Which new Switch games are winning the discovery war?

Publikováno: 2.2.2022

We use data to try to work it out. Because of course we do.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to Wednesday, at least in the U.S. - with time zone apologies to you international folks who are ‘not working’ or ‘sleeping’ when you get this, or any of those good things. This is your second newsletter check-in this week from us.

Most importantly, it’s 2/2/22, so we get to kick off an ironically catchy promotion - 22% off all GameDiscoverCo Plus subscriptions for the next 22 days, in honor of this doubly portentous date. (We’re always telling you about discoverability tactics. So don’t blame us if we use discounts to stimulate sales, like you’all do…)

[REMINDER: your Plus subscription gets you an extra exclusive game analysis newsletter every Friday, using real-world data on Steam/console sales that we also give you direct access to, as well as a Discord to hang with your peers & more. Thanks to those who already subbed!]

Switch third-party games: how can we rank them?

We’re always trying to get more info on console game sales at GameDiscoverCo, especially for platforms that a) don’t offer a lot of public charts or b) officially or unofficially NDA developers on their sales numbers. (They should be more transparent, btw.)

And Nintendo Switch is especially interesting, since the platform has gone from ‘not many games & crowded/rabid fan base’ back in 2017 and 2018 - at that point, many vanilla titles were selling 100-200,000 copies or more in the first few months - all the way to ‘30-40 games released per week, darn it’s crowded out there’ in 2021 and 2022.

While it’s not easy to see absolute sales number on Switch - there’s no ‘review to sales’ ratio or ability to look at owners via profiles - we have been keeping a twice-weekly chart for our Plus subscribers. In it, we use eShop search to look at the top new games in the U.S. (and U.K.) Basically, we do the following:

Grab a ranked list of ‘most downloaded games’ on the eShop, including free and paid games.

Filter only by games released in the last 3 months at the time of the chart.

Further filter solely by third-party games, since Nintendo-published games can otherwise dominate.

This gives you a list of titles in the same order as the ‘Top 30 games’ chart you can see on your Switch dashboard. It’s ranked by total downloads over the last 14 days. But it allows you to go much lower in the rankings and see more games than the Top 30 - where there’s often only 3 or 4 ‘new’ games shown.

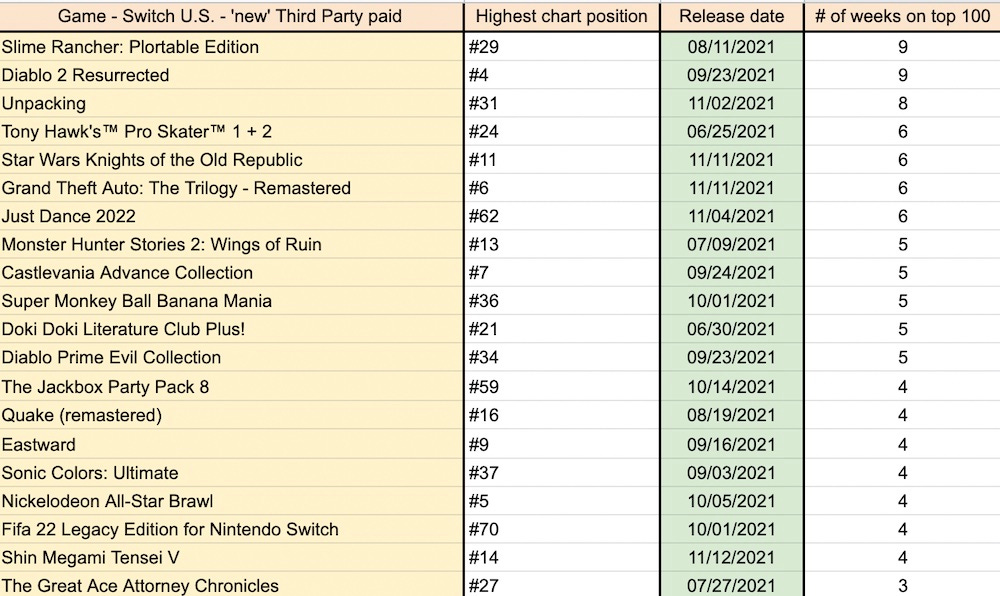

Anyhow, thanks to our data whiz Al, we compiled a list of ‘new’ Switch games released in the U.S. between June and December 2021, ranked by the number of weeks they appeared in the Top 100 most-downloaded games. Which gets you this, in part:

And indeed, if you compare to Nintendo’s ‘top selling indie titles of 2021’ across the entire year, you’ll see quite a lot of overlap. (If we’d been checking this data for the whole year, we bet it’d be near-100%, depending on Nintendo’s definition of indie.)

