Will your Steam 1.0 launch outpace your Early Access start?

Publikováno: 8.11.2023

We have some answers to this. Also: Nintendo's strategy, happily poked at.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to GameDiscoverCo, the newsletter that puts the work ‘Discover’ in between the words ‘Game’ and ‘Co’ - and presumes you’ll work out what’s going on via a process of elimination. (‘Discover’ our true purpose, in other words…)

And what’s the lead story this time out? Another day, another set of ‘gripping’ bar graphs - that’s just how we roll. (And actually, these ones are exciting to us, because they’re empirical data on a much-asked question - how Steam 1.0 launches go…)

[HEADS UP: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, six detailed game discovery eBooks - & lots more. ]

How does a ‘normal’ Steam Early Access → 1.0 go?

As always on Steam, there are aspirational games when it comes to ‘how you graduate from Steam Early Access’, which “enables you to sell your game on Steam while it is still being developed”, into a full 1.0 release. And one of those is Supergiant’s ARPG Hades.

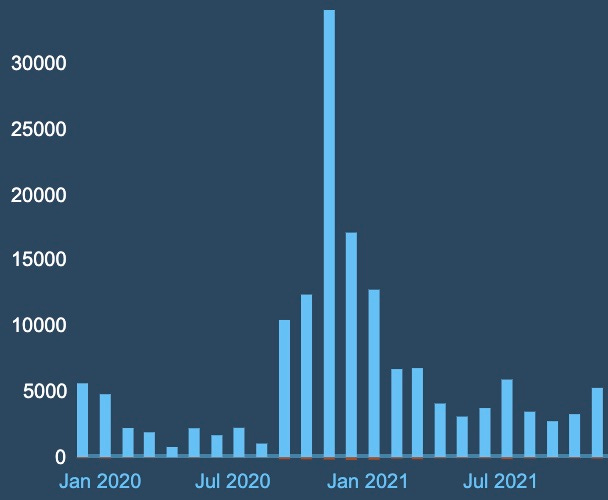

Hades did start as an Epic Games Store exclusive, but came to Steam in December 2019 and then graduated to 1.0 in September 2020 - at which point it really took off. Check out its Steam review curve (below) - this is what a ‘fantasy’ 1.0 looks like:

So yes, not all of us are doing 20x monthly Early Access reviews after 1.0 (!) and ending up with >6 million units* sold LTD on Steam. (*per GameDiscoverCo estimates.) But what is the median game doing, if we look at the last 8 years of Steam data?

