Which Steam games 'won' the first half of 2024?

Publikováno: 13.8.2024

Well, revenue-wise, at least. Also: 'gauging vibes', and lots of links.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re definitely back, and it’s definitely time for a ‘deep into the numbers’ look at how most PC games* (*except those few successful off-Steam titles like your Fortnite-s, LoL-s, Valorant-s, and Tarkov-s) have been doing for the first half of 2024.

But before we start: we’ve been enjoying Poor Charlie’s Almanack, a collection of writing by late Berkshire Hathaway exec (& Warren Buffett’s right-hand man) Charlie Munger. A great example quote from a 1994 talk transcript? “You’ve got to hang experience on a latticework of models in your head.”

[HEADS UP: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data suite for unreleased & released games, weekly PC/console sales newsletters, Discord access, eight game discovery eBooks & lots more.]

Which Steam games 'won' the first half of 2024?

So it’s a few weeks after the first half of 2024 ended, calendar-heads. And we thought we’d use data and moxie to take a look at Steam performance for the first half of the year, from a variety of lenses.

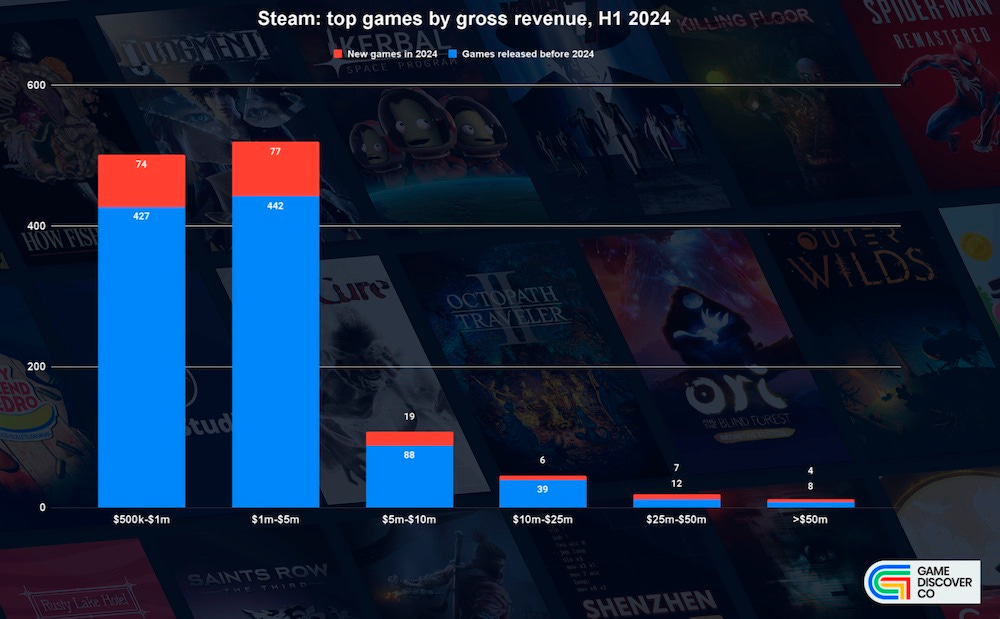

As always, a caveat - we’re constantly tweaking our algorithms. And in fact, a change is going into effect in the next few days, based on some things we learned putting this together. But here’s what we got in terms of Top 20 titles and gross (pre-Steam cut) $:

What we noticed in particular from this chart is the following:

Free to play games are less than 50% of the Top 20: however, many other titles beside the few giant new ones are ‘paid, but with IAP/DLC’ - think Call Of Duty HQ, Elden Ring’s big DLC boost, etcetera. And Last Epoch made an impressive showing thanks to its strong 1.0 release combined with IAP/DLC.

Seven ‘new on Steam in 2024’ games had >$40 million gross LTD: the breakout games (Helldivers 2 at ~$450m, Palworld at ~$375m) are big outliers compared to games like Granblue Fantasy: Relink, Enshrouded, Tekken 8, and Manor Lords, which have done amazing, but we estimate in the $40-$60m gross range so far.

Valve’s own games continue to do surprisingly (?) well: we’re estimating Counter-Strike 2 at $610 million in the first half of 2024 - wow - and also DOTA 2 at ~$120 million. That’s pretty good money, considering the dev team size, and the fact Valve doesn’t have to pay platform royalties to itself (lol!)

So far, so good - there probably weren’t a bunch of games in the above Top 20 that you were surprised by, right? (Maybe Naraka: Bladepoint, if you’re not up on how big this game is in Asia, especially after its F2P relaunch?)