Before we talk about the methodology, here’s what we think the range of new third party titles and their success shows:

Standout ‘indie’ titles are probably ones that you’d expect: Slime Rancher has been a gigantic hit on PC and is ‘Switch-friendly’, vibes-wise, Unpacking has been a bit of a phenom, and Eastward also has hella Switch-positive vibes. Oh, and nice going, Doki Doki Literature Club & Jackbox Party Pack, both original indies doing well.

There’s definitely a set of ‘Switch player love Japanese games using classic franchises’ games up there - Castlevania, Super Monkey Ball, Sonic, Ace Attorney, Monster Hunter, for example. Not sure if all of these are outperforming PC sales on Switch, but I bet some are.

There was a point where there were near-zero ‘bigger games’ coming to Switch - which coincided with the golden age for indies, I suspect. Nowadays, there’s a fair amount of titles - Diablo, Tony Hawk, GTA, Quake, FIFA - that show up in the biggest games of H2 2021, at least in the U.S. Switch charts.

A number of these titles - especially on the indie side - have got coveted Nintendo ‘Featured’ buttons in the eShop interface, or were on a Nintendo Direct/Nindies Showcase. We’re pretty sure the Featured button in particular helps sales. But this is a bit chicken/egg like - was it big because of the feature, or big anyhow, thus the feature? So… just get featured? :P

Finally, to clarify the above data: ‘Highest chart position’ is using data that includes evergreen ‘free to download’ titles like Fortnite, Apex Legends, Knockout City & so on. So the above paid titles may have got to #3 in the high-profile eShop charts you are used to, which exclude free games, but only #30 in overall download counts.

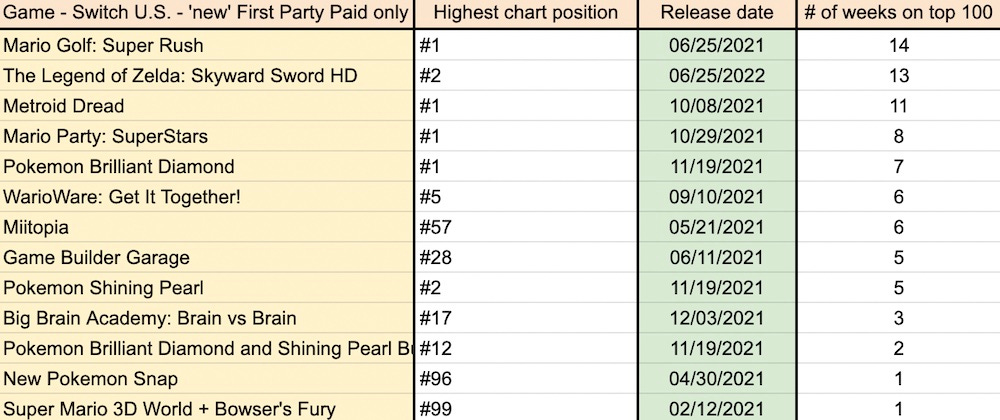

And the # of weeks on the Top 100 works so that if your game was a big hit for the whole time, you could max out at 12-14 weeks - all 3 months since your release. Games like Mario Golf: Super Rush (first-party paid, below) & Pokemon Unite and Trove (free to play, in full doc) have done this:

Also, some of the top third-party (Unpacking, KotOR, Just Dance) are still charting in the Top 100 in 2022. So they would be even higher up, if we allowed them to continue their streak into this year. But this chart is already complicated enough, haha…

Anyhow, there are about 60 games on the full third-party chart linked above. We’re guesstimating that their worldwide LTD sales to date range from the low five figures (in units) to somewhere in the mid six-figures, with the majority being on the lower end of things. (But with the ability to discount aggressively to spike sales, of course.)

And with just under 1,000 Switch games digitally released in H2 2021, according to my laboriously manual adding-up of the ICO Switch Newsletter numbers, you’re looking at… around 5% of games doing five figures worth of units before the discounting starts? That sounds about right, given what we’ve heard.