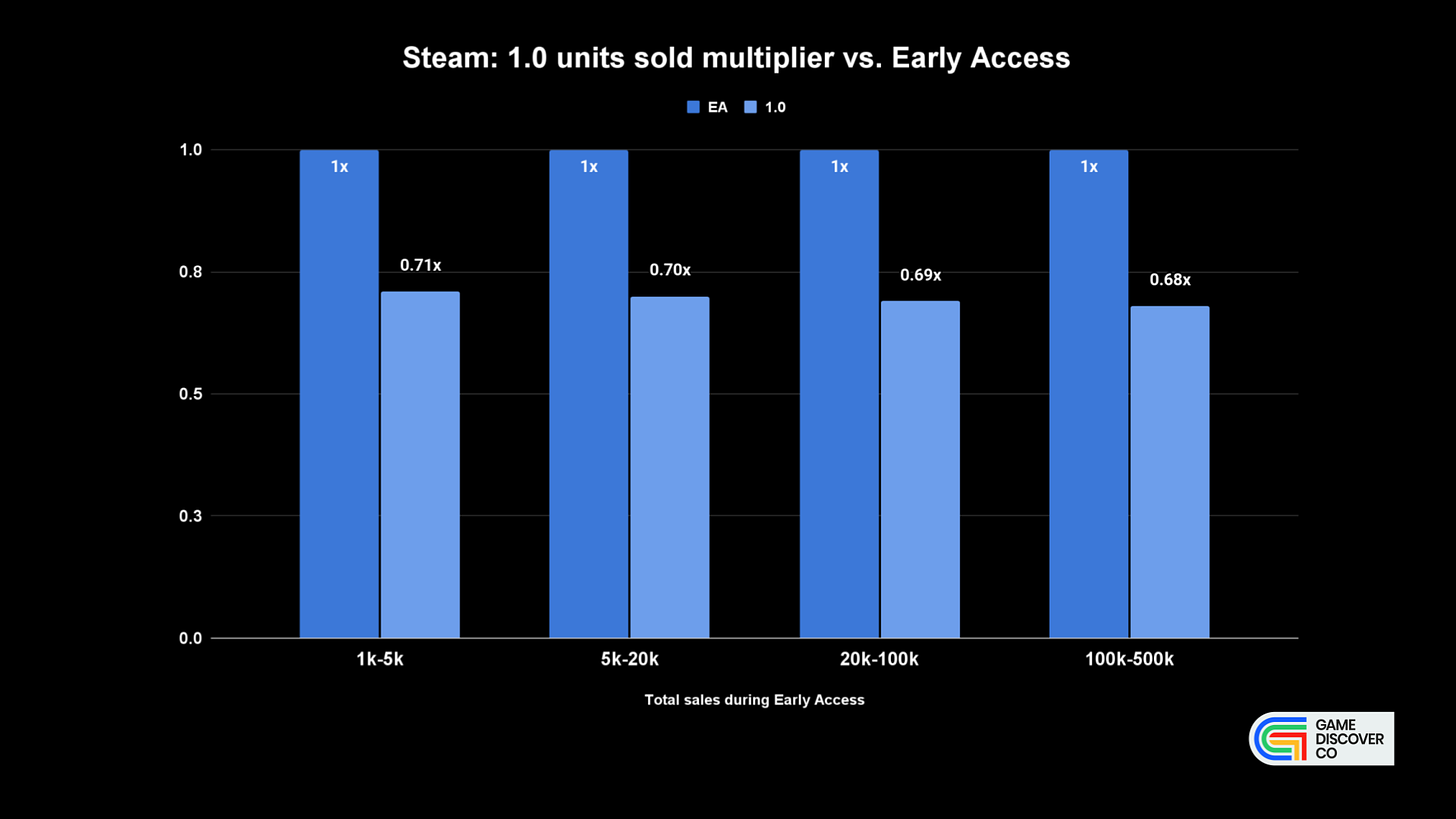

GameDiscoverCo did just that (in association with our Data Fellow, Gamalytic’s Strale), and we’re happy to pass along detailed results. The overall view? The median game sells slightly less at 1.0 launch than EA - but results vary a lot:

Firstly, an important note: this data is based on estimates of the first three months’ unit sales at Steam 1.0 for games released from 2015-2023, compared to the first three months of Early Access. And over 1,500 games in total were surveyed.

The median Early Access to 1.0 ratio hovers around 0.7x (going down slightly as games get bigger!) for all sizes of game. This means that if your game sold 10,000 copies in its first 3 months in EA (then more copies for the rest of Early Access!), the median title sells 7,000 more copies across the first 3 months of 1.0.

