We need to talk about Steam & China

Publikováno: 22.10.2020

The facts of (Chinese government approval) life.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, this was going to be the last GameDiscoverCo newsletter update of the week, but we’ll do an extra final round-up tomorrow, since something interesting came up. See… right now:

Steam and China - what happens next?

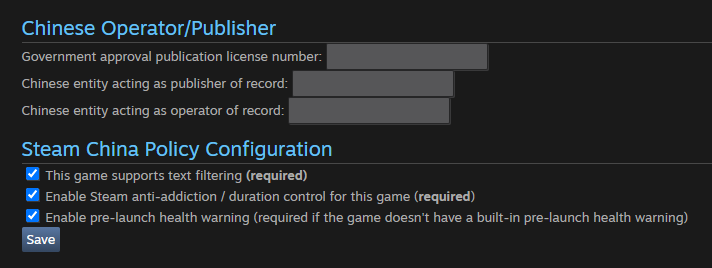

So, SteamDB creator and dataminer Pavel Djundik posted the above image mined from the latest Steam code. It’s not operational yet, but it seems to give an indication of what you might need - at some unknown and even possibly non-existent point in the future - to get your game approved on Steam in China.

Pavel also noted: “For anyone curious, they're adding ‘realms’, one for steamglobal, and one for steamchina. There's also a separate store category for ‘Steam China Workshop’.” So, some additional trajectory towards new rules for China is in progress. (And it does seem that Steam’s recent text filtering roll-out was done - in part - to have it available for the Chinese market.)

There’s clearly things happening here. But there have been for a long time - since Perfect World and Valve announced a collaboration on Steam China in 2018, and since 2019 saw a larger announce/preview with Western partners at The International 2019 in Shanghai. And now we’re rapidly approaching 2021. So what’s up?

As an article covering the 2019 announcements explains: “Steam China, known domestically as “Zhengqi Pingtai,” [will be] independent from the global version of Steam. Steam itself is not blocked in China like Facebook or Google… However, Valve’s storefront is not officially approved either. Both gamers and publishers in China have used Steam for games that fail to meet the country’s stringent regulations and are not available on other platforms such as WeGame, China’s biggest PC games distribution platform.”

That’s the background. And in 2020, we’re in a period of tension between global powers - especially between the U.S. and China. Partly as a result, China seems to be more aggressively closing loopholes around creative content - both domestic and foreign - not approved by the government. Along the way, it’s looking for cultural content that neutrally or ideally positively reflects its ‘national values’. Hm.

I’ve reported briefly on 2020’s stricter enforcement by Apple (no doubt demanded by the Chinese government) of publication licenses for iOS games. This led to nearly 50,000 non-licensed games being removed from the Chinese version of the App Store earlier this summer.

For a while, I was speculating that Steam China and Steam Global would run in parallel. (And this may still happen - we just don’t know.) But let’s talk about the two main ‘unexpected’ takeaways I think you should be aware of, if and when Steam China becomes the only choice for Chinese game publishing on Steam:

Getting licensed by the Chinese government isn’t just ‘when’, it may be ‘if’.

China’s game regulator, the National Press and Publication Administration (NPPA) hands out game licenses in China on a limited basis, even to domestic companies.

Daniel Ahmad of Asia-focused research firm Niko Partners (which is an excellent resource in this space!) was kind enough to send me some statistics on current approvals: “There have been 1,062 domestic games approved [by the NPPA] as of October 16, 2020. This is in line with last year, where 1,385 titles were approved through 2019. We expect approximately 1,350 titles to be approved this year.”

These totals are across all mobile, PC, and console games (though there’s not really much console in China!) So.. that’s already a very small amount compared to the amount of games that get released in the West on PC and mobile alone.

But check out the numbers for games made by non-Chinese developers and published via a local partner: “In 2019 a total of 185 import/foreign games were approved, of which 139 were mobile games, 32 were PC and Web games and 14 were console games. The NPPA did not start approving import titles until March 2019.”

Moreover: “In 2020 a total of 55 import/foreign games were approved, of which 40 are mobile games, 9 are PC and web games and 6 are console games (As of Oct. 1). There has only been two batches of import games approved this year, compared to 8 in the prior year. It is unlikely that total approvals will reach 100 this year.”

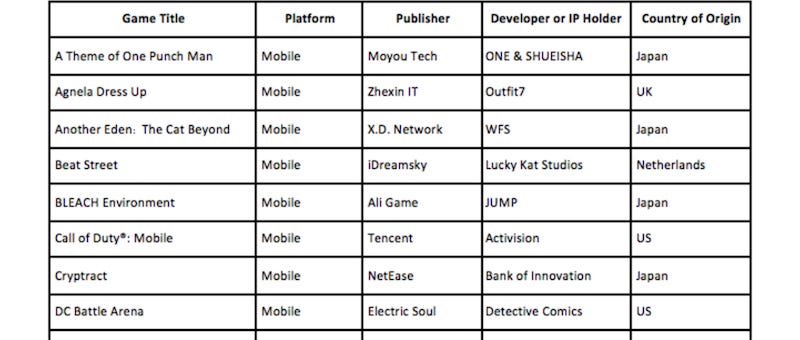

So that’s - a tiny amount of games. Niko Partners has a public list of the first batch of non-Chinese ‘approved in 2020’ games and the second, for those wanting to understand things further. (Many of the foreign approvals are big F2P mobile games with high-profile local partners, such as Harry Potter and Disney titles, but there are a few smaller indie titles like Figment.)

Overall, my point is that there’s no way the Chinese authorities are going to start ramming thousands of non-Chinese games through their approval pipeline - for multiple reasons. (Especially since the pipeline is presumably already full of iOS games that actually got kicked out of the Apple store in July.)

