Why older games rule - and new games drool - in Discoveryland

Publikováno: 3.4.2024

Also: interesting stats from a niche success & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s midweek in Discoveryland, and we’re enjoying the Spring. And due to free association, we’re now also enjoying Rob Hubbard’s 1985 music for Thing On A Spring on the C64. (Here’s a history of the franchise, surely due a reboot any time now.)

A scheduling note: besides the Friday Plus newsletters, which are still happening & we’ll talk about in a sec, we’re partly out next week. So there will be just one free newsletter next week - Tues, April 9th. (Back to normal schedule on Mon, April 15th.)

A milestone & a pressing Q on our Plus newsletter!

Before we get started, a little milestone and a PSA. The reveal: the GameDiscoverCo newsletter now has >25,000 free subscribers - hurray to us. (And thanks to everyone who reads us religiously - or at least semi-fervently.)

But we’re often surprised that only <2,000 of you (including groups and clients) opt to get the extra Friday newsletter & other GameDiscoverCo Plus goodness. That’s the newsletter where we get deep into which PC/console games do well, and why. It’s literally ‘which games are ‘making it’?’ - which you should probably all care about.

So we’ve made last Friday’s Plus newsletter 100% free. In it, there’s comments on Outpost: Infinity Siege, a full analysis of which games converted on Steam last week (and which have Hype this week!) & more. If you dig it, here’s the Plus upgrade link to get it every week. Seacrest out.

How older games dominate PC/console playtime…

We at GameDiscoverCo have talked about some of the current issues with market tightness - especially for new games - before. We’ve particularly discussed the high game supply issues around a ‘no-reset’ console and PC generation.

We summed up our view of the market in a recent client note: “The issue remains: catalog revenue is strong, big old games get played continually, but the gap for new games to be bought and played is smaller than the amount of money going into that hole, by a lot. But obviously, new games are where most of the investment is going.

This is going to be a permanent problem and significantly affect employment levels and success in the game biz - particularly because there's a lot more games out there in the market than there used to be.”

So we’ve talked about high supply. But we haven’t quantified the ‘big old games get played continually’ data point. That’s what game analyst firm Newzoo has done as part of a ‘state of PC & console in 2024’ report(free reg. req) that we would v. recommend.

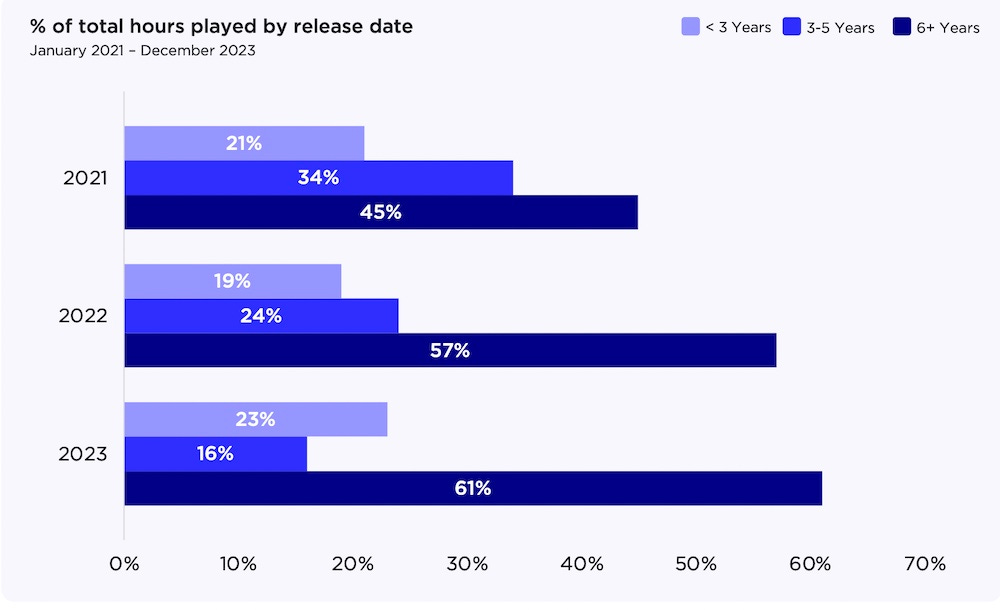

As you can see in the above Newzoo graph, older games (6+ years old) are now taking 61% of all PC/console playtime in 2023, up from 45% in 2021. And in fact, Fortnite, Roblox, League of Legends, Minecraft, and Grand Theft Auto V made up 27% of all playtime in 2023.

Newzoo adds: “These older games are gaining an increasing share of playtime over games between three and five years old... The drop in [3-5 year old game] playtime in 2022 can be attributed to Fortnite's shift into a 6+-year-old game, but not in 2023.”

That’s not all, though. The Newzoo report also estimates the following re: playtime:

The ‘annualized franchises’ like Call Of Duty, EA Sports FC, NBA 2K are a big chunk of new game play: “Out of that 23% share of total playtime that went to new games (released fewer than two years ago), yearly franchise titles accounted for 60%. That means that annual releases snagged around 15% of total playtime.”