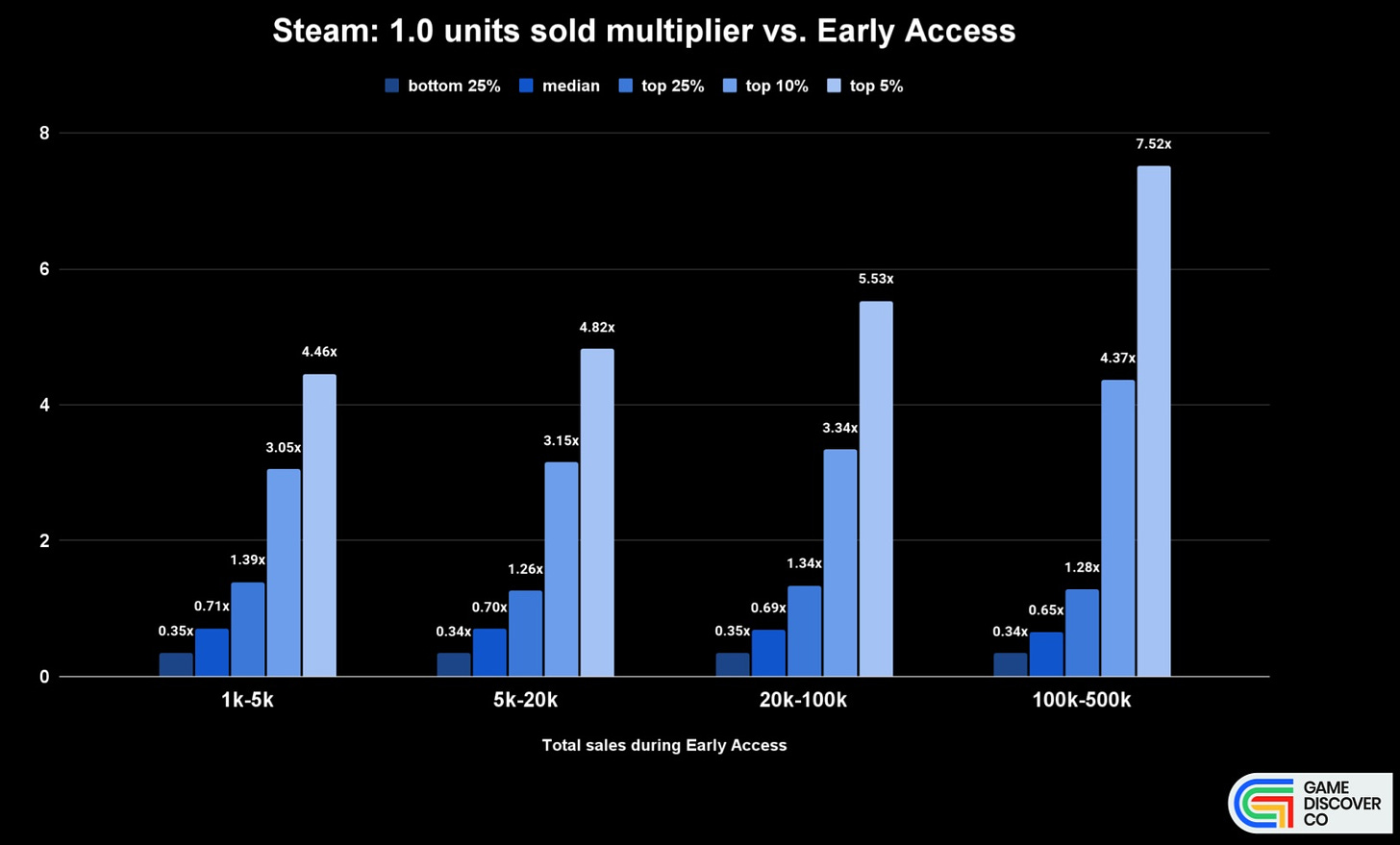

But median is simply ‘the 50th percentile of all results’. So what’s the spread of outcomes here? It turns out to be surprisingly wide. This is probably why devs are confused about possible outcomes:

For example: for games selling 20-100,000 units during the entirety of Steam Early Access, the lower 25th percentile of games does ‘just’ 0.35x the first 3 months of EA during 1.0 release, the top 25% does 1.34x, the top 10% does 3.34x, and the top 5% does a whopping 5.53x its Early Access numbers.

You’ll also notice that as the ‘total sales’ band edges up, the results on the top end get more extreme. At 1k-5k sales, the top 5th percentile of Early Access graduates do 4.46x at 1.0, but in the 100k-500k range, the top 5th percentile does 7.52x.