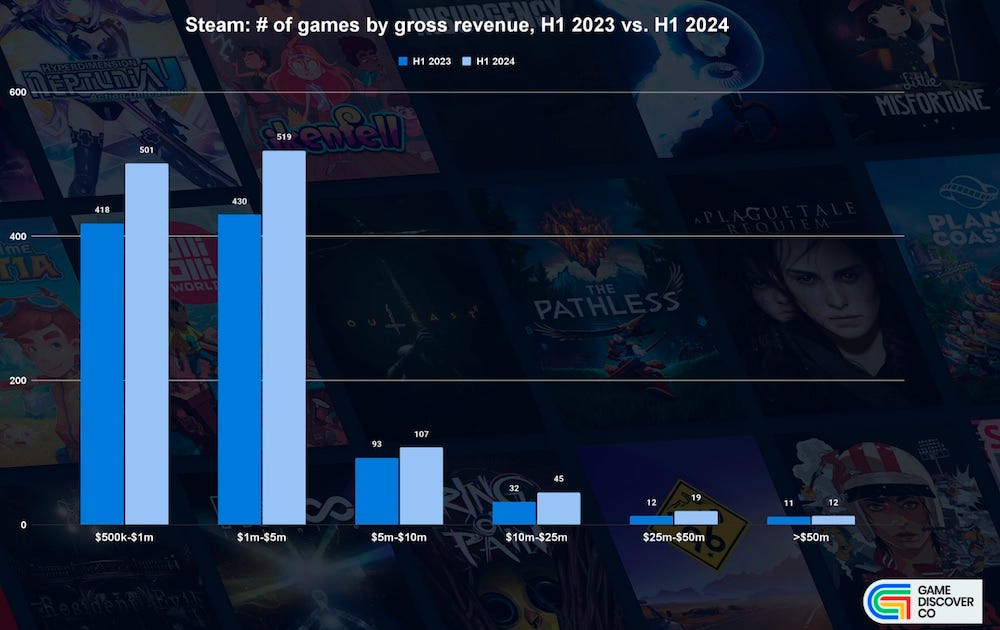

But a bunch of you are trying to launch new games into the space, or nurturing existing ones. How did brand new titles fare in H1 2024 compare to games released before this year? We have a graph for this, too:

This presents the situation starkly. As a new release in H1 2024, to battle and become one of the 74 new games that made >$500k gross on Steam you had to compete with people spending that much in 427 older games. (That’s ~15% share to new games.)

The percentage is pretty similar (~15%) for the $1m-$5m share, too. But at the very top of the tree, 37% of the games from $25-$50m were new, and 33% of the games that grossed >$50m were new on the market.

We’re not sure if that signifies much, frankly. This year’s new game grossing $50m sinks into its ‘long tail’ over time. And - depending on DLC, updates - it’ll eventually become one of the 88 old titles grossing between $5m-$10m per year. Circle of life.

But yes, those catalog games are going to proliferate over time - which, again, is why publishers rarely say in their public financials that their back catalog sales are poor. (Just their new game sales.) There’s more great games to play, all the time, right?

