Who won Steam's 'Best of 2025' revenue rankings?

Publikováno: 6.1.2026

We look at multiyear trends, too. Also: paid marketing analysis & lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

And we’re back - did you miss us? That’s OK, you don’t have to answer that question. But GameDiscoverCo is re-energized and ready to go for 2026, and the dynamic PC and console game market isn’t getting any less… dynamic. So let’s hit it.

Before we start, a key holiday book for us: Chris Hayes’ ‘The Sirens’ Call’. It’s high level, but asks the right big questions - one reviewer explains: “In the same way industrialization in the 19th century turned labor into a commodity, we now have turned attention into a commodity. But attention is what we are.” (We think about it constantly.)

[FREE DEMO OF GDCo PRO? You too can get a gratis demo of our GameDiscoverCo Pro company-wide ‘Steam deep dive’ & console data by contacting us today-~85 orgs have it. Or, signing up to GDCo Plus gets the rest of this newsletter and Discord access, plus more. ]

Game discovery news: eShop clone woes abound..

So let’s start the year by sorting through the (lots of!) game platform & discovery news since we last checked in. And it goes a bit like this:

Congrats to the winners of 2025’s player-voted official Steam Awards, including Hollow Knight: Silksong (Game Of The Year), Baldur’s Gate 3 (Continued Updates) Hades II (Steam Deck), Peak (Better With Friends), Silent Hill f (Visuals), ARC Raiders (Gameplay), Dispatch (Story-Rich), and RV There Yet? (Sit Back & Relax).

Above, our spicy LinkedIn post had us noting: “Game platforms should protect against obvious keyword spoofing by 'shovelware' games... judging by the fact the Switch eShop released both Megabonk Smash & CloverPit Gamble, neither made by the OG devs, I'd say Nintendo aren't doing a very good job right now.” (What solution, tho?)

Also new: GDCo’s ‘trending wishlist counts for unreleased Steam games’ chart for Dec 29th-Jan 5th shows Wuxia ARPG Phantom Blade Zero (#1) and first person basebuilder StarRupture (#2, releasing this week!) each adding 80k+ wishlists. Next? Lots of evergreens: Subnautica 2, Forza Horizon 6, Slay The Spire 2, etc.

Other chart standouts we haven't talked about much? Ambitious indie co-op Souls-like extraction game Tenebyss (#7) is trending. And it's great to see the return of Butterscotch Shenanigans (Crashlands) with How Many Dudes?, a very silly-looking dice-builder roguelike getting big influencer reach with its demo.

In not-100%-surprising news, PC game store GOG was sold by Cyberpunk/The Witcher dev CD Projekt (non-core asset!) to CDPR co-founder Michał Kiciński for ~$25m. GOG says it’s business as usual, “DRM-free is more central to GOG than ever”, and it’ll focus on both classic PC game preservation and new titles.

Ready to blow your big-data mind? This YouTuber “downloaded a screenshot from every single game on Steam and used a neural network to build The Gaming Map: a landscape where games that look alike cluster together.” (It’s the same person who analyzed all the Silksong Steam reviews in entertaining fashion, btw.)

Microlinks: PlayStation Plus’ ‘monthly’ free games for Jan. are Need for Speed Unbound, Disney Epic Mickey: Rebrushed & Core Keeper; Steam just hit a new on-platform CCU high of 41.8m players, with 13.4m of them in-game; why the PS5 BootROM leak may be a major blow to Sony’s bootleg/hacking security.

What are the most influential games for game makers? The Polaris non-profit actually asked this question to 160+ pro game designers, and the results intrigue: Portal, Civilization, Dwarf Fortress, Shadow Of The Colossus, and Slay The Spire make up the Top 5, but there’s a Top 100 also listed.

As spotted by The Verge’s Sean Hollister: “The Steam Deck [PC handheld] no longer starts at $399. It’s $549 now. Technically that’s because Valve has discontinued the LCD version. Realistically, it changes every conversation about handheld price from here on out.” We agree.

ICYMI: before the holidays, Meta confirmed “it ‘paused’ its initiative to bring third-party Horizon OS headsets to the market… it has shifted focus to ‘building the world-class first-party hardware and software needed to advance the VR market.’” (Asus & Lenovo were formerly named as partners in April 2024 for AR & Quest-like devices.)