These are just a handful of titles, of course, but it’s always good to be aware of outliers. Nonetheless, you might want to think of ‘the middle 50%’ (from 25th to 75th percentile) as your anchor for visualizing things. And that’s a range with 1.0 from about 0.35x to 1.35x of Early Aaccess. That what you can ‘expect’.

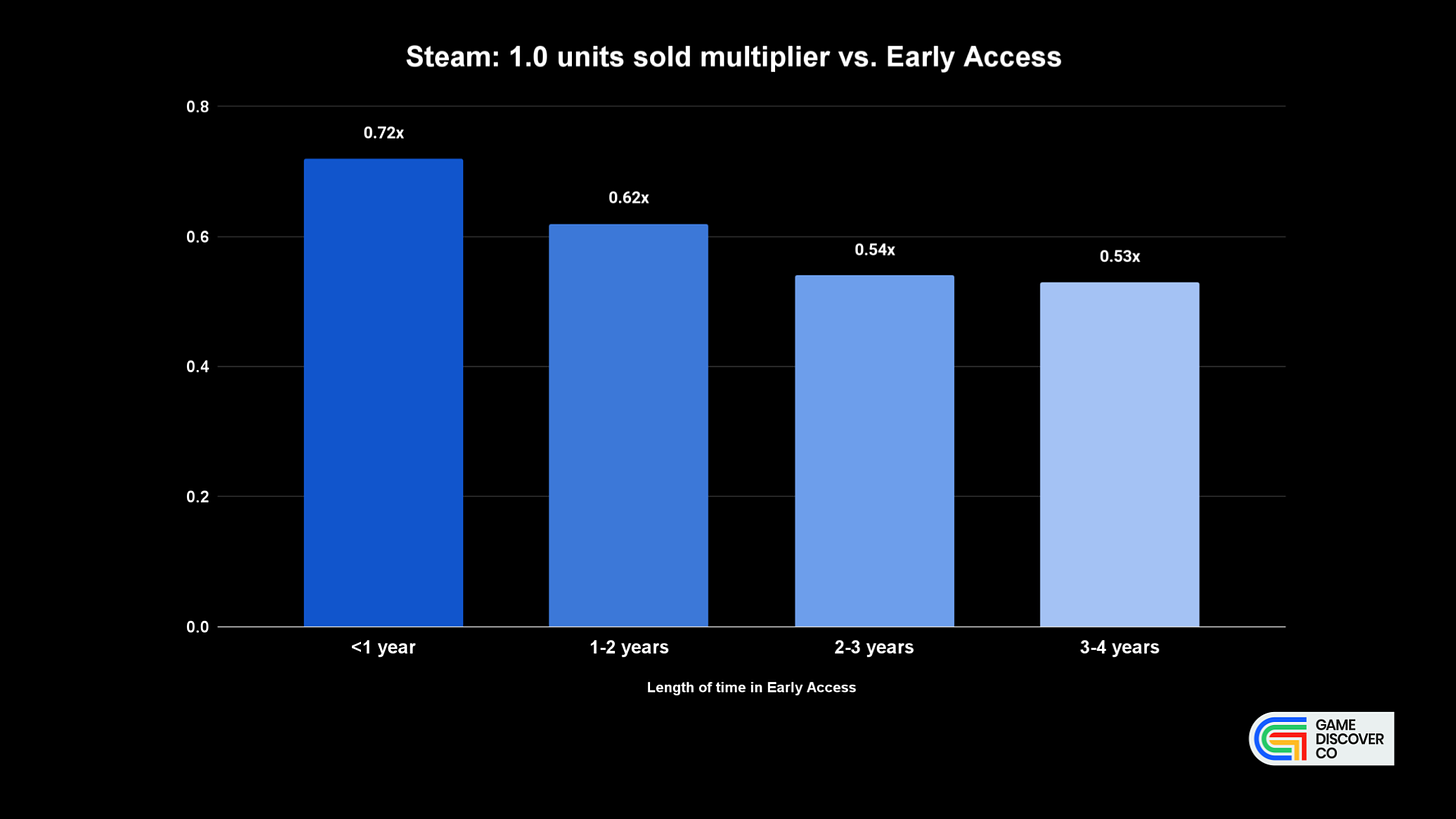

Finally, how does length of time in Early Access affect median conversion? You might not be surprised, but the longer you are in Early Access, the lower the 1.0 unit multiplier compared to EA.