So this isn’t a ‘longer wait’ issue, I think it’s a ‘most Steam games won’t be able to get ISBNs in China’ issue. How you get to the front of the queue (does strength of local partners get you better treatment?) is a question I’m not qualified to answer, but others may be.

Losing your Chinese revenue is bad, but maybe not as bad as you think?

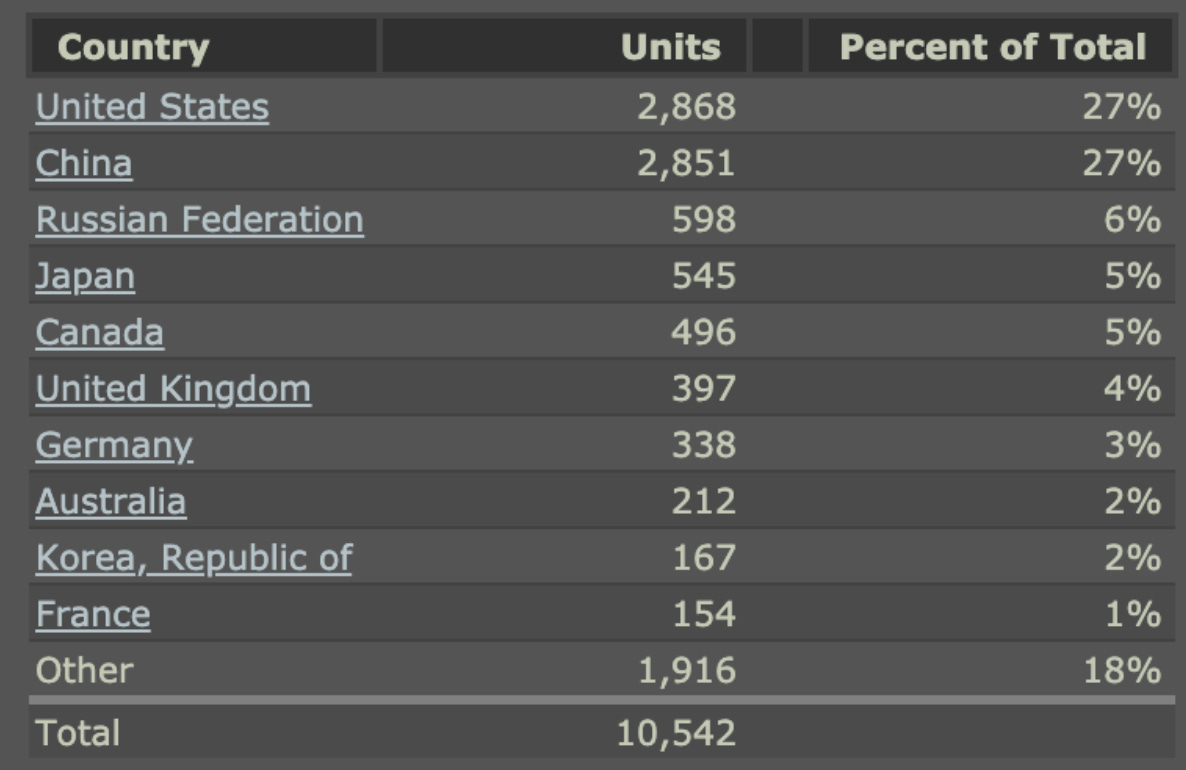

Here’s my valiant attempt at ‘don’t worry, be happy’. Let’s take a worst-case scenario - ironically, the country split for Meteorfall: Krumit’s Tale that Eric Farraro talked about in the last newsletter’s deep dive.

So in this case, 27% of the sales (!) are from China. That’s definitely on the high end. But poking around Steam games that I have easy access to, anywhere between 10% and 22% of the sales of games with Chinese translations are from China, averaging out at about 16%. (Text-heavy games with no Chinese translation can be more like 1-2% Chinese sales.)

But remember, this is raw sales, not taking into account either pricing or refunds. And this changes things up a bit! Recommended Steam pricing for China is almost 60% less than the U.S. price. And I’ve tended to find (anecdotally!) that Steam refunds in China are about double those in the U.S.

So when you see 27% of Steam unit sales from China (worst case?), that might ‘only’ be 16-18% of gross/net Steam revenue. And a more normal - for me - 16% of Steam unit sales could ‘only’ be 9-12% of gross/net Steam revenue. (I haven’t done the precise math here, since it’ll vary on a game by game basis.)

It’s scary, but not as scary as just looking at units. Of course, hopefully you won’t lose that revenue. (Or hopefully you get approved for Steam China if it goes exclusive, and make all of it back and more!)

Conclusion

As for the actual process of applying for a Chinese ISBN/license, Cocos has a very, very long, helpful article with all the conditions that need to be satisfied, if you’re masochistic and/or curious for next steps. For starters, you do need a local partner/publisher based in China. (And your co-operation with them needs to be specifically approved by the NPPA.)

But separately of that, there’s all kinds of ‘entertaining’ content checks, such as the game not “Having opposing opinions on the Constitution of The People’s Republic of China”, or “Promoting obscenity, gambling, violence, or glorify crime.” If your game has ‘edgy’ content at all, it may just be impossible to get it approved, separately of the bureaucratic minefield.

So, that’s where we are. Ending out, this Twitter comment from Another Indie founder Adria Carrasco - who has navigated Chinese government approval previously, even getting games onto Tencent’s WeGame Store - is notable and suitably cautionary, IF and WHEN this change happens:

[This newsletter is handcrafted by GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We’ll be launching a ‘Plus’ paid newsletter tier with lots of extra info/data - watch out for it soon.]