Who's playing what on PlayStation 5?

Publikováno: 22.12.2020

We have some data for that!

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the final GameDiscoverCo newsletter before the holidays! It’s been a bit of a crazy year, huh? Looks like there’s a lot to get through in this edition. (Though we’ll still have at least one newsletter before the end of 2020.)

We should probably get to it, huh? Let’s go:

A PlayStation 5 playtime primer

So, it’s not the biggest sample size in the world, but I’ve been keeping an eye on the PS Time Tracker website recently. It allows players to add a bot as a friend on PSN, and then has the bot keep a track of the games you’re playing. (Don’t shut this down, Sony - it’s interesting!)

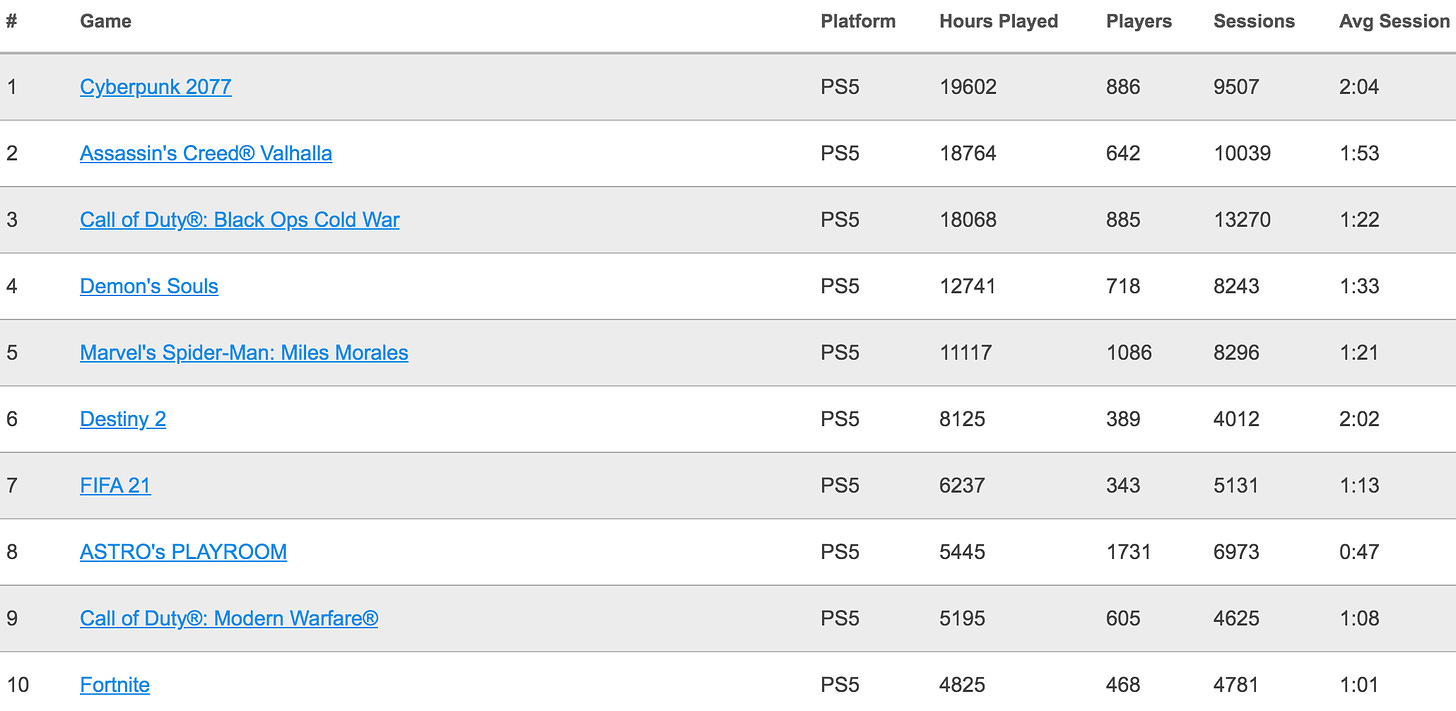

In the above image, there’s the Top 10 PlayStation 5 games played over the last 30 days, with number of sessions and average playtimes, from a sample size of 3,018 active players. (Presumably mostly English language & more ‘core’ gamers!) The top 100 is listed here.

Not surprising to see Cyberpunk 2077 atop the list (despite not having been out for 30 days!) But I did think it notable that Assassin’s Creed Valhalla is doing so well playtime-wise (averaging 30 hours per player?) And the Demon’s Souls remake has been the standout PS5 exclusive from a playtime perspective right now.