There’s one likely and obvious reason for this - the longer you are in Early Access, the more you’ll be tempting your existing wishlisters to buy, via discounting and other methods. (Not a negative, in our view.)

We’re not saying that waiting to go 1.0 is bad. (In fact, some of the games debuting after 3-4 years may have made a lot more $ than the <1 year titles!) Just be aware that the first three months of your eventual 1.0 release will be lower, if you wait longer…

Where’s Nintendo going, strategy-wise? Let’s look!

Originally, we were going to relegate Nintendo’s latest quarterly results to the ‘discovery news’ section. They are, well, ‘more of the same’, with the Switch at 132.5 million lifetime hardware units, with 6.84 million sold so far this fiscal year.

And as analysts have been mapping, the OG Switch hardware is slowly on its way down. But meanwhile, Nintendo is denying briefing publishers on Switch 2, which gets a ‘Sure, Jan!’ from us. They’ve clearly got something up their sleeve for 2024.

However, the company just put out its ‘corporate management policy briefing’ [.PDF] alongside the results. This document? Way more intriguing, with 64 slides of goodness on Nintendo’s strategic direction. Here’s what we picked out as notable:

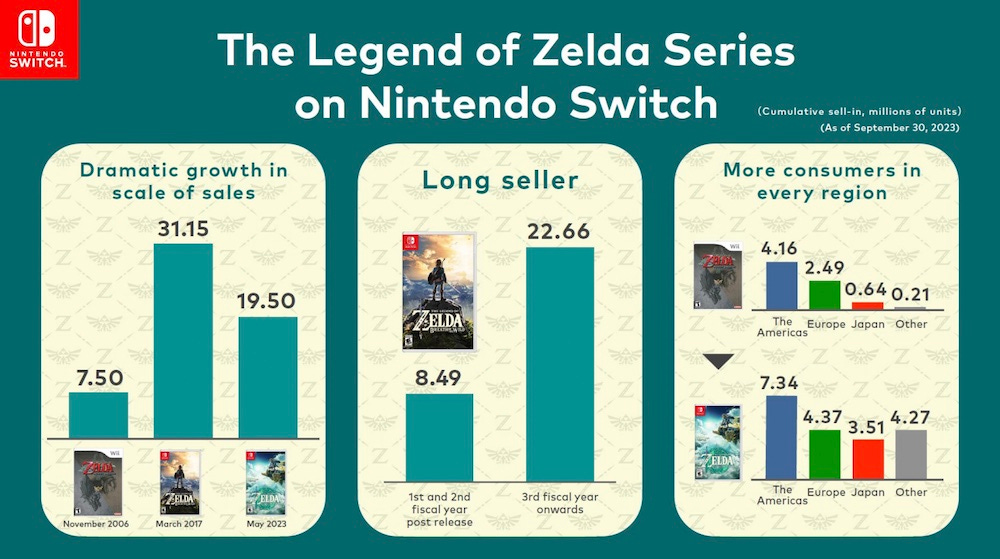

In game software, Nintendo’s first-party domination continues: Zelda: Tears Of The Kingdom has now sold 19.5 million (!), “Pikmin 4, released in July, sold 2.61 million”, 52% of them in Japan, and: “Nintendo reported that 16 Switch games sold more than one million units during the first half of its fiscal year” - almost all first-party.