Here’s a bunch of interesting/specific marketing data for Steam coworking game/gamified tool On-Together, which hit 40k pre-release wishlists and 3+ million views across TikTok, Twitter & RedNote. And for this style of game, “social posting surpasses the effect of any Steam event.”

Microlinks, Pt.2: Netflix acquires gaming avatar maker Ready Player Me as it continues to pivot in games; Google is charging $ for games installed outside of its Android ecosystem; Cloudflare’s ‘year in Internet traffic’ has a games section, w/traffic headed by Roblox, PlayStation, Xbox/Xbox Live, Fortnite/Epic & Steam.

Who won Steam’s Best of 2025 revenue rankings?

Every year at year-end, predominant PC game platform Steam puts out its ‘Best Of The Year’ charts - and here’s the countdown for 2025. Overall, these charts are great for tracking multi-year trends.

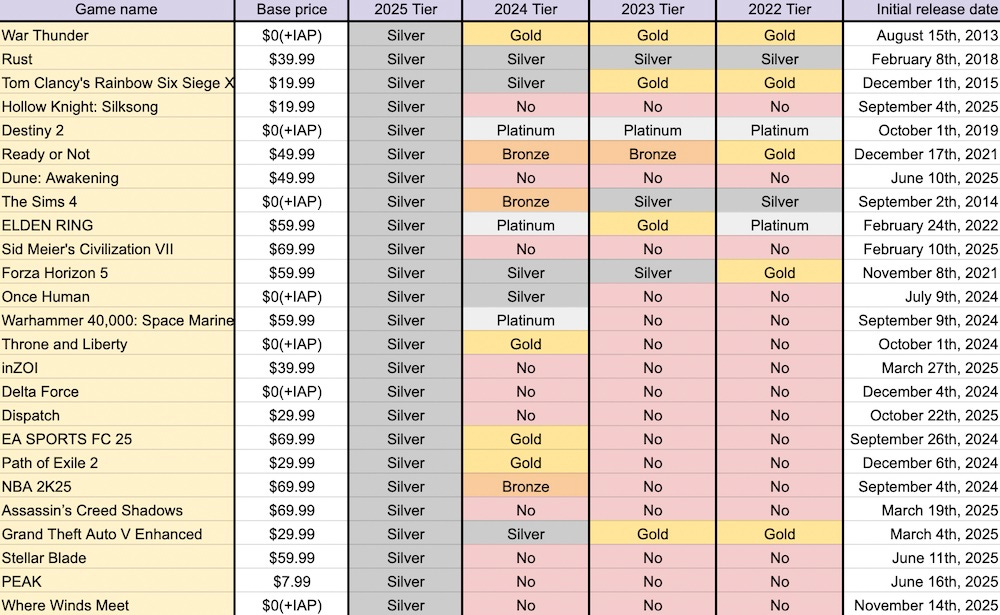

Reminder: the charts, such as these for the Top 100 highest-grossing Steam games of 2025 - are sorted by Valve into Platinum, Gold, Silver and Bronze tiers, but randomly displayed within those tiers. (So you get some idea of ranking, but not exact rank.) What’s particularly fascinating is seeing which games rose up and down in the tiers.

