Who's top of Steam Next Fest for June 2023?

Publikováno: 26.6.2023

We delve into the details. Also: the FTC vs. Microsoft & lots of platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, time for us to return to newsletter sending-out mode. And there’s actually a lot to talk about, what with Steam’s Next Fest just ending, and the FTC’s lawsuit blocking the Microsoft x Activision deal apparently never ending, sigh.

Before we get started - we spotted that YouTube is piloting a ‘thumbnail A/B test’ feature which checks ‘watch time’ & displays the winner. Would game platforms doing this for icons or videos be a) marketing nirvana b) evil over-instrumenting? Your call!

[Reminder: just three days left on our 25% off deal for our GameDiscoverCo Plus paid sub, which includes a Friday ‘exclusive’ newsletter, Discord access, our Steam ‘Hype’ & post-release back-end, multiple eBooks & more. Support us & make this all possible..]

Steam’s June Next Fest - who came out on top?

With Steam’s latest Next Fest demo showcase just finishing up, it showed itself to be a mammoth affair. There were around 1,200 PC game demos showcased in it, about 7.5% of the 16,000 unreleased Steam games being monitored by GameDiscoverCo in our Steam Hype charts.

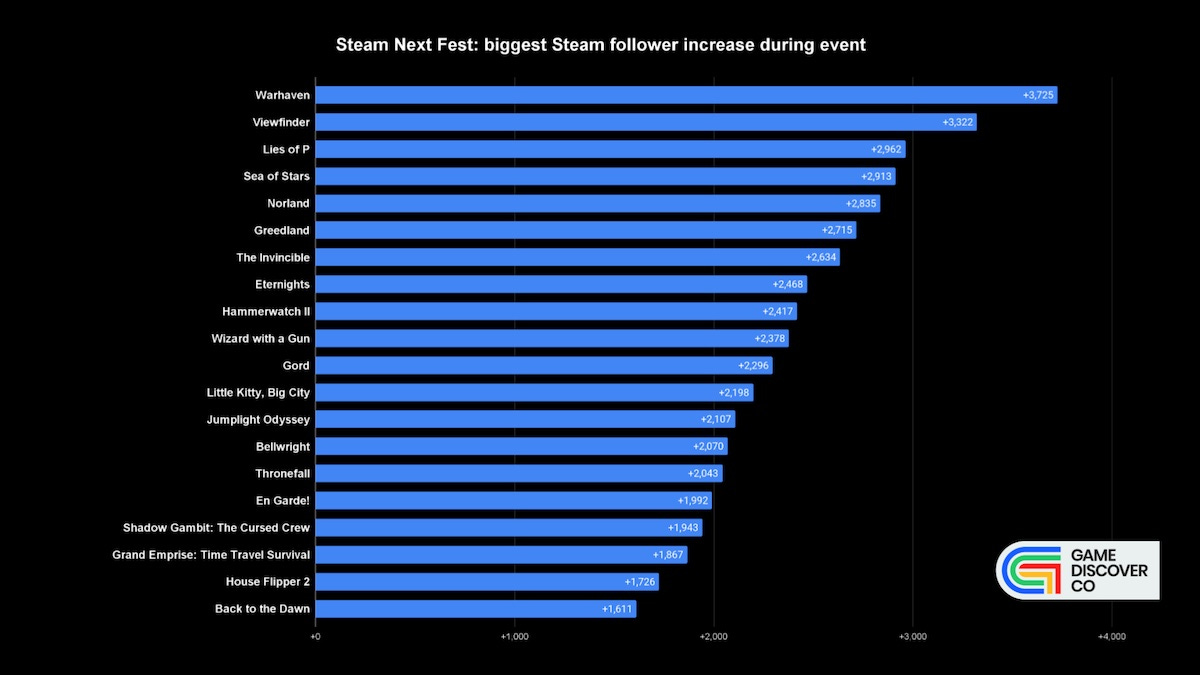

There’s a number of lenses on which of the (excellent!) demos performed the best, each of which shows somewhat different things. But we’re starting with ‘total Steam followers added during Next Fest’ (above). Some notes on these titles:

Many of these top games already had interest, and are piling on more: titles like ‘killer hook’ puzzler Viewfinder, 16-bit RPG Sea Of Stars and Rimworld-ish medieval kingdom sim Norland are adding to existing, substantial wishlist & followers. (The first two are ‘rare’ standouts in difficult genres to chart with, btw.)