Nintendo’s strategy is about smart integration of hardware and its own games: you won’t see third-party Switch games much in the strategy document, which says: “By developing and integrating hardware and software as one, we can surprise people with Nintendo’s unique brand of play.” (38 million members for Switch Online and over 330 million Nintendo Account holders are the ‘base’ to market to.)

The Mario movie is the tip of the ‘Nintendo IP beyond games’ iceberg: the company’s main push, following a 25-year licensing hangover from the OG Super Mario movie, is to “continue expansion into a broad range of areas, including mobile devices, visual content, theme parks and merchandise.” Hence the new live-action Zelda movie announce alongside Magic Bottle Baby creator (?!) Avi Arad.

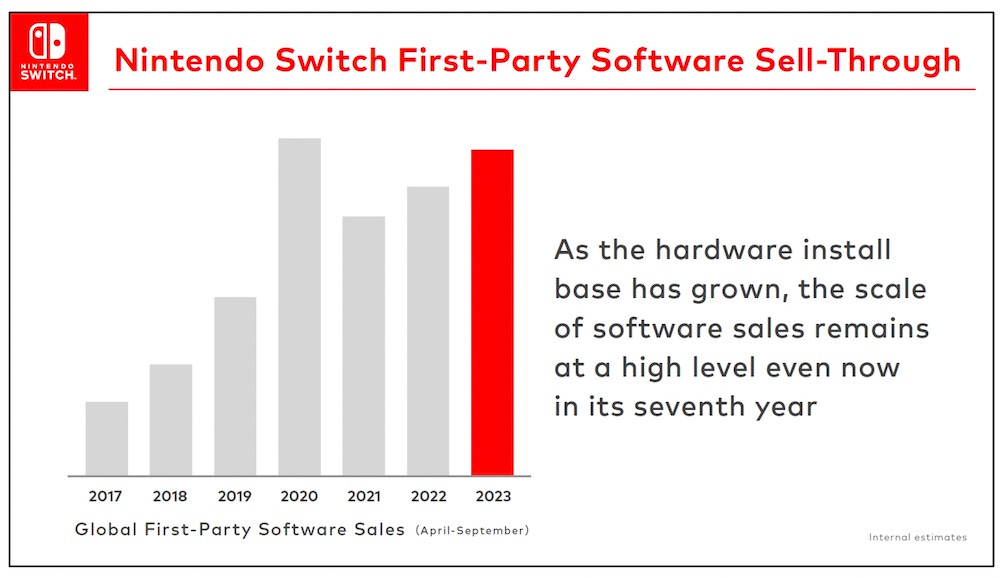

There’s a couple of good slides around Nintendo’s first-party performance worth reproducing. Firstly, here’s its (pretty decent) continued sales profile on first-party games sold for Switch:

Secondly, this chart shows both the great ‘long tail’ for the Zelda franchise, and how Nintendo has grown Zelda players from the Wii version - which had sales heavily tilted toward the Americas - to a much more global footprint:

There’s also slides showing how games like Mario Kart 8, Animal Crossing, and Super Smash Bros Ultimate have had veryvery good ‘continued and lifetime sales’ compared to previous-gen titles. (The ‘we love the long tail of our major franchises’ button is mashed repeatedly.)

Finally, Nintendo also shows ‘number of software units sold’ between first and third-party games - about 50/50. But it doesn’t include download-only Switch games in the totals, or IAP revenue, or take into account selling price. (A lot of the presentation methodology in this area is adorably archaic and semi-retail centric, in fact.)

Turning to IP diversification, early attempts have been stellar. Illumination’s Super Mario Bros. Movie has been seen by 170 million people (!), and grossed $1.36 billion at the global box office, leading to a 30% increase in sales of legacy Mario games.

Overall Mario hype helped Super Mario Bros Wonder for Switch hit 4.3 million units sold in its first two weeks, the “fastest-selling Super Mario related title” since the Nintendo DS - and potentially of all time.