The other obvious lesson? People are still playing plenty of previously released titles (like FIFA 21, Destiny 2, and Fortnite), with varying degrees of graphical upgrade, just because they’re great titles that are frequently updated. While ‘only on PS5’ works in a few cases, it’s really the cross-gen sell that cements the deal for prospective buyers.

Briefly, the site also does have PlayStation 4 Top 100 playtime stats. And wow, Grand Theft Auto V is still doing so well (partly because of its GTA Online GaaS elements, I’m sure!) And there’s lots of GaaS-y stuff in the Top 50, as you’d expect, since this is all about playtime. Anyhow, poke around, and hopefully learn some things you didn’t know!

Follow-ups: eShop discounts, ‘Growth stocks’

A couple of recent GameDiscoverCo newsletters have seen more widespread feedback, so here’s a couple of follow-ups:

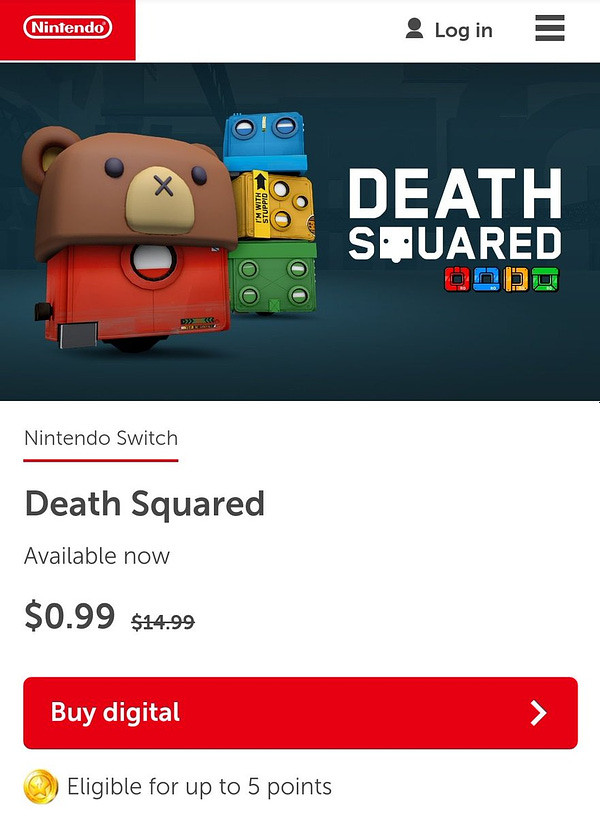

First, the newsletter discussing the eShop’s crackdown on extreme discounting ended up getting pretty popular, including a re-report by Polygon citing GameDiscoverCo. There were some skeptics on the ‘$1.99 minimum for North American eShop’ report, because there are still a handful of games that show up cheaper.

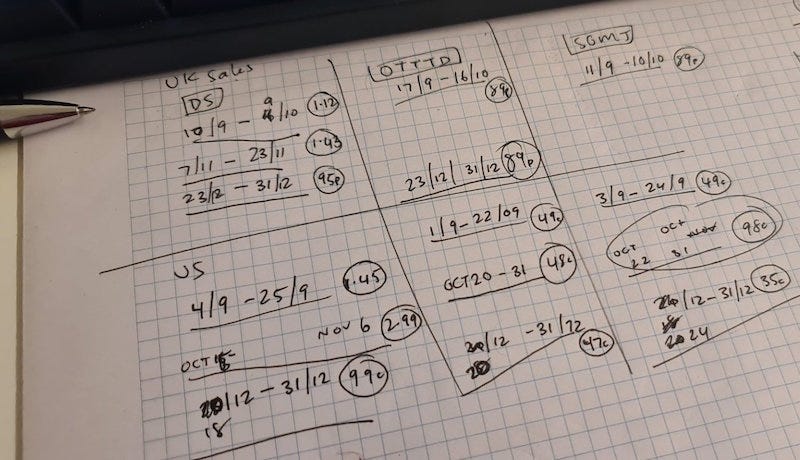

But it turns out this is due to some devs (like SMG Studio of Death Squared fame, ahem) setting their discounts months and months ahead, before the rule changed:

Relatedly, it was pointed out as a follow-up that the Japanese eShop has capped the maximum sale price to 100 yen (~1 USD). But due to the more, uhh, ‘orderly’ approach to Switch in Japan, there’s been less crazy discounting in general for Switch in Japan. Which really can’t be said for North America or Europe, haha.

(Though Martin Lindell does note that he “imagines there will be more games releasing as IARC is now approved, meaning no CERO certificate required for the JP eShop.” This is a good point, as CERO was a bit of a nightmare(tm).)