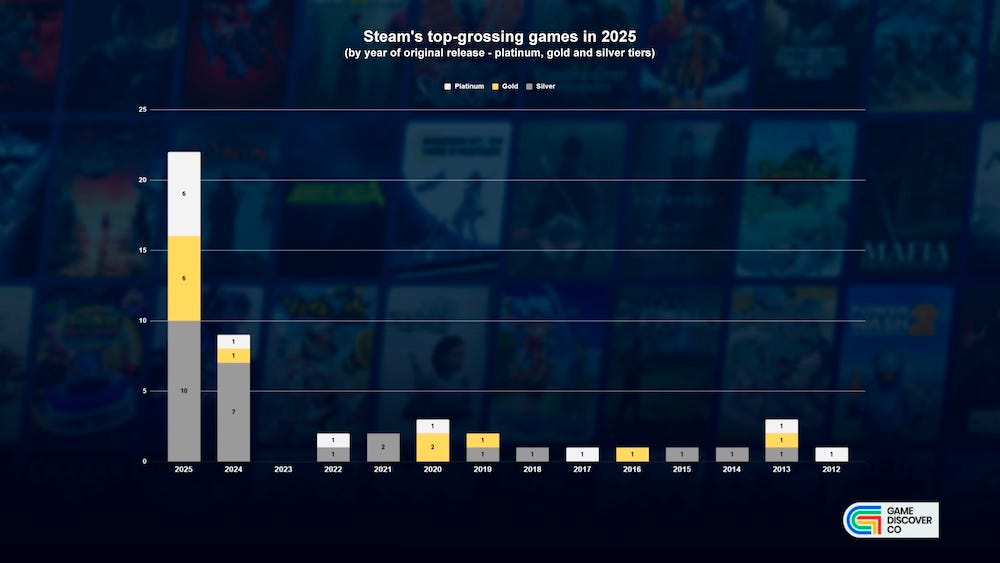

But before we do that, here’s the top-grossing Steam games in 2025 (in all tiers except Bronze), listed by the year that the game originally came out:

Our initial reaction on this is that it’s more front-loaded for recency than we expected, despite ‘ancient’ GaaS titles (Counter-Strike!) staying strong. And indeed, if you look at the same chart for 2024, 24 of the games were released in ‘that year or the previous year’. But this time, 31 of the titles debuted in ‘this year or the previous year’.

Why would this be? It’s possible that 2025 was just a super-strong year for new games. It’s also possible that with more and more ‘catalog games’ being sold cheaply on discount, sorting by revenue will favor $60 newcomers & viral hits (vs. games at 25-50% of the price that still do good ‘long tail’.) It’s probably.. a combo of these things?

But let’s go deeper. We documented the top-grossing games from 2019 to 2025 by tier(Google Drive doc!), and it behoves us to go through each tier and talk about what’s interesting. Let’s start with the Platinum tier (which GDCo estimates at >$125m gross):

Points of interest here: Valve’s first-party F2P duo (Counter-Strike 2 and DOTA 2) have been Platinum tier constantly for the last 4 years, as have battle royale standout PUBG: Battlegrounds & shooter stalwart Apex Legends.

Everything else is ‘new’, though, with Marvel Rivals the sole newer F2P winner*, and a lot of other usual suspects (ARC Raiders, Kingdom Come: Deliverance II, Battlefield 6, Monster Hunter Wilds.) Also impressive to see Schedule I and R.E.P.O. make it on here, despite a much lower price point…

(*One point of order: last year, Call Of Duty: Black Ops 6 was listed in the Platinum tier, but this year, Steam has changed to showing the generic Call Of Duty app, which includes F2P and paid elements, in Platinum. So it’s not ‘new’, really, but a different app name/combo.)

Where it gets more interesting still is Gold (above, ~$75-$125m). There’s many GaaS titles with reliable yearly revenues, but would y’all have picked Warframe & Dead By Daylight as the only ones to keep Gold tier for the last four years? Cos it’s those!

Other surprises in here include Red Dead Redemption 2 making it back up to Gold (while Grand Theft Auto V hangs out in Silver.) We also note that last year had 2x EA Sports FC games in Gold tier, but this year, the previous-year title (EA Sports FC 25) has slipped into Silver. Also: wow at Baldur’s Gate 3 & Cyberpunk’s staying power…

Next, here’s Silver, which we’re estimating as $40-$75m gross for the year (not bad!) There’s a lot of individual game stories here: we see The Sims 4 moving up from Bronze (evergreen!), as Destiny 2 has a bit of a dethroning (from 3x Plat to Silver.)

There’s also a load of ‘quietly outstanding’ live service grossers, including Ready Or Not, Rust, War Thunder, Rainbow Siege X, and even Once Human. Also: many of the newer F2P winners are Asia-developed and semi-focused, inc. Delta Force (also massive on mobile in China!), Throne and Liberty, Where Winds Meet, Once Human.

Finally, our full document also lists the Bronze tier (#51-100, $20-40m gross), which includes some perma-top grossers like No Man’s Sky, Euro Truck Simulator 2, Rimworld & Crusader Kings III alongside fading-out GaaS hits (like Naraka: Bladepoint & Lost Ark.) It’s a delightful way to see multi-year trends, folks…

PC/console paid marketing: nurturing matters, too

The folks at PC/console marketing measurement & creator campaign firm Gamesight - who measured >$625m in digital marketing spend in 2025 for companies inc. 2K, Bungie, Krafton, etc - just released a new performance marketing report (free reg. req.)