We’d recommend taking a close look at the full list for smaller games further down it, too - especially if you are quite Switch focused, or are trying to do more ‘traditional’ Nintendo genres like 2D platformer, etc. Not convinced titles like that are keeping the sales buoyancy they did back in the day. But research/data will tell you.

Steam rolls out new discounting rules, shazam!

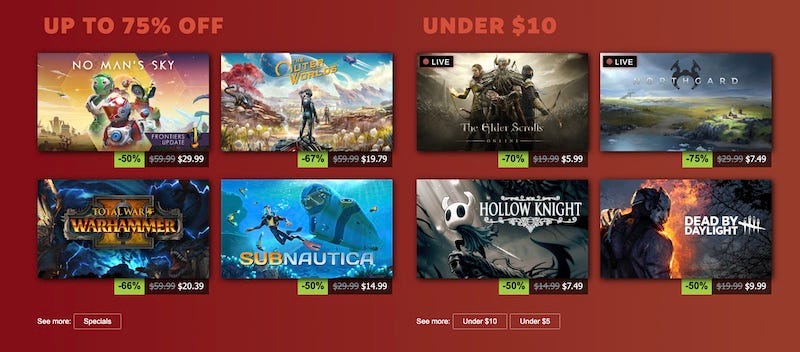

The embargo on this was up yesterday (when we don’t publish newsletters), so we had to wait until today to tell you. But Steam announced some new rules around discounting, alongside a bulk discounting tool beta and a set of themed sales.

And we’re here to explain it to you. It seems like it’s a progressive refinement, rather than anything crazy:

Starting on March 28th, Valve is “shortening the required cooldown period between discounts on Steam to four weeks (28 days to be exact) from the previous six week term.” But the smaller ‘custom’ sales that used to be cooldown-excluded - and even medium-sized sales like Halloween - are now subject to cooldown. Only Lunar New Year, Summer, Autumn, and Winter Sales aren’t.

New bulk discounting tool! It’s “a centralized place where you can see all the promotions for which your game(s) qualify. It offers options to filter for specific games and events, register for participation, and set discounts.” For folks with the correct SteamWorks access and privileges, it should be accessible here.

Valve also released a list of the upcoming themed sales to press, as reprinted here at RockPaperShotgun: “Next Fest: February 21-28; Remote Play Together: February 28 - March 7; JRPG: March 14-21; SimFest - Hobby Edition: March 28 - April 4; Die-a-lot: May 2-9; Racing: May 23-30; Next Fest: June, 2022; Summer Sale: June 23 - July 7; Survival: July 18-25.” Full promo calendar here if you’re a dev.

The community feedback I’ve seen on this change has largely been neutral to mildly positive - with some concerns that it ‘ups the ante’ on constant discounts on Steam for the average game. (But I would say that boat has already sailed, really!)

It also might have a negative effect on participation in some smaller Steam third-party events, if too many overlap and your discount isn’t ‘free’? But difficult to tell at this stage. Devs will at least need to be way more intentional in their sale planning.

One detail a few have missed in the FAQ at the bottom of the article tho: “Discount cooldowns will apply to promotions like Daily Deals, Midweek Madness, Weekend Deals, Weeklong deals, publisher weekends [and so on.]” Perhaps a couple of these are unexpected because they’re not ‘group deals’?

So yes - to some extent, this does level the playing field. And those well-connected devs who were getting featured all of the frickin’ time are going to be more selective about the discounts they decide to participate in. It’ll be interesting to see the revenue effect this has, longer-term.

The game discovery news round-up..

Let’s finish up with some fine charts, graphs and commentary from the world of ‘dammit, what are platforms up to today?’ And there’s been a lot of dammits recently, folks:

The Sony/Bungie deal is going to get a paragraph, and that’s it. So - an interview with SIE head Jim Ryan explaining: “I would back us to do [live-service games] ourselves, but when you have the potential to have a partner like Bungie who has been there, done it all before.” And The Verge on why the Bungie acquisition is about“huge virtual worlds on multiple platforms"? You get the jist, right?