5 new games grabbed 3.5% of the remaining 8% of playtime: “The top five titles within this smaller portion of new game playtime were Diablo IV, Hogwarts Legacy, Baldur's Gate 3, Elden Ring, and Starfield. Collectively, these games accounted for 3.5% of last year's total playtime.”

New free-to-play titles did not do particularly well last year: “In 2023, only 48 titles accounted for 90% of new game playtime in the US and UK. Of these 48 titles, 25 were live-service pay-to play games, 20 were premium, and the remaining three were free live services.” (The Finals was one F2P breakout, although its CCU has stabilized at 10% of launch numbers on PC.)

It’s interesting to see such stark and slightly scary data from Newzoo, whom we’ve historically considered a little anodyne and ‘rah-rah’? We actually went and re-downloaded their 2023 PC/console report to make sure we weren’t misremembering.

We weren’t! Last year’s takeaways include things like: “2023 will be a strong growth year for the PC and console market… packed with top games across many genres and on every platform.” (Whee?) Yet 2024’s report is way more, um, realpolitik. Kudos on the pivot.

And sure, playtime doesn’t necessarily map perfectly to spend in today’s PC and console markets - you don’t spend linearly per hour played. But the fact remains: time spent playing another game is player time not spent on a newly launched game.

Anyhow, we highly recommend reading the full Newzoo report for a lot more detail on large-scale market trends - and paths to growth in this extremely tricky market.

WitchHand - data on a niche solo Steam success!

We recently spotted WitchHand, a strategy card game semi-inspired by Sokpop’s breakout hit Stacklands, which we spoke to the devs about back in 2022. It’s a really interesting microgenre, actually - card stacking as a strategy game mechanic.

So we caught up with WitchHand’s creator Jon Nielsen, who was kind enough to chat about the game. It launched in early Feb. 2024 at a $12 price point, and maxed out at 750 CCU (concurrent players) on Steam, a very creditable result!

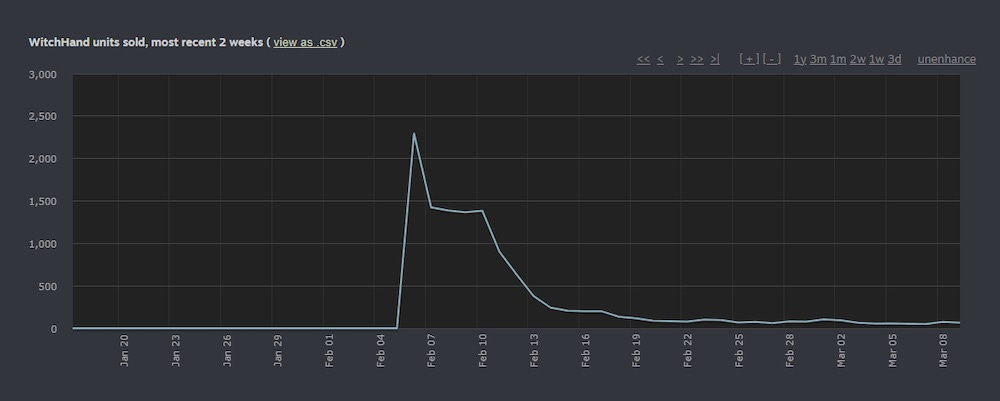

Here’s the first month of so of WitchHand’s Steam units sold. The sales curve is interesting, and we’ll return to it later:

Additional data: the game is only English language, so 50% of the players were U.S., with 7% from Canada, 7% from the UK, 5% Germany, and 4% Australia. (Localization would have increased Asian players - but for micro-indies, it’s not always easy.)

And here’s WitchHand’s overall Steam stats, as of earlier in March (we took a little while to publish this, sorry!) Items of interest? The very high median time played, relatively low refund rate, and decent (but not giant!) overall wishlist balance:

The other things we found interesting about WitchHand specifically are the following:

It’s inspired by Stacklands, but goes off in a whole new direction: Jon told us: “It's no secret that I love Stacklands… gameplay mechanic inspiration came from Stacklands, Stellaris, and other 4X games. Aesthetic inspiration came from Cult of the Lamb, Cultist Simulator, and my friend's tarot decks.”

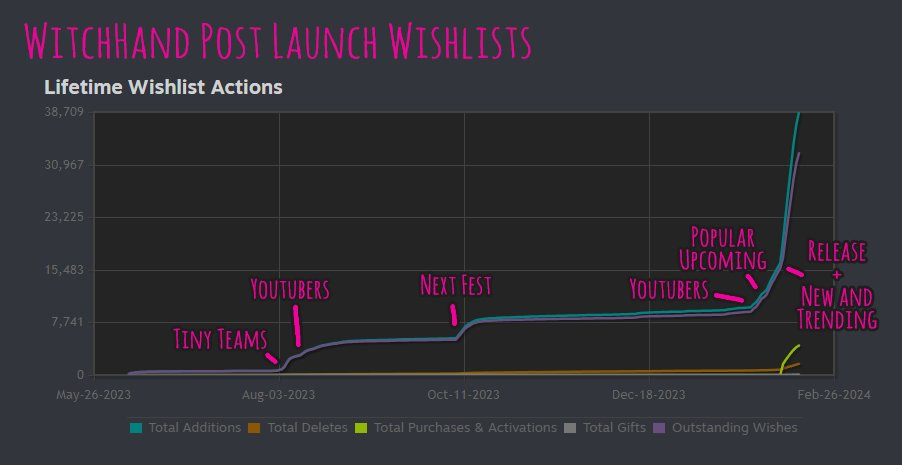

It genuinely got good YouTuber pickup when it came out: Jon credits his simple, direct email pitches, and the fact he’s interacted with YouTubers on his previous two games - “my games aren't critical successes but they're well made and well reviewed.” And we’d also note the ‘audiences want more of this microgenre’ appeal.