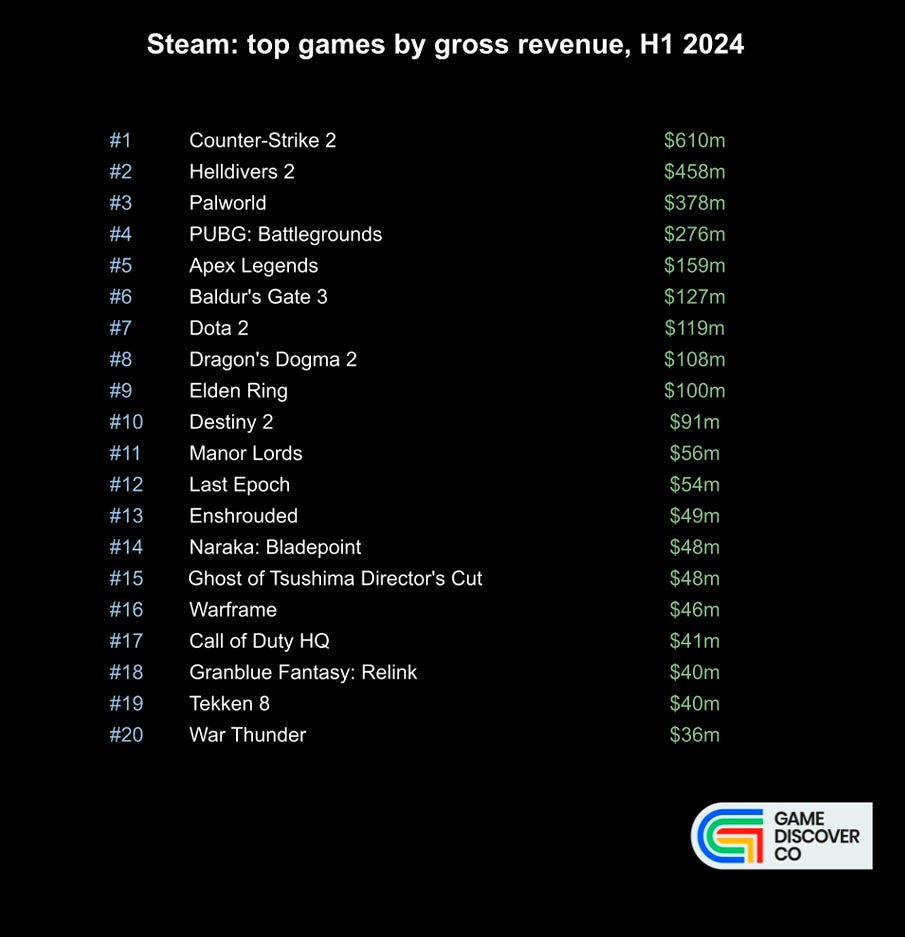

Can we get a handle on how $ bands are evolving? Valve has been stating that the platform has been growing overall, and our data reflects that. Here’s our estimates of the first half of 2023 vs. the first half of 2024, in terms of games at each revenue level:

So yes, we’re seeing more success, year on year. There’s 20% more games grossing $500k to $1m between H1 2023 and H1 2024, and 15% more in $5-$10m. (It’s more similar at the top, with 11 games at >$50m in H1 2023, vs. 12 games in H1 2024.)

That’s great, right? Well, yes, but let’s also look at things on a per-game basis. Our data (via SteamDB) is that there were ~75,500 games on Steam at the end of H1 2023, and ~92,000 at the end of H1 2024. That’s 22% more games in total.

So if you can see there’s more money being spent YoY on PC games as a whole. But often, we reckon, it’s going to be ‘long tail’ from the previous year’s hits making up the lower revenue tiers. Many of these older titles simply are evergreen. (Even if you’ve personally seen them before, many players haven’t.) And that’s the dynamic!

Automate Your Distribution Processes with Our Sponsor: VaultN.com

VaultN is a comprehensive platform designed to manage all aspects of third-party distribution for publishers and retailers. This includes the distribution of game keys, keyless activations, product codes, catalog management, and the automation of pricing and promotions. Managing inventory and activation control while increasing reach and discoverability has never been easier!

With a rapidly growing network of partners such as Bethesda, Team17, Thunderful, Fanatical, and Microids, VaultN is facilitating the distribution of game keys and GOG keyless activations for its connected partners.

Connect with VaultN today to explore how their platform can help you manage third-party distribution, or meet them at Gamescom, Hall 4.1, A021g-B030g at the Dutch Pavilion.

How much of your business is ‘gauging vibes’?

Nowadays, one of the hallmarks of launching a PC or console game, frankly, is the uncertainty. It’s not enough to make an objectively good game. It needs to be in the right niche, or have that special ‘something’ to really scale, and that’s fiendishly difficult to work out.

We actually did just a survey for Plus subscribers (about some newsletter changes arriving shortly!) And one respondent noted that GDCo’s ‘how this gamebecame a hit’ newsletters “usually read like ‘got lucky’”. To which we’d say - yep, that’s somewhat true!

The first stage of acceptance in today’s market is - in our view - to think of your game concept like a poker hand. You want to give yourself two great cards to start with (by picking the right genre/concept), but it’s still a giant gamble. And we 100% agree with Ryan Rigney’s excellent recent newsletter: ‘Nobody knows if your game will pop off!’

Ryan’s newsletter got discussed on the GameDiscoverCo Plus Discord. And Mad Mushroom’s marketing lead Connor Bridgeman - who was also a key publishing manager at Humble Games - had some great comments about the idea of (as he said!) ‘gauging vibes’ on games.

He gave us permission to reprint his musings about managing a portfolio, and when you can tell that the vibes are right, and just maybe your game is going to break out:

On top-tier games:“I feel most successful titles I've been around have had that ‘on fire’ feeling going into launch. Every piece of content is desired, outlets/creators are reaching out to you, there's genuine discussion on social surrounding them, Discords are overflowing, fan art is being made before the game is out.” (Examples from him: Temtem, Forager, Unpacking.)