And on the theme park side, Super Nintendo World is open at Universal Studios in Tokyo and Los Angeles, with expansions in Orlando and Singapore due soon, and a Donkey Kong area opening in the Tokyo park area in 2024.

The company also confirmed ‘first-party physical event showcase’ Nintendo Live promo events in Taipei, Seoul, and Hong Kong, after a successful test in Seattle during PAX West, with a Japanese version in January 2024. (The return of Space World, huh?)

As for what’s next for Nintendo? Whatever it is, judging by this wholehearted endorsement of ‘our games on our own game platform is working… for us!’, it’s not Nintendo IP jumping across to other game hardware platforms. More power to ‘em.

The game discovery news round-up.

And finishing up our work for the week - at least until Plus subscribers get their super-cool Friday newsletter - let’s take a look at fresh platform & discovery news:

The Verge is covering the Epic x Google trial in detail, and a lot of chatter is related to mobile store retention ‘payoffs’ to devs from Google. Here’s a more PC/console relevant bit: “Epic Games Store boss Steve Allison says on the witness stand his store isn’t profitable yet… Emails revealed during the Epic v. Apple trial suggested the company was hoping to claim half of all PC gaming revenue.”

The crew at ‘player motivation’ analysis firm Quantic Foundry have a great post about ‘the demographics of sci-fi’ among gamers, noting: “Shooter fans 35+ are more than twice as likely as Shooter fans age 13-17 to rate Hard Sci-Fi as ‘extremely’ appealing… the appeal of Sci-Fi most consistently correlates with Fantasy (being someone else, somewhere else).”

Good news for players who want to play ‘naughty’ games on their main Steam account? Valve is apparently working on “allowing you to mark a game as private and hide it from your friends”, according to datamining conducted by SteamDB’s Pavel ‘xPaw’ Djundik. (Selective privacy? Good!)

Sony-owned anime streaming service Crunchyroll is adding a Game Vault for its higher-tier subscribers, “available on Android now and iOS very soon in more than 200 countries, all playable with no ads and no in-app purchases.” A bit Netflix Games or Apple Arcade-y, but for anime-tinged games like Captain Velvet Meteor…

Betting x eSports newsletter Sharpr covers the rise of offshore casinos sponsoring game streamers, ugh: “The biggest and obvious issue is that these sites often operate illicitly with little-to-no customer verification… the other morally questionable piece is how gambling content has typically been presented to users on livestreaming platforms [in terms of] a high-profile influencer recklessly playing slot-style games with lofty balances.”

Social media giant X/Twitter is slowly sinking into the (disinformation?) sea, folks. Thus, PlayStation 4 and 5 will no longer be able to post videos & other content directly to Twitter starting on November 13th. (Xbox already dropped the feature back in April, likely because of expensive API pricing on X’s end.)

The most-played Steam Deck games for October 2023 is topped by a lot of the usual suspects (Baldur’s Gate 3, Elden Ring, etc.) But also: Cyberpunk 2077 doing good after its update/DLC, and a brand new appearance from Microsoft’s (lol?) Diablo IV, which surfaced on Steam during last month.

Subnautica co-creator Charlie Cleveland has a blog post on defining ‘success’, citing Rick Rubin’s new book on the creative process, which I found touching: “What person in their right mind would allow public perception, ratings, audience, money, followers or other trappings of external success, change that?”

Asia x games things: China's ByteDance to overhaul VR arm Pico as global demand declines; how AR mobile game Monster Hunter Now has succeeded for Niantic in Japan; DouYu founder/CEO has been held ‘incommunicado’ by Chinese authorities “after online censors allegedly uncovered pornographic content on the popular video game livestreaming platform”.

Finally, Japan-based game dev & composer Chibi-Tech has been exploring itasha meetups in Tokyo, devoted to cars “decorated with images of characters from anime, manga, or video games”, and found this wonderful tribute to Sega Dreamcast & Jet Set/Grind Radio, including a VMU car key (!):

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]