Most of you have probably been hit up for Steam keys for your game by straight-out impostors using fake emails. But influencer x Steam key scams are getting more complex, as noted in this November 2021 Twitter thread from Ishtar’s Bruno Laverny. Basically: lots of channels with the ‘correct’ amount of YouTube subscribers and views, but non-real traffic or content. Ugh - watch out for them.

It’s worth checking GameRefinery for mobile trends & their 2022 overview is worth reading for sure. For example, to get away from loot box complaints: “we’re expecting to see iterations of this preview mechanic [created by EA’s FIFA] move into mobile gacha in 2022. While the preview option may seem counterintuitive to gacha, it could actually lead to more monetization channels being created.”

We need to do more content on Steam competitions or giveaways, but - did you all realize the Steam-specific features that Gleam.io has nowadays? Among other things, you can check if users are a member of specific Steam groups, whether they’ve played particular games, and more. It’s good for Beta key redemption and more besides.

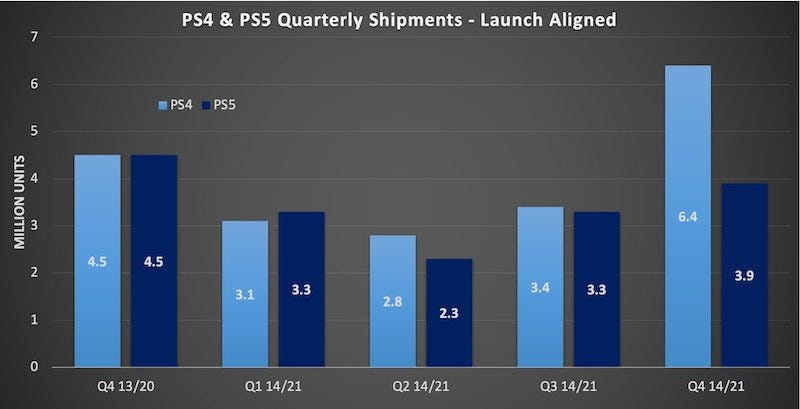

Separately of the Bungie news, Sony put out its quarterly results, with “PS+ members reaching 48M in fiscal 2021 Q3, up from 47.4M a year ago. Monthly Active Users declined slightly to 111M, from 114M. Digital download ratio for full-game software was 62%, compared to 53%.” The game biz as a whole was down 8% in revenue YoY, since, as Niko’s Daniel Ahmad shows (above pic!), the PlayStation 5 hit a quarter where it couldn’t scale hardware production to met demand.

Microlinks: how Pokemon Legends: Arceus did on Twitch/YouTube vs. previous Pokemon titles; you can now link your PlayStation and Discord accounts to show what you’re playing on your PS4/5; Tokboard keeps an eye on popular TikTok songs, should you want to put ‘up and coming’ ones in your video game TikToks?

There’s a Twitter thread on building successful PC/console games from Toge Productions’ Kris Antoni (Coffee Talk) which I recommend, since it gets crunchy with things like market fit, hook, and research. One key point in here: “Some genres can be complementary. eg: I like playing strategy games, after playing one game I'll be looking to buy more strategy games with similar mechanics or settings. While others can be substituting each other, eg: MMO, people tend to play just 1.”

Over on Reddit, somebody looked at Steam250’s top-rated games of 2021 and worked out which game engines they ran on: “Unity: 25, Unreal: 6, Game Maker: 4, RPG Maker: 2, Custom: 9, Other: 4+.” Reminder that SteamDB is now autoscraping this information across the entire Steam catalogue, impressively, if you want a very big-picture view.

So yes, the Wordle deal is interesting. Many don’t realize the New York Times is already a game subscription player with its puzzle/crossword subs, which costs $5 a month or $40 per year, and is part of a non-news subscription offering that’s racking up quite a lot of fresh subs. (Not saying Wordle’s becoming non-free now or soon, just adding extra context.)

Microlinks, Pt.2: Digital Foundry tested out the Switch cloud streaming games (Kingdom Hearts, Control, etc) & wasn’t impressed; you can now have unlisted apps in the iOS App Store, if that helps you; Tencent is putting Unreal Engine in its QQ app, so bring on the metaverse - or just avatarverse, I guess?

Finally, if you’re a VR dev with launched games and you haven’t filled out our GameDiscoverCo VR survey yet, please do so before the deadline on Friday 4th. It just takes 5 minutes, would be very much appreciated, and we’ll beam results back to you all soon.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]