Some top games advanced ‘known’ game styles in smart ways: the Pinocchio themed Souls-like Lies Of P hit Next Fest on the tail end of a giant 15,000+ CCU spike for an earlier demo release, and still excelled. Other notables? First person sci-fi exploration adventure The Invincible, top-down co-op ARPG Wizard With A Gun, and starship management game Jumplight Odyssey.

The Steam tags for the top games are skewing to ‘core’ PC genres: of this Top 20, we see these subgenre ‘Top 5’ tags for 4 or more games - Colony Sim, Survival, Building, Roguelike, Action Roguelike, City Builder, Action RPG, Roguelite, Tower Defense.

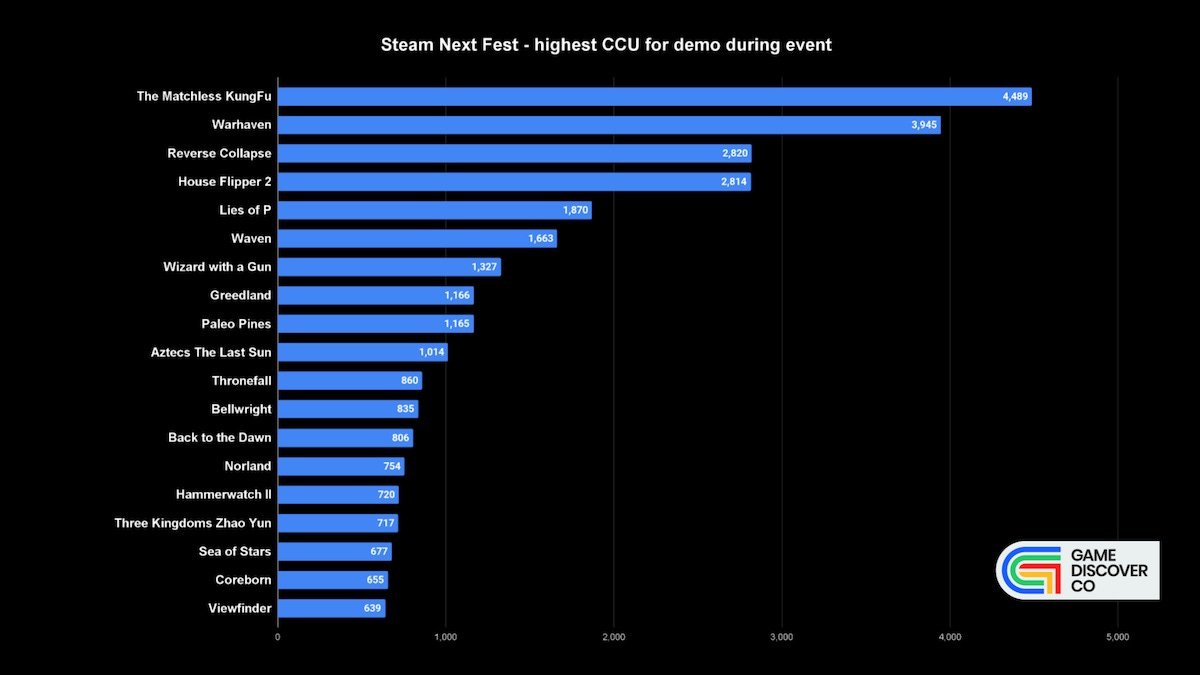

So that’s just one view. Another interesting one is by ‘highest Steam demo CCU during the festival’. And if you want to sort things that way, you’ll get the following:

There’s some different titles further up charts here - particularly a couple of Chinese titles, WuXia sandbox RPG The Matchless Kung Fu (4,500 CCU) & turn-based SRPG Reverse Collapse (2,800 CCU). But there’s also the first ever demo for house renovation sequel House Flipper 2 (2,800 CCU).

There are also F2P titles with demos in Next Fest, of course. Dofus creators Ankama charted here with turn-based tactical multiplayer RPG Waven (1,700 CCU), and Nexon’s medieval 16 vs. 16 action game Warhaven (3,900 CCU) did even better. (BTW, did you notice that if you remove three letters for Warhaven you get… Waven? Creepy!)

Finally, since ‘max CCU’ may not reflect popularity 100% accurately - since some demos are way more limited than others in ‘number of minutes you can play’ - Valve put out a ‘top 20 demos by unique players’ chart at the end of last week, as follows:

There’s a few games that ‘jump up the charts’ notably in this view. In particular, the aforementioned Viewfinder, adorable cat exploration game Little Kitty, Big City and minimal railway building title Station To Station benefit by this comparison vs. CCU.

Finally, if you want to see how your - or a competitive - game ranked in CCU vs. other demos on Steam, go to our data scratchpad for Next Fest[Google Drive link] and check out the ‘Day 1 CCU’ tab. This is adapted data from SteamDB’s demo CCU page.

