags for each game in this Top 10, plotted for us (kindly!) by AccelByte’s Michael Chan. One of the only big tag overlaps? FPS:

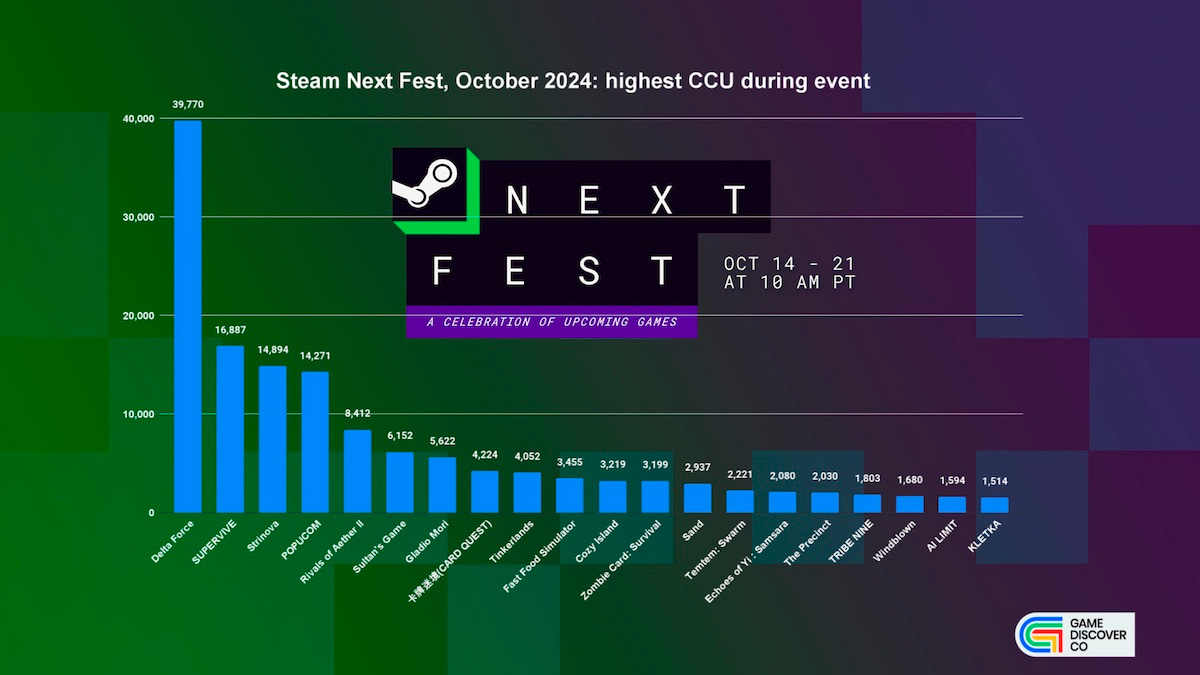

Of course, sorting by top new followers (which might or might not imply the most-wishlisted games during the Fest) is just one way to see things. Here’s the Top 20 games by peak demo CCU:

Sure, a number of the titles are the same. But plenty in or just outside of the Top 10 are different. We’d particularly highlight co-op platformer Popucom (#4), Smash Bros-like sequel Rivals Of Aether II (#5), 2D card game Sultan’s Game (#6), and the Half Sword-ish physics combat sim Gladio Mori (#7).

And there’s a host of other interesting titles here, such as co-op pixel adventure Tinkerlands (#9), ‘next possible sim hit’ Fast Food Simulator (#10), clever Survivors-like spinoff TemTem: Swarm (#14), and more. And listen, getting >1,500 peak CCU for a demo does portend well for the full game, since replayability may be high…

[Steam does have a Most-Played Demos of Next Fest sale page, featuring the 50 top games by unique players, including many of the above. It seems to sort randomly right now, despite saying it’s “ordered by number of unique players.” These games all got notified they’d be on the page, and are the official ‘top games’ of October’s NF.]

How did Oct’s Next Fest demand shift vs previous?

So that’s at least an attempt to categorize some of the top Next Fest titles. But again, consult GDCo’s giant Google Drive document for much more granular detail. And so the next question is - did Valve’s new approach to Next Fest make things ‘better’?