On mid-tier games:“These… have great sentiment and a genuine "fanbase" of tastemakers… but often doesn't catch the attention of influencers or mainstream press. [They can be] positively reviewed titles, or ones that focus on an under-served genre. They either start slow and have high sales floors, OR they start very fast, but burn out faster than a mega hit.” (Examples: Signalis, Project Wingman, One Step from Eden.)

On underperforming games: “These… are a crapshoot. You've got flops, wishlist conversion underperformers, some that lacked a long enough marketing campaign for traction, and those that just never could get traction. The games that I've worked that have underperformed based on their forecasts have a mixed bag of reasons.”

Connor went on to highlight some reasons for underperformance, including weaker aesthetics - which can be overcome by a ‘killer hook’, sure - and Game Pass inclusion (which he believes doesn’t help non-GP launches). Here’s some other highlights:

Poor player reviews: “Offering is not competitive in the space, or the game's content underdelivers at launch-common Early Access problem. EA content expectations are absurd nowadays for most genres.”

Poor genre choice:“Game is ‘appealing’ visually/aesthetically/etc... but is in a very niche genre of low-performing titles OR genre is extremely competitive, FPS, and the game does not live up to the genre's high baseline standards.”

Ancient/inflated wishlists:“Game had an incredible reveal... 4 years ago. OR did very well in Next Fest... years ago. This is why I monitor the wishlist/follower ratio. Marketing goal is to get this as close to 12:1 as possible pre-launch.”

So should you hire a chief vibe checker to ‘chase the devil out of Earth’? Not quite, but you should think very carefully about your portfolio analysis, market uncertainty - and how tricky it is to market your way out of these problems. (That’s why A&R - signing or making the right games - is so important nowadays.)

The game platform & discovery news round-up…

There’s been just a few(TM) things going down in platform & discovery since our last round-up. So let’s present them in buttoned-up fashion for your delight:

Sony’s results for Q1 of its 2024 fiscal? Good for PlayStation, though partly powered by exchange rate shifts: “PlayStation revenue +12% [year on year] to ~ $5.56B. Without exchange rate impact, growth is only 1%.” Pleasant profit increases for now, though: “Operating profit ~ $419M, +33%. Driven by 1st party & services.”