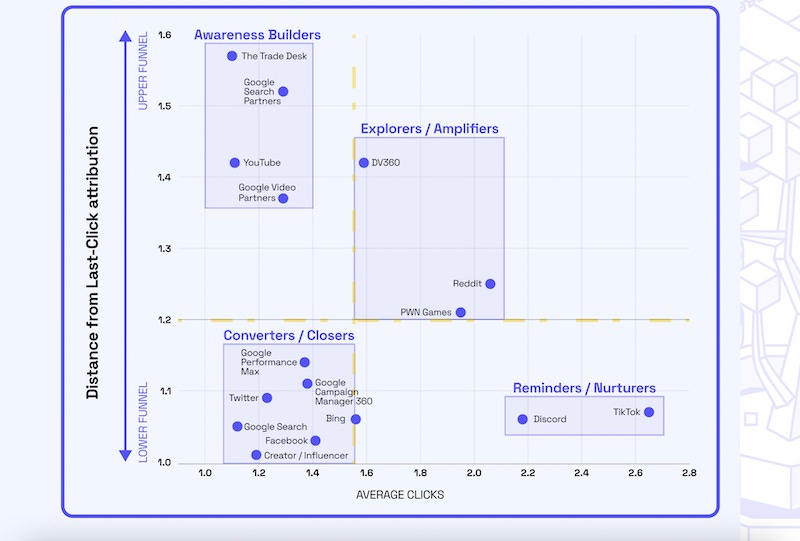

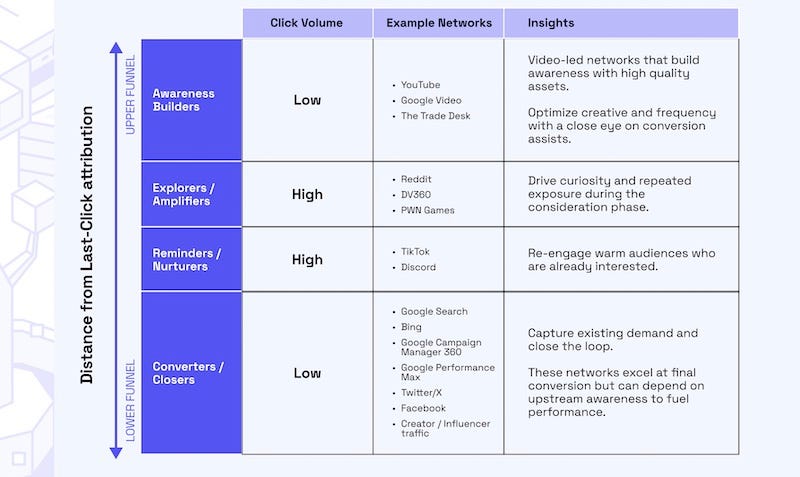

In general, PC/console marketing is starkly trickier to measure than mobile UA. But we appreciate Gamesight for trying to analyze a tough issue which gets hundreds of millions of spend thrown at it! And we def. wanted to highlight the above graph, which is about how to evaluate marketing mix. The suggestion from the team:

Last click reporting consistently undervalues upper funnel contributions: “Higher-funnel strategies like YouTube can get overlooked… because their value comes from broad reach and early exposure that can be undervalued in a last click model.”

Lower funnel networks are efficient, but rarely self sufficient: “High click networks like TikTok and Discord work as reminders that reinforce intent and convert warm audiences. Low funnel closers like Google Search, Facebook, and Creator / Influencer Traffic finish the job but cannot generate demand on their own.”

Sometimes we feel like ‘a bear of little brain’ when it comes to this level of marketing analysis. But we believe what Gamesight is saying is: people can watch a YouTube ad and internally register that they dig a game, but the trackable metrics can be poor.

But if you optimize your campaign only on high-click ‘calls to action’, there’s a chance you haven’t persuaded the customer that the game is worth buying. Which is why mixing up paid ad sources and not going 100% ‘close-first’ seems empirically sensible.

There are several other discrete pieces of research in the report, including this part excerpted by GI.biz noting that “[Steam player] reviews moving from ‘Mixed’ to ‘Very Positive’ nearly tripled conversion rates [of paid ad campaigns] when features like bug fixes and game patches were implemented.

By comparison… review scores showed ‘no measurable impact’ on conversion rates for free-to-play titles, which it attributed due to there being no cost barrier for players.” (And players not caring much about reviews for F2P games, which can be very based on the ‘tantrum of the moment’, haha.) Anyhow, interesting stuff…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]