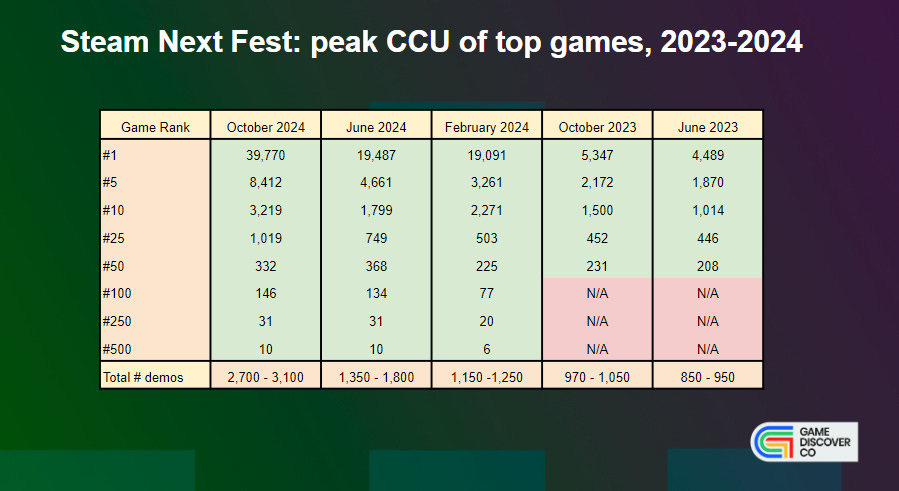

All we can do here is try to evaluate performance vs. previous Next Fests. And here’s what we get for the last 5 Next Fests, comparing peak in-Fest CCU of top games:

So what we’re seeing here is that, despite lots more games, the top CCUs of games in Next Fest are - largely - going up. (It was pointed out to us that Oct’s Next Fest had at least a partial Steam front page takeover for 6 of the 7 days, something that’s not always the case at busier times of year. We bet that helped, too.)

But cutting back to a ‘correlation x causation’ question: what if there’s just more games with bigger CCU because more large multiplayer games are choosing to enter Next Fest? It’s worth looking at follower increase, also - which we only have for 2024’s NFs:

This is an interesting and slightly different view. It looks like on the top end, we’re not really seeing major increases in follower additions. But for lower-ranked games, theres some decent upshifts.

Specifically, the #250 ranked game has gone from +106 followers (+1,000-2,000 wishlists?) in Feb. 2024 to +171 followers in October. And the #500 ranked game has shifted from +29 followers (Feb. 2024) to +70 (Oct. 2024.)

So yes, it does seem like lower-ranked games are getting their interest boosted - both before this Next Fest redesign, and after it. (So good job, Valve. BTW, we suspect the new layout of Next Fest’s page has some effect, but streamer and existing fan interest on a ‘game by game’ basis is a big part of the puzzle.)

Of course, one big caveat: if you were #500 ranked for follower increase in Feb. 2024’s NF, you were close to the 50th percentile. But the #500 rank in Oct. 2024’s NF is closer to the 20th percentile - you did better than 80% of Next Fest games. (For the record: the 50th percentile in Oct. 2024’s Nest Fest added just 12 Steam followers.) So once again, high supply of (good!) games is the game biz disruptor, folks...