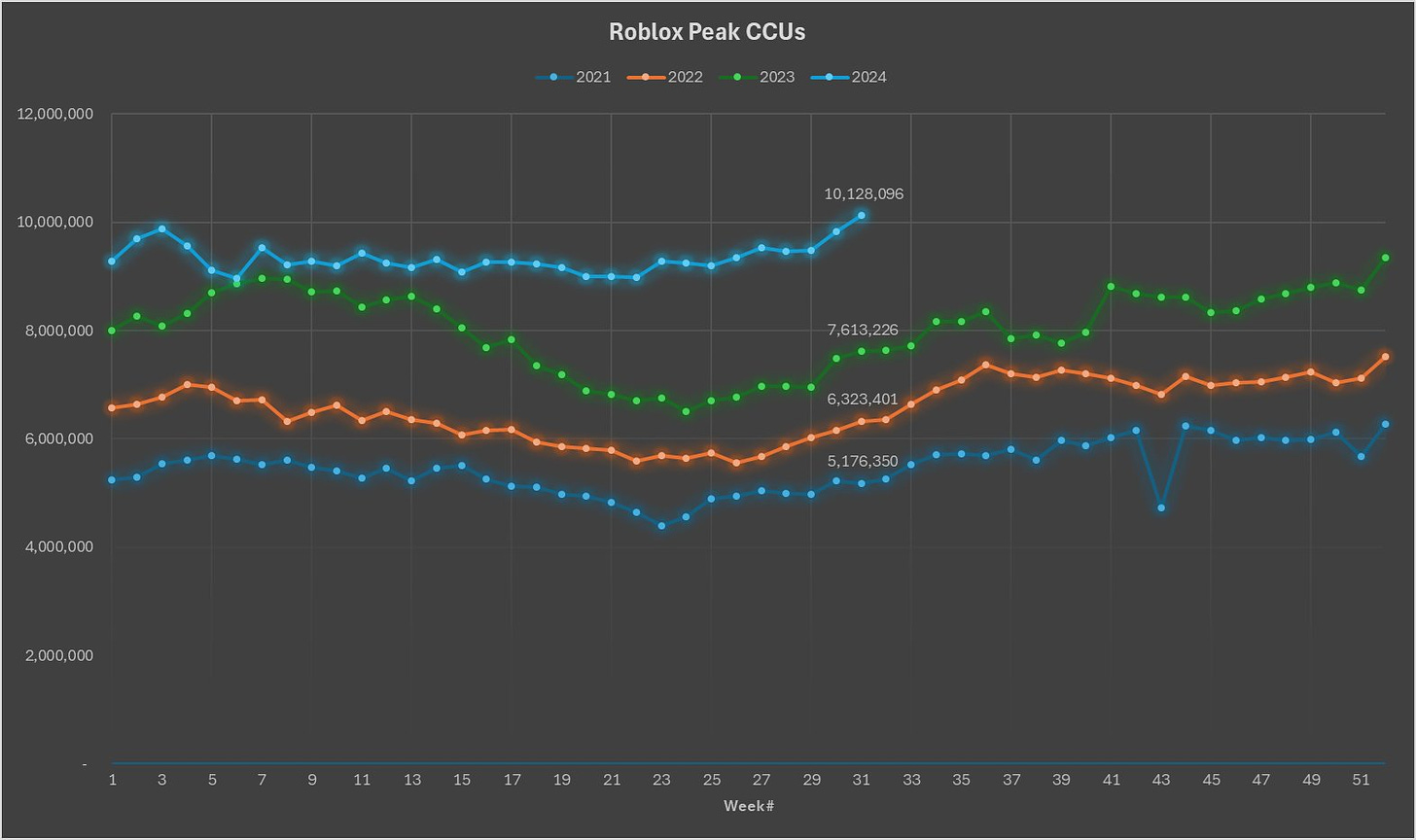

Roblox things: the platform’s growth is continuing, with 10 million CCUs (concurrents) recently (above); Naavik did a good piece contrasting genre successes in Roblox vs. Fortnite, and noting Roblox’s diversity, while Fortnite’s are still shooter adjacent; Roblox banned paid lootboxes for <18s in the UK.

It’s also worth a separate bullet point for PlayStation 5 hardware slowdown, as, per John Welfare: “After 15 quarters: PS4: 3.3M [shipped this quarter] / 63.3M [LTD units]; PS5: 2.4M / 61.7M. We already know PS5 wasn't expected to catch PS4, but like last year, how does PS5 hit the targeted 18M [this fiscal year]?” Indeed.

PSA: Valve added a cute extra banner to your Steam page if your game is in the Steam Deck top-played charts, and you’re in a country where Steam Deck is available. (Deep Rock Galactic: Survivor has one, for example.)

Microlinks: some‘what moved the needle?’ wishlist data for Feed The Deep; Tinybuild’s CEO on how to pitch games in 2024; Steam is now supporting larger store graphical assets - for hi-res monitor and Steam Deck OLED fiends.

Take-Two’s head honcho Strauss Zelnick still ain’t a fan of ‘Call Of Duty - Day 1 on Game Pass’, saying it will “push consumers to that subscription service for at least a period of time”, but as a third-party, T2 won’t be doing it “because our decisions are rational.” (This is probably not intended to be a Microsoft burn. Probably.)

Trying to ameliorate ‘joke’ player reviews which get a lot of prominence on some Steam pages, Valve is experimenting with a new ‘helpfulness system’, which cuts out the ‘funny’ and ‘recent’ in reviews. (It was live briefly, but isn’t right now.)

In ‘more feedback and data = good!’ news, PlayStation Store is testing out written reviews alongside their 5 star rating system - right now: “Reddit users reported receiving emails asking them to review select games including Helldivers 2, Final Fantasy VII: Rebirth, and Resident Evil 4..”

The mobile app store shuffle continues: Apple has revamped its iOS business terms in the EU to enable App Store link-outs and out-of-store promotions - but it’s damn complicated; the Xbox mobile app store is “progressing well”, says Microsoft – but there’s still no launch date.

As it’s confirmed that Star Wars Jedi: Survivor is coming to ‘last-gen consoles’ - PlayStation 4 and Xbox One - GameDeveloper.com takes a look at why we’re still seeing some console back-porting, especially for huge IP games (e.g. Hogwarts Legacy) that might sell at retail or to more casual ‘Fortnite machine’-type players.

Esoteric links: what’s happening with ‘the new consumer economy’, from cannabis to beauty; why social video like YouTube is eating the world of viewed content; turns out the majority of songwriters earn <$10,000 per year; McKinsey’s top consumer trends in tech for 2024 (stop booing over there!)

Finally, we’re very impressed with Tony Hawk’s Pro Strcpy, a hack based on a memory leak “15 years in the making” (!) for the ‘Create A Park’ feature in the Tony Hawk series of console skateboarding games. These led to Xbox 360, PlayStation 2 and Gamecube exploits (some useful, some not), way after the fact. Plz nerd out:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]