Just ‘CTRL-F’ and search for your game’s rough rank on each subsequent tab/day. And don’t worry if your game didn’t take off at Next Fest - it was super crowded this year. Try sending it out to streamers again alongside a demo at another point, pre-release?

Things you might have missed from ‘FTC vs. MSFT’

For anyone stuck in a mine (a Minecraft mine?) and not aware, the U.S. Federal Trade Commission is in the midst of applying for a preliminary injunction to stop Microsoft buying Activision Blizzard for, uh, $68.7 billion in cash, and a hearing is in progress.

We’d recommend sources including Axios’ Stephen Totilo and TweakTown’s Derek Strickland on Twitter, IGN’s web coverage & The Verge’s nifty ‘live comment/article’ combo on the whole case, which has created a flurry of headlines.

The general view seems to be that the FTC is struggling to prove its point that “the deal would enable Microsoft to suppress competitors to its Xbox gaming consoles and its rapidly growing subscription and cloud-gaming business.” But we still have plenty of witnesses left (including Activision Blizzard’s Bobby Kotick, not known for his understatement.) So we’ll see if anything changes.

In the meantime, we think there were some genuinely important points relating to game platforms, buried in the mass of headlines. And we’re going to highlight the following:

PlayStation’s habit of paying third-parties for exclusives helped push Microsoft to buy Bethesda: Xbox boss Phil Spencer noted on the witness stand that “one of the impetus for that is that Sony had done a deal for Deathloop and Ghostwire... to pay Bethesda to not ship those games on Xbox”, and “when we heard that Starfield was potentially also going to end up skipping Xbox”, it played into acquisition reasoning: “we’ve had to secure content to remain viable in the business.”

Activision used Call Of Duty to muscle a bigger (80/20?) revenue split on Xbox: nobody should be surprised about this, but Xbox’s Sarah Bond revealed that Activision CEO Bobby Kotick made it clear that “if we did not move beyond standard [70/30] revenue share, that he intended to not place Call of Duty on Xbox.” It’s likely Activision has a similar ‘extranormal’ deal on PlayStation, btw, with some extra PlayStation-specific clauses that disadvantaged Xbox’s CoD marketing.

The tension over owned content & seeing rival hardware early is a complex one: for example, Phil Spencer said that“Sony was reluctant to ship us PlayStation dev kits... it put us behind on our development for Minecraft on PS5”. It’s less an issue for a game like Minecraft, but much more for CoD. Spencer said under oath “we will continue to ship future versions of Call of Duty on Sony’s PlayStation 5.” And surely PS6 won’t ship devkits to a Microsoft-owned Activision early, which means…?

Xbox did bash Apple and Google’s mobile platform dominance & rules: Spencer, who came across very plausibly overall, re-iterated: “Apple won’t let us put a streaming app in their store, so we can’t bring console games through their storefront.” As for why? “Its competition for their control in the largest gaming platform. These are games that players want to play, we have a delivery mechanism to deliver games, they choose to block it.”

So what’s happening here? There’s a console rivalry at play - for example Sony paying Square Enix an ‘exclusive marketing deal’ for Final Fantasy XVI that keeps it off Xbox. And Microsoft has absolutely - at times - responded to by buying game companies and choosing not to ship on PlayStation. The upcoming Bethesda-published Indiana Jones game isn’t on PS5, and neither is Starfield, of course.

[Late breaking addendum - The Verge just got an Xbox internal document indicating that Sega and Bungie - the latter before it was bought by PlayStation, of course - were on a possible Xbox shopping list in 2020, as was IO Interactive (Hitman), Scopely, Thunderful, Supergiant, Niantic, Playrix, and Zynga. Interesting.]

But the Activision deal is big enough - in dollar terms, with Call Of Duty generating a lot of that $ on Sony consoles - that no, Microsoft isn’t going to make subsequent versions skip PlayStation. And the FTC’s subpoena revealed PlayStation head honcho Jim Ryan saying as much, in a private email to former Sony exec Chris Deering:

“[The Microsoft/Activision deal] is not an exclusivity play at all… They’re thinking bigger than that and they have the cash to make moves like this. I’ve spent a fair amount of time with both Phil [Spencer] & Bobby [Kotick] over the past day and I’m pretty sure we will continue to see Call of Duty on PlayStation for many years to come.”