The game’s launch curve reflects streamer & algorithm virality: Jon says: “WitchHand is by far my most successful game in terms of sales and reception. The first two weeks following release were very hectic and stressful and exciting, but things have largely calmed down to pre-launch levels at this point.”

That’s what we tend to find in this market - especially for games like WitchHand, which are great but you won’t necessarily ‘idly stumble upon’. The first week or so’s sales are very anomalous - in a good way, sales curve-wise, due to various YouTube videos hitting & miscellaneous virality.

But as the virality dies down, you’re reliant on a much gentler discount-based long tail. As Jon says: “The game did well, but hasn't shown explosive growth that I'll be able to ride for years. I have one large update planned and then it might be time to move on to new projects after that.”

That’s the reality, even for well-crafted games in today’s market, unless you can get people to play your game over and over for their audience. (Or can re-activate them via patches and/or clever new features.)

Anyhow, Jon did a postmortem thread back in mid-February on Twitter/X which includes the above annotated wishlist graph, which we’re always fans of. And we appreciate him being so transparent with us.

The game platform & discovery news round-up…

And as we slide inexorably away up the wooden hill to Bedfordshire, let’s check some of the most notable game platform and discovery news from the last coupla days:

The latest Xbox Game Pass confirmations for early April 2024(above) include GaaS biggies Lego 2K Drive & EA Sports PGA Tour, the stop-motion ‘handmade narrative’ title Harold Halibut (Day 1 Game Pass), and the adorable 3D platformer Lil Gator Game. (Another good mix of games here.)

The latest log on the ‘not-E3’ pile for June? Ubisoft has confirmed its ‘Ubisoft Forward’ streaming event for June 10th in Los Angeles. It joins Summer Game Fest (and associated events) and a confirmed Xbox showcase in June, with more to come, doubtless.

As part of a GDC 2024 talk, Dana Trebella & Derek Lieu talked about setting game marketing timelines. The talk’s not available online yet, but the timelines worksheet is, “to help you organize your myriad marketing tasks and integrate them into your schedule.” Handy!

Microlinks: here’s a handy list of game-focused VC funds, via InvestGame; Discord is rolling out its ‘Sponsored Quests’ game-centric feature & hiring ad-sales people; Steam Deck’s most-played games for March sees Balatro in like a joker-powered rocket at #2, between Stardew Valley (#1) and Helldivers 2 (#3).

PlayStation is putting more ‘indie-ish’ titles directly into the higher-tier PS+ Game Catalog on Day 1 on the console, having just announced EA Originals title Tales Of Kenzera: Zau on April 23rd, and Dave The Diver’s April 16th arrival. Change of strategy, or some opportunistic pickups?

New Blood’s reliably chaotic Dave Oshry just talked to TouchArcade, including comments on Epic (“Their focus is Fortnite and making Fortnite into the game to have all games. It is a platform now”) and Steam’s cut (“30% is a lot, but it’s a great platform to ship games and sell games… Do I wish that they didn’t take as much of a cut? Sure, but what the f*** am I gonna do about it?”)

Microlinks: in ‘discovery woes’ news, retro gamer website RetroDodo is being crushed by Google algorithm changes; the FTC has blocked (for now) an ESRB-led proposal to use facial recognition for age ID checking; there’s about 26% more games released on Steam in 2024 so far compared to 2023.

Two Steam micro-indie data points: a one-year postmortem of chess roguelike The Ouroboros King goes into detail (sold 17,630 copies - $84k net revenue); here’s some real data on street-building casual management game Minami Lane ($184k gross on a $5 game in a month.)

An interesting point on Roblox’s Game Fund from David Taylor - it’s “invested $35 million in innovative experiences. Of the 14 public investments they've made, only one has more than 500 concurrent players today.” But they’re adding another $35m on a Creator Fund - “betting on platform-level innovations, rather than specific games.”

Finally, some esoteric microlinks that we dig: Frank Lantz talks about Balatro and its beguiling mix of being “deeply strategic… and high variance”; Matt Alt on the passing of U.S. politician Joe Lieberman, and how “a U.S. senator compelled the heads of Sega of America and Nintendo of America to appear before Congress and explain themselves over games they hadn’t even created.”

To end, we liked Danny O’Dwyer’s latest video for the a16z Games YouTube channel, which posits: “The cost of games relative to their respective prices seems to have hit a tipping point.” It’s high level, but definitely worth a watch:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]