The game platform & discovery news round-up…

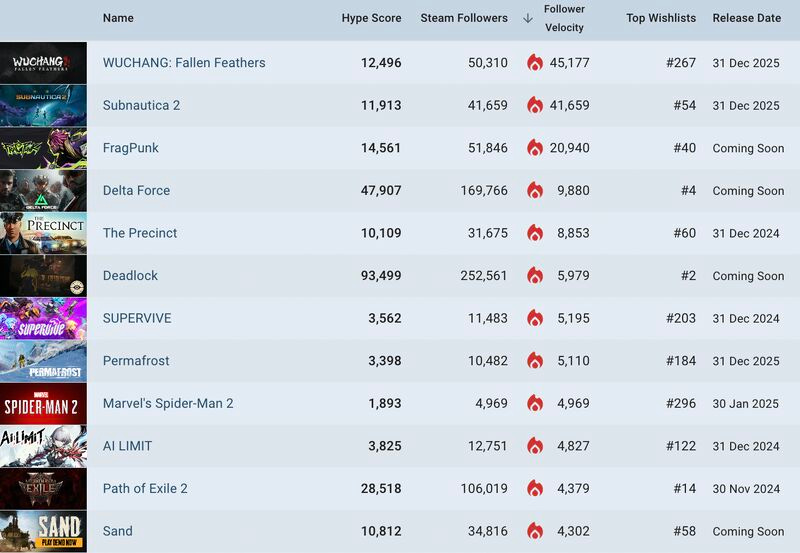

So, that was a lot. And we’ll finish off with a dessert of ‘moar’, starting with the ‘trending unreleased Steam games’ list we now publish weekly:

Sure, there’s quite a few Next Fest games in GDCo’s ‘biggest gainers in the last 7 days by Steam followers’ charts, but new trailer for the Black Myth-ish Wuchang: Fallen Feathers (#1) skyrocketed interest in China, and the official announce for Subnautica 2 (#2) also zoomed up the charts. Oh, and there’s Spider-Man 2 for PC!

That Nintendo Online playtest nobody was meant to leak? Well, some people leaked it as an MMO, and “the game shares.. similarities with family-friendly [online games] like Minecraft and Roblox. The IP is either entirely new.. (it doesn’t feature any recognizable Nintendo characters) or it’s a placeholder for the game system itself.”

How digital is the AA/AAA games market in 2024? Circana’s Mat Piscatella says that in the U.S.: “53% of Switch software sales were done digitally, compared to 52% in the same period last year. PS5 is now 78% digital vs 75% [in 2023]. 91% of XBS software was done digitally this year vs 90%.” (Many top digital games aren’t tracked, tho.)

We also got a view* in Europe, thanks to GSD & GI.biz: “For the first 40 weeks of 2023, 41% of new PS5 games were sold via physical retail, but this year that's.. 32%… this year just 19% of new Xbox Series S and X games were sold via retail stores. In 2023, 26% of Xbox game sales were physical.” On Switch? 65% physical, vs. 67% last year. (*Similar caveat over many top digital-first games being missing.)

In ‘games as platforms’ news, Activision has made it way easier to directly access Call Of Duty franchise iterations in the CoD ‘wrapper’ app: “the new UI’s Home tab includes Game Tiles, which means that unlike the previous Call of Duty UI, players will now be able to directly access games via their own self-contained user interfaces.”

Some impressive Roblox milestones: fashion game Dress To Impress (which only launched a year ago!) just hit 1 million concurrents on Roblox, woww. And the platform as a whole hit 10.29 million CCU, very close to its all-time high of 10.32m in September.

Here’s some good transparency on a Steam Daily Deal for wine-making sim Hundred Days: “6M impressions, 140K page visits, 5,600 base game copies + 1,900 Napa DLC, 10K [new] wishlists… [of the 5,600 copies sold] 1,100 comes from our old wishlist bucket; part of our public hasn't converted yet in 3 years.”

In surprise news, Game File’s Stephen Totilo confirmed that Netflix have shut down Team Blue, the California-based studio that seemed to be working on some kind of big-budget “AAA multiplatform game and original IP”. (Maybe not 100% surprising, if you consider leadership changes and their top mobile downloads.)

LTTP, but here’s some interesting comments from former PlayStation exec Shawn Layden on hollowing-out of the middle of the game biz: “If you [can become] AAA, you survive, or if you do something interesting in the indie space, you could. But AA is gone. I think that's a threat to the ecosystem, if you will.”

Here’s a useful ‘explainer’ on the top - and most-subscribed Twitch streamers from StreamHatchet: “Among the most subscribed Twitch streamers right now, VTuber Ironmouse stands far above the rest with 247K active subscribers – more than four times that of second place.”

Microlinks: some good macro-level data for mobile games, where revenue is growing swifter than downloads; there’s a ‘cozy gamer’ survey showing how hobbies matter to them; Twitch is retiring the public ‘game developer’ badge, while catching up on backlogged ‘developer organization’ requests.

Finally, incredibly cheeky first-person meta-game The Stanley Parable recently released a ‘try before you buy’ mobile version. And when you get to the point in the free app where you need to pay, you get - well, you get this wonderful situation. Plz watch:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]