But what we’re seeing, behind the scenes, is the inherent chaos around massive game companies trying to build and maintain their own platforms (whether hardware or software), while still shipping some games on everybody else’s. As Phil Spencer said at the hearing - and please read this in an appropriately pained tone:

“Every time we ship a game on PlayStation... Sony captures 30 percent of the revenue that we do on their platform and then they use that money - among other revenue that they have - to do things to try to reduce Xbox’s survival on the market.”

Or 20% for Call Of Duty, Phil! But I don’t think you can ‘anti-competition’ your way out of this mess as a regulatory agency. The FTC is trying, but it seems complex beyond legislation, frankly. Still, there are lessons. Joost van Dreunen has a typically galaxy-brain (in a good way!) take on this, noting some smart things.

Firstly: “Losing its lawsuit against Microsoft does not mean that the FTC’s instincts are wrong, however. Much of the current pushback by antitrust watchdogs originates in the ruthless tactics among large tech firms, ranging from absenteeism to outright exploitation.” And what is the above, if not evidence of very sharp elbows by very large companies?

Van Dreunen also identified two other reasons that maybe massive mergers aren’t… good? “There exists a documented history of mergers failing to deliver or even keep their promised benefits… and Wall Street loves mergers because of the short-term gains. But there is evidence that acquisitions erode shareholder value and wages alike.”

As for whether this one is toast or not? It may not be blocked by the FTC (we’ll find out soon!) But the UK’s Competition & Markets Authority still said no, so an end-run is still needed there…

The game discovery news round-up..

And as we ease to the end of this particular newsletter, let’s take a look at the latest game platform & discovery news, headlined by a notable VR evolution:

Meta just announced the Meta Quest+ subscription service that got accidentally teased via banner a couple of weeks back: “For just $7.99 USD per month or $59.99 USD annually… you’ll get access to two hand-picked VR titles every month.” The first two games are Pistol Whip & Pixel Ripped 1995, with August seeing Walkabout Minigolf & Mothergunship: Forge. A super interesting move…

That Nike x Fortnite collab that was rumored to be NFTs? It’s not, and it’s pretty darn interesting, since it's a custom island in Fortnite (Airphoria), which has a) an exclusive item if you play the island for >10 minutes b) buyable items in Fortnite’s shop, tied to the promo. Pretty metaverse-y, huh?

Humble & Interpret presented some research on indie game player personas at GDC 2023 in March, and GI.biz has a write-up of the results, yay. (We intended to write this up, but didn’t get to it - slides are available for free here, if you’d like to follow along at home.)

Instantly playable games, huh? Well, apparently Google’s Playables “will enable users to instantly play online games via YouTube's website or via its mobile apps on iOS and Android.” And Now.gg is embedding a playable cloud-streamed version of games like Honkai: Star Rail into regular webpages.

After E3 being ‘canceled for 2024 and 2025’ popped up in a LA tourism board Powerpoint? It quickly became clear that ‘the ESA doesn’t currently have LACC secured as a venue’ was the backstory, with the ESA telling publishers: “We expect E3 to continue to be a part of ESA’s storytelling.” (Storytelling?!)

Spicy interview of the week? Former Apple exec Phillip Shoemaker, one of the key early App Store rulemakers, was reached by MobileGamer.biz, and he sure wasn’t holding back: “I think the way to radically improve the App Store is have Phil [Schiller just] be an Apple fellow and get his hands off the App Store… If Phil doesn’t step back, it’ll absolutely be the courts making changes.” And furthermore: “This is a utility and they need to be charging utility prices, not innovation prices.”

Steam’s top new releases for May 2023 got an official Valve sales page, and while Plus subscribers may have already seen the highlights here, it’s very useful to see top DLCs of the month, including for Crusader Kings III, Gunfire Reborn, Age Of Empires II, Stellaris, and Call Of Duty: Modern Warfare II.

Good news if you’re a Chinese game publisher trying to get your game approved domestically? “Chinese regulators have approved 89 new video games for sale in China for June, covering titles from major players – including Youzu Interactive and NetEase.” But that China/non-China approval ratio, ow: “The NPPA has approved over 500 domestic games so far in 2023.. [but] just 27 imported games this year so far.”

Really interesting to see not only that Diablo Immortal hit $500 million in cumulative revenue on mobile, according to Data.ai, but it being #15 most fast mobile title to hit that milestone. (Quicker? Pokemon Go, by a mile, as well as Clash Royale, Genshin Impact, Candy Crush Saga & a host of Asian-first titles.)

Finally, we’ve been talking about U.S. retail giant GameStop as a platform (for selling both physical video games and, uhh, Squishmallows.) So it’d be remiss not to point out the trailer for Dumb Money, which dramatizes the GME short squeeze in some style:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]