Secondly, the opinion piece on game company acquisitions and ‘the growth stock bubble’had an excellent reply from Edo Salvesen at Finstock Capital, a London-based company that specializes in video game financing.

Edo makes the fair point that it’s not just company execs that are hot on making acquisitions, it’s also their shareholders: "Those games companies which are listed [on public stock exchanges] (Team 17/Keywords etc) and are already generating profit are being questioned by investors what they are doing with the excess cash they are producing.

They have a number of options available to them. They could return it to shareholders [as dividends], but it’s in management’s interest to keep hold of it and prove that they can hit long term incentives. By returning to shareholders they are limiting their own growth plans - so they would argue that by investing in Company A/B or C, they are generating better returns."

So ‘game companies are profitable, nothing else to do but buy more companies, since your investors insist on it’ seems to be the reality for public firms, in this growth-centric ecosystem. Not a massive fan of this infinite roll-up scenario, but that’s where we are at.

Thanks for supporting GameDiscoverCo in 2020!

Before we get to the round-ups, wanted to thank all of you for reading and supporting the GameDiscoverCo newsletter - and the company - in 2020! Consulting clients like No More Robots, Dotemu, Akupara Games & a number of others I can’t talk about have made it a rewarding and fun time for us so far.

And I definitely want to thank those who supported the GameDiscoverCo Plus newsletter and data tier when it launched - it’s already one of the top 10 paid technology newsletters on the Substack platform, after just a month or so, woo.

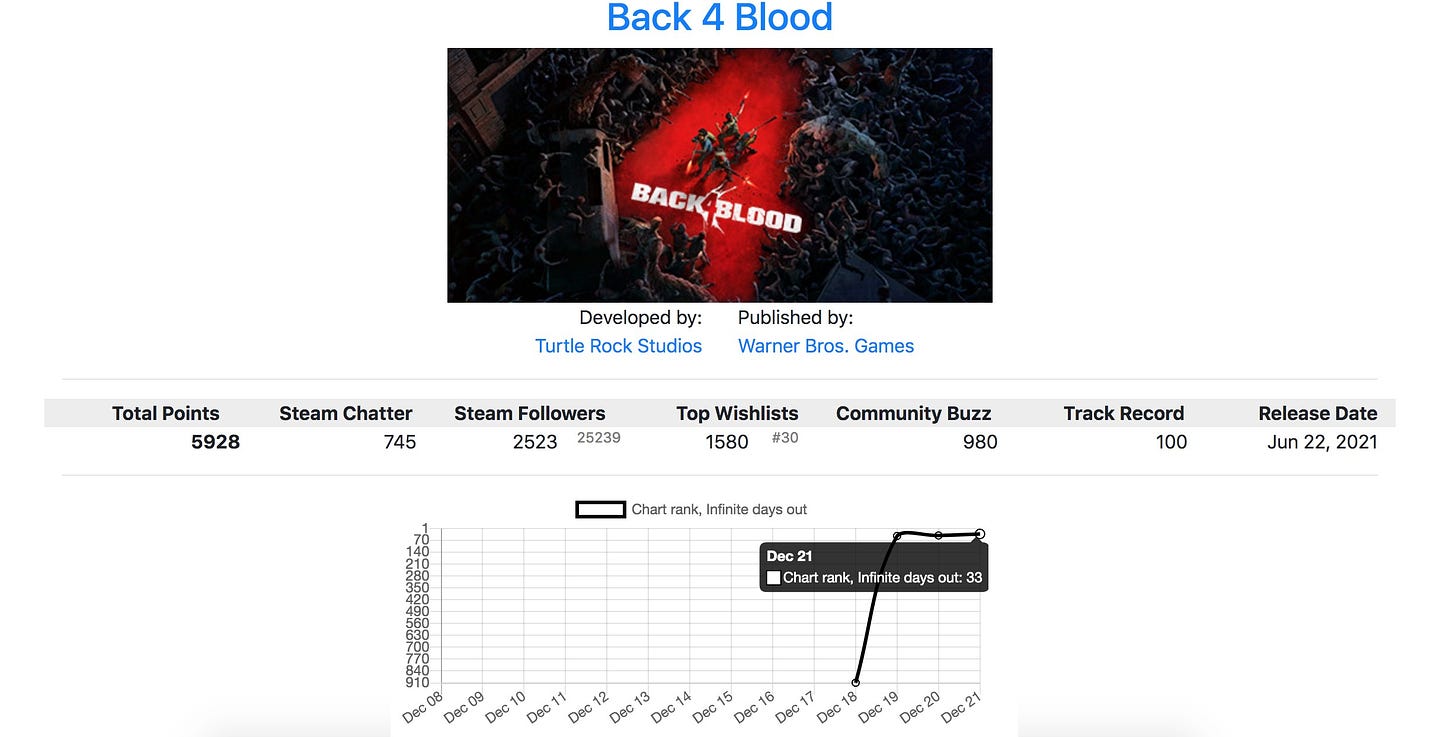

While I’m here, a quick note about enhancements for GameDiscoverCo Plus subscribers. We recently added Steam Hype scores on our Plus back-end details page for every single unreleased Steam game, updated daily & browsable on demand. (I showcased this on Twitter, re: Back 4 Blood’s swift rise to a near-Top 30 Hype score as one of the most anticipated Steam games. And did you know that Party Animals is now #1 on the GameDiscoverCo Steam Hype list, after Cyberpunk’s release?)

We're not planning to make GameDiscoverCo a ‘data coming out of our ears’ Newzoo or EEDAR competitor. But we will continue augmenting our Plus-exclusive newsletters with interesting data, AMAs, Discord conversations and analyses you can’t get elsewhere - so sign up & help us keep up the good work!

The game discovery news round-up..

Since the last newsletter didn’t have any round-up elements, we’re backed up with just a few billion links here. So let’s bust ‘em all out at once and dissolve your brain into gelatinous material:

Some of you may remember this from last year, but Facepunch Studios (Rust, Garry’s Mod) is very, very transparent - so much so that its 2020 year in review blog posted its lifetime revenue for both games. Comparing it to 2019’s post, looks like Rust sold 530,000 copies during 2020, and grossed another $43 million during the year (wow - it’s $40, and has DLC and an item store.) And Garry’s Mod did $11 million gross and 1.7 million extra copies. Pocket change, then.

Lots of Steam stuff: the Valve team published a retrospective on the Autumn Sale noting that “just shy of a million players bought a game or made a microtransaction on Steam for the very first time (a 33% increase over the same timeframe in 2019)”; the Top Steam releases of November 2020 include a lot of Early Access => full releases, and are worth perusing at length; the latest Steam weekly charts are still headed by Cyberpunk, duh.

Google has rolled out Google Stadia on iOS devices, and “as expected, the company is using a web app to access the service.” Seems fairly easy, but the adoption will clearly not be as good as a dedicated app due to the extra steps: “Head over to stadia.google.com from your iOS device. Log in to your Google account, add a shortcut to your home screen and open the web app.”

I was a little surprised to find that the Epic Games Store has added Spotify as an app, but as The Verge says: “With the Epic Game Store’s growing user base, developer-friendly fee structure, and the fact that it now hosts one of the most popular apps in the world, Epic seems to be making the case that non-gaming developers should consider its distribution platform as a viable alternative to other app stores.” Or is this partly an ‘Apple lawsuit buddies’ type thing?

Looks like China is rolling out a new video game ratings system, via the government-backed China Audio-Video and Digital Publishing Association (CADPA): “The new standard divides games into three age categories: eight, 12 and 16 and older, represented by green, blue and yellow labels respectively.” Chinese industry watcher Daniel Camilo has a Twitter thread on it where he notes: “Obviously social/politically sensitive content will still prevent some games to enter China, but [higher age] ratings could (maybe) mean that more gory/violent elements will be allowed.” We’re still at the speculation stage, though…

Chris Zukowski at HowToMarketAGame has a useful case study on a game that increased its base wishlists (something I’ve been talking a LOT about!) by changing, uhh, pretty much everything about itself - release date, name, tags, screenshots. (I quibble that some of the micro-changes can be graphed down to very specific days. But the ‘best practices’ approach to getting natural discoverability up is 100% correct - kudos.)

Microlinks: The Independent Games Festival is looking for judges (I recommend it if you’re not planning to enter, it’s a lot of fun!); this piece on HybridCasual games in the mobile space is a window on a whooole other fascinating world; GamesIndustry.biz has an absolutely gigantic infographic about this year in video game numbers.

Microlinks Pt.2: Google Stadia licensed Cthulhu Saves Christmas as a special holiday game, which is a super cute idea; crowdfunding game service Fig is still just about going, but its latest game has just 17 backers; follow the GameDiscoverCo Twitter feed to discover stuff like the hot new U.S. Switch eShop games right now - they’re Moi Rai/Team17’s Monster Sanctuary, Peachy Keen Games & WhiteThorn Games’ Calico, and Terry Cavanagh & Distractionware’s Dicey Dungeons, for the record.

[Happy holidays! We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game. You